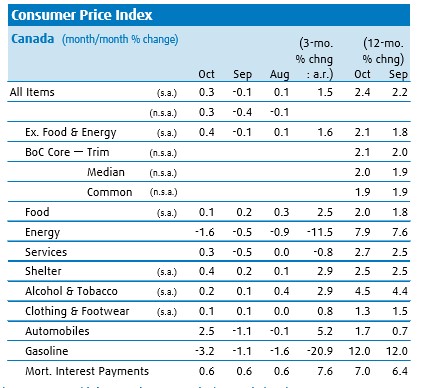

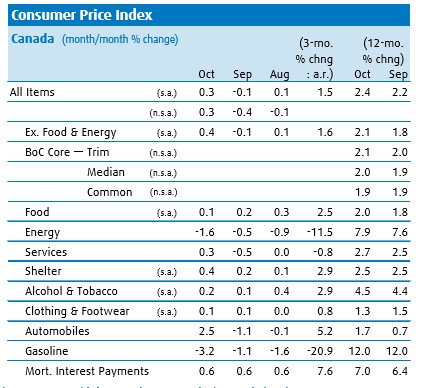

Canada’s year-over-year consumer price index rose 2.4% in October following a four-month low of 2.2% in September. On a simple monthly basis, the CPI rose 0.3% since September.

The largest contributor to October’s CPI increase was the 2.5% increase in auto prices. Auto prices on their own account for 8% of the index. Airfares also rebounded 4.6% in the month and telephone service prices also increased in the month.

The October increase in Canada’s inflation rate was consistent with the underlying strength of the economy, though the all items CPI pace was significantly lower than its 3% peak in July.

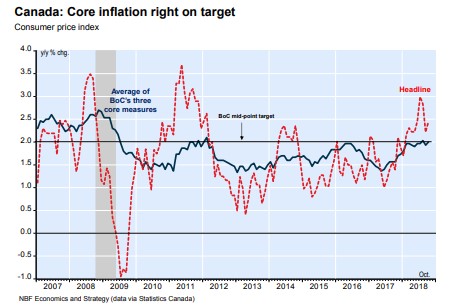

Statistics Canada observed that the Bank of Canada’s three preferred measures of core inflation – designed to filter out short-term distortions and identify broader trends across the economy – averaged 2% in October, little changed from September.

Over the past nine months, all three core inflation indicators have been close to the central bank’s long-standing 2% target even the all items inflation rate has swung rather wildly. The Bank of Canada’s preferred core measures on a y/y basis were as follows: CPI-trim (2.1%), CPI-median (2.0%) and CPI-common (1.9%).

November’s headline inflation rate will likely be lower since gasoline prices in Canada have dropped roughly 10% this month. Indeed, headline inflation might come in under 2% as the economy and its price statistics real from the severe impact of falling oil prices.

The key message here is that core inflation has been roughly steady at around the Bank of Canada’s 2% inflation target.