Another day, another set of political headlines dominating trading with the surprise result that ongoing US/China trade tensions hasn’t fully derailed yesterday’s gains. Oil consolidates, USD bid, but Copper leads commodity pain trade and adds to global slowdown fears. There is no doubt that its politics first, economics second so far. The key will be the tie-breaker of FOMC speeches and data. The analogy of Chess to the markets is worth considering today as Norway’s Carlsen battles to retain his championship title against American Caruana in a quickfire tie-breaker Wednesday after the 12th draw game in London yesterday. Everyone wants a winner. Consider the headlines:

The fact that the markets aren’t completely risk-off today, after these headlines, indicates something important, momentum to sell is slowing. The place where good and bad news seems to be ignored is the UK where politics and Brexit all lead to a dreadful game of Nine Men’s Morrisoutcomes with everyone losing. For the US today, the USD bid is more about Europe and UK weakness than US strength but the tie-breaker for momentum will rest on the Clarida speech and housing data ahead. Pay attention to GBP as its looking set to move much more aggressively.

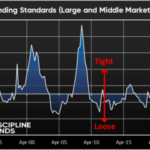

Question for the Day: Has the market already done the Fed’s work? The key speech today happens soon, from FOMC Vice Chair Clarida with the market listening to hear if there is hope for a pause in the hiking regime. The US market turmoil is showing up as a factor for many to predict less action from the FOMC in 2019. Clarida could clarify how the normalization to neutral plans can change according to market conditions and data. So far, the tightening of financial conditions hasn’t been as bad as the 4Q 2015 but we maybe are underestimating the next 6 weeks.