One of the strangest things about this strangest-ever expansion has been the way pretty much everything went up. Stocks, bonds, real estate, art, oil – some of which have historically negative correlations with others — all rose more-or-less in lockstep. And within asset classes, the big names behaved the same way, rising regardless of their relative valuation.

This seemingly indiscriminate buying created a paradise for index funds that simply accumulate representative assets in their chosen sectors. And it made life a nightmare for the higher-order strategies of hedge funds that get paid to beat the market.

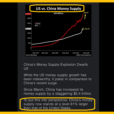

The cause of all this, of course, was the tsunami of new currency being created by the world’s central banks and dumped into the banking system. It had to go somewhere and ended up going everywhere.

But now the central bank spigot is being turned off, and – surprise – everything is heading back down in the same way that it rose — in lockstep. From today’s Wall Street Journal: