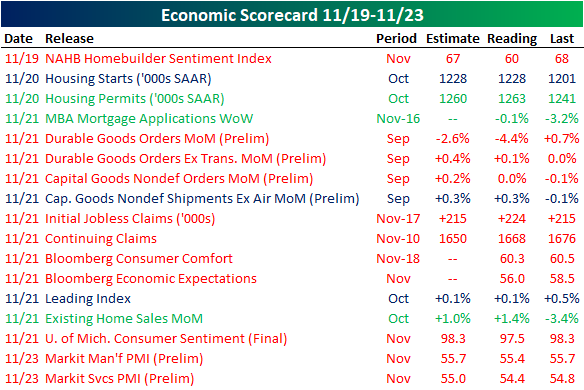

Even with the holiday, last week we saw 17 US economic data releases. It was very negative with only 3 of those indicators beating forecasts or their previous readings. The front half of the week was predominately housing data. Homebuilder sentiment badly missed estimates on Monday. Tuesday saw the release of housing starts and permits. Starts came in line with forecasts while permits beat estimates for only the second time since April. Wednesday saw the preliminary M3 report from the US Census which mostly missed estimates but still showed positive activity. Jobless claims missed estimates on Wednesday as well. There were no releases on Thursday due to the Thanksgiving holiday, and Friday was a light day only seeing preliminary Markit PMIs, which came in slightly below estimates.

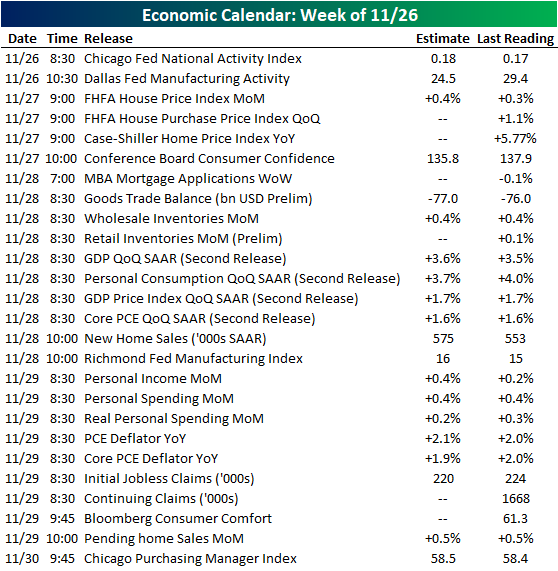

The Chicago Fed National Activity Index kicked off this week stronger than forecasts, but the Dallas Fed fell more than expected. Tomorrow we will get the FHFA and Case-Shiller home prices. Wednesday will be the big day this week with the second Q3 GDP release. Thursday will be an equally busy day with personal income and spending, claims, and the Fed’s favorite inflation gauge the PCE Deflator. Chicago PMI caps off the week as the only indicator releasing on Friday.