History may not repeat itself exactly, but it can be an excellent guide to what lies in store, especially in the oil industry. Dramatic changes in the price of oil have long been a harbinger of the big changes in prices and incomes for a major producing country such as Canada. Let’s start by looking at the experience of the 2014 -2016 to gauge how Canadians will adjust to the seismic shift in the world oil industry we witnessing today.

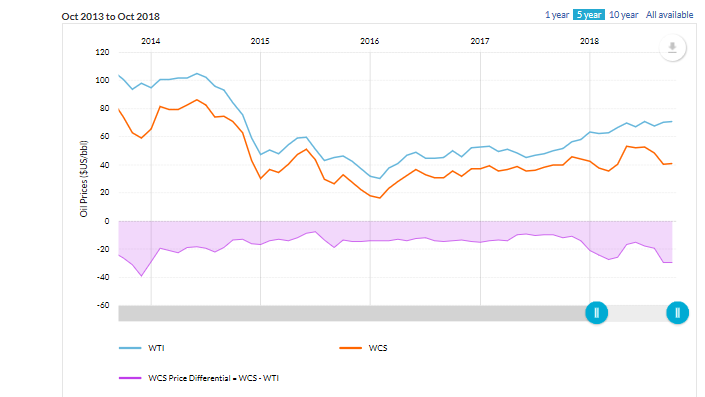

Historically, Western Canadian Select (WCS) normally trades at a discount of US$ 15 bb/ to the West Texas Intermediate (WTI). The discount reflects the higher cost of refining Canadian heavy oil (Figure 1). The collapse in world oil prices starting in 2014 hit the Canadian producers rather hard. By 2016, WCS fetched roughly $15/bbl in March of that year compared to $30/bbl for WTI.

Figure 1 Canadian and US Oil Prices 2014-2018

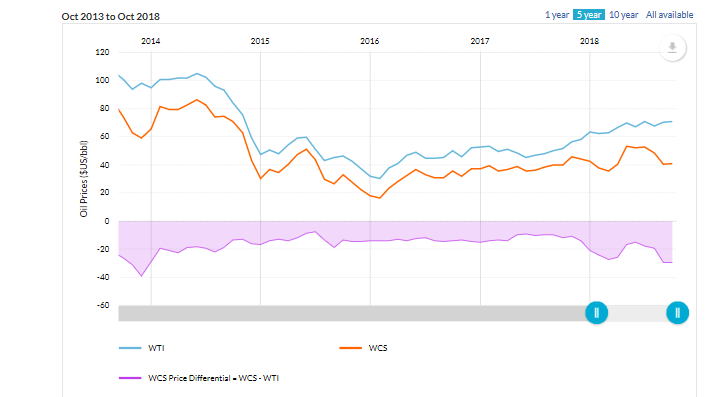

The impact on the Albertan economy was swift and dramatic. Prior to the oil price drop in 2014 average weekly wages in the goods-producing sector were registering gains of 4-6 percent, only to contract by 4-6 percent by 2016. (Figure 2). It took another four years for wages to match the annual growth prior to 2014. It was a painful period in a province that was used to strong growth from natural resource development.

Figure 2 Impact of Oil Collapse on Alberta Economy

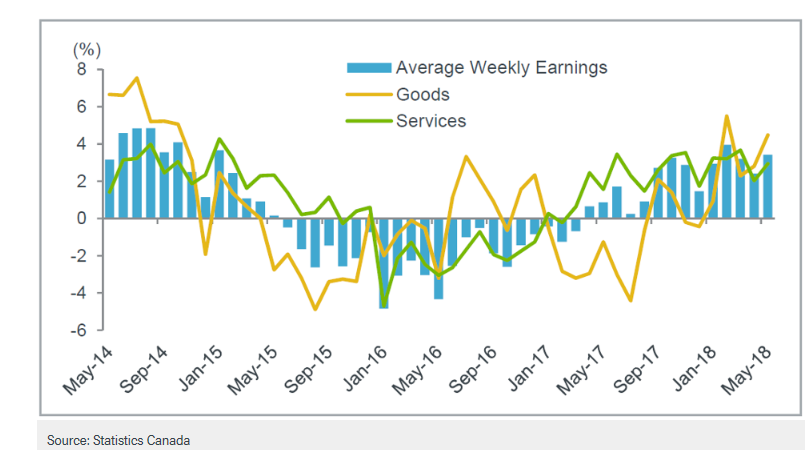

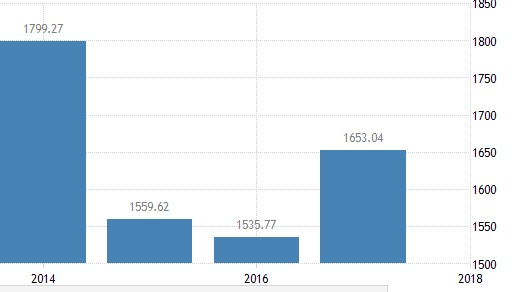

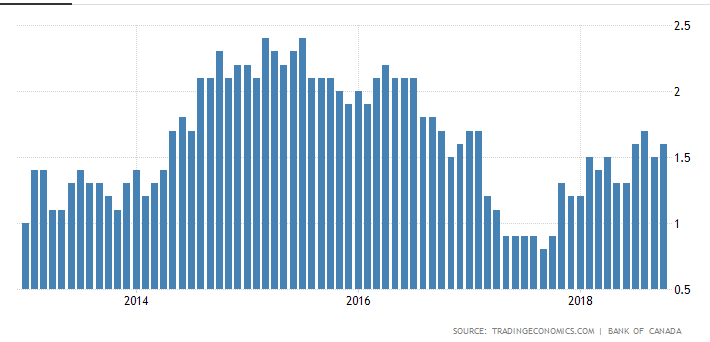

The dramatic fall in oil prices eventually affected other regions of the country as national output declined in 2015 and it was not until 2017 that economic growth emerged (Figure 3). Initially, consumer prices continued to increase at around 2 percent. However, the weakness in the economy eventually resulted in the CPI advancing at less than 1 percent by 2017 and averaging about 1.5 percent since (Figure 4).

Figure 3 Canadian GDP (US$)

Figure 4 Changes in the Canadian CPI

The Bank of Canada cut the bank rate twice from 1 percent to ½ percent in response to the deteriorating conditions. It is only in this past year that the Bank has, in a sense, lifted these emergency rate cuts, an indication of the lasting effects of the 2014 oil price collapse.