As we discussed yesterday, the recent bout of optimism over Italian assets was not meant to last, following what was first a warning of an imminent sovereign rating downgrade by an Italian official, followed by a report that the EU Commission would reject the Italian 2019 budget.

And while there have been no material new developments, the optimism has finally faded amid escalating concerns over Italy’s irreconcilable financial situation and the standoff with Brussels, which has manifested itself today with the spread between Italian BTPs and bunds blowing out to 325bps, a new five year high.

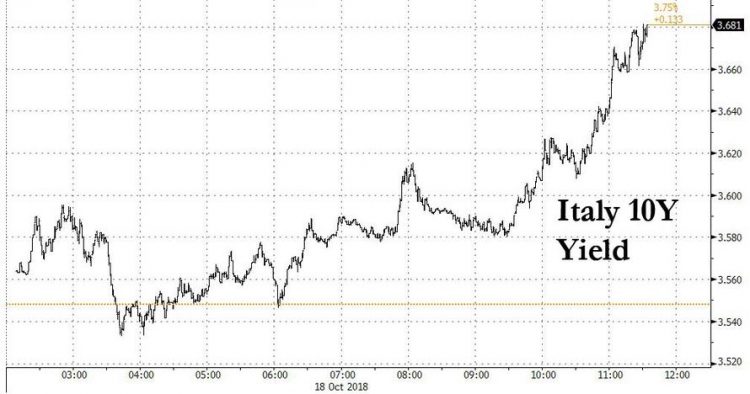

The surge in Italian yields, which have hit a whopping 3.68% as a result of a sharp selloff in Italian 10Y paper…

… is spilling over resulting in contagion on risk assets across Europe, and are now hitting the US, where yesterday’s brief S&P gains are long-gone as US equity markets devour Monday’s massive short-squeeze rise. No specific catalyst but we not that Italian credit spreads have blown out to their widest since 2013 as global risk appetite turns sour.

In short: Italy is not fixed.

We note in the chart above that the spread between US Treasurys and Bunds is now at record highs, and with The Fed making it clear they are in favor of further interest-rate hikes, Treasury yields could climb higher, while German bund yields are likely to stay low on haven demand from Italian political risks and doubts about how willing the European Central Bank is to raise borrowing costs.

Meanwhile, as the European market close approaches, flows leading this. Additionally, we are getting some noise from the EU Summit press conferences that suggest a stand-off is almost a certainty.

And that ‘risk-off’ sentiment has crossed the pond, as US equities are rapidly losing Monday’s gains…

And with attention once again shifting back to Italy, it may get worse before it gets better as next week there are several key catalysts, including the EU Commission’s response to the Italian budget plan by October 22, while on October 25 a ratings review by S&P is due, with Moody’s also potentially on deck; a downgrade by one or both rating agencies would likely result in even more selling and risk contagion.