Euro has rallied more than 1.6% against the US Dollar since the yearly/monthly lows with price carving out a well-defined weekly opening-range just below technical resistance. Its decision time for the bulls- here are the updated targets and invalidation levels that matter on the EUR/USD charts.

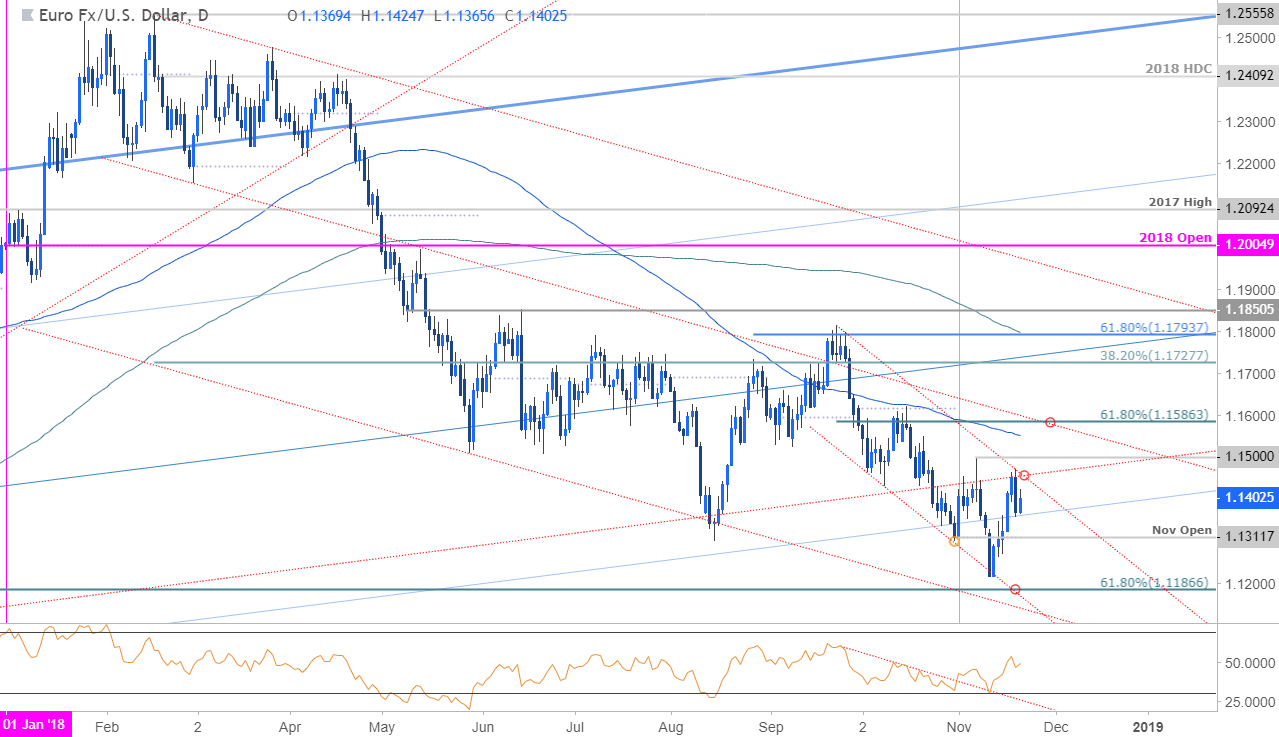

EUR/USD DAILY PRICE CHART

Technical Outlook: In our latest EUR/USD Weekly Technical Outlook we noted that Euro had, “responded to long-term support and keeps the focus weighted to the topside while above 1.13.” Price registered a high at 1.1472 yesterday before posting an outside-day reversal candle off slope resistance. Note that Euro has carved a well-defined monthly opening-range and ultimately we’re looking for the break for guidance.

Initial resistance stands at the highlighted trendline confluence, around ~1.1460s with a breach / close above the November opening-range high at 1.15 needed to validate the reversal. Subsequent topside resistance objectives eyed at the 100-Day moving average at ~1.1554 and the 61.8% retracement of the September decline at 1.1586.

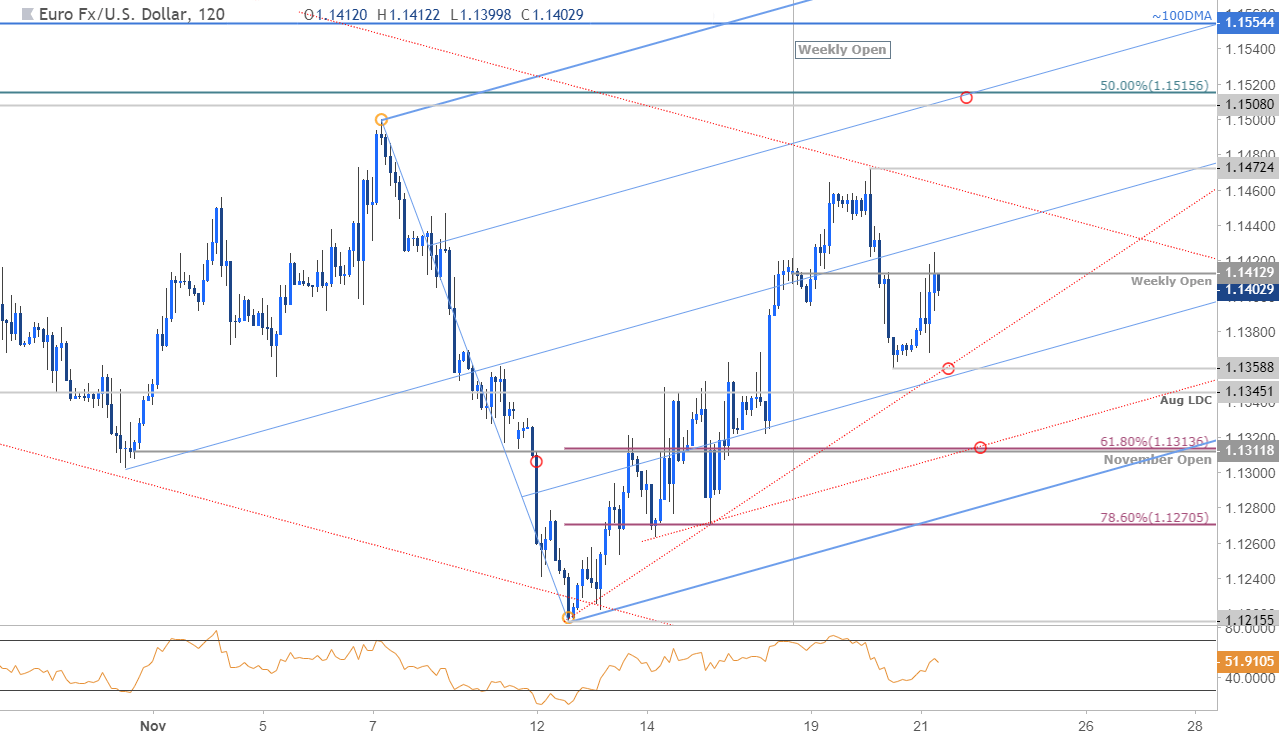

EUR/USD 120MIN PRICE CHART

Notes: A closer look at price action shows Euro straddling the weekly open at 1.1413 with the pair trading within an ascending pitchfork formation extending off the October / November lows. Interim support rests at 1.1345/59 with a bullish invalidation now raised 1.1312/14 – this region is defined by the monthly open & the 61.8% retracement of the monthly advance and converges on a sliding parallel of the dominant slope extending off the 11/14 swing lows (area of interest for possible exhaustion / long-entries IF reached).

Bottom line: An outside-day reversal yesterday does cast a bearish tone on price near-term but we’re looking for exhaustion on a move lower for re-entry. From a trading standpoint, I’ll favor fading weakness while above 1.1312 for now with a breach above 1.1516 needed to fuel the next leg higher in price. A break below this formation would shift the focus back towards the yearly lows / low close at 1.1215/18 and the 61.8% retracement down at 1.1187.