EUR/USD is trading above 1.1350, recovering from the lows in the wake of the last week of November. The central driver is Italy’s willingness to compromise on the budget deficit. Deputy PM Matteo Salvini, considered by some as the de-facto PM, opened the door to lowering the deficit over the weekend. His colleague Luigi di Maio also opened the door to lowering the deficit.

The European Commission demanded a 2% deficit and recommended a disciplinary procedure against the euro zone’s third-largest economy. Up to now, both sides dug into their heels, and this triggered a sell-off in Italian bonds and weighed on the Euro.

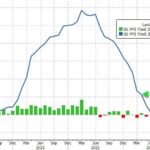

Now we are seeing the spread by Italian 10-year BTP’s and the benchmark German bunds narrow and fall below 280 basis points, the lowest since early October. The road to an agreement between Rome and Brussels is still long.

Brexit, Germany, and the US

The picture around Brexit not as happy. While the EU approved the deal, UK PM Theresa May faces an uphill battle in parliament. The concessions around Gibraltar, the DUP’s threat to abandon the supply and confidence agreement, and the call by European leaders o back the deal do not help. The pound is the primary mover on Brexit news, but the Euro remains affected.

The most significant source of worry comes from Germany. The fresh IFO Business Climate figure for November dropped to 102 points from 102.8, indicating growing concern. The result goes hand in hand with Friday’s Purchasing Managers’ Indices that also fell short of expectations.

Later today, ECB President ECB will testify in front of a committee of the European Parliament in Brussels. It will be interesting to see if he remains optimistic about growth and reaching the inflation target or if the recent data cause him to change his mind.