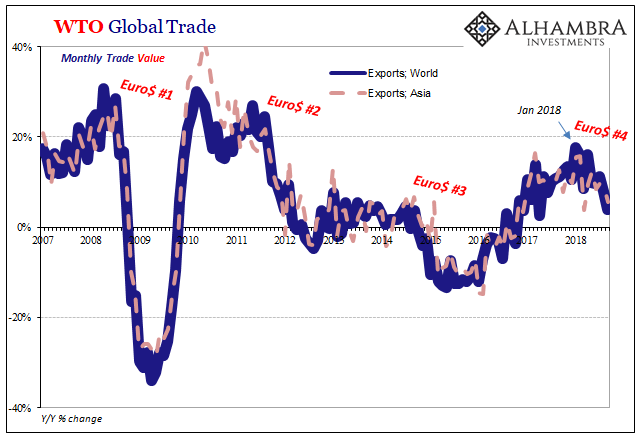

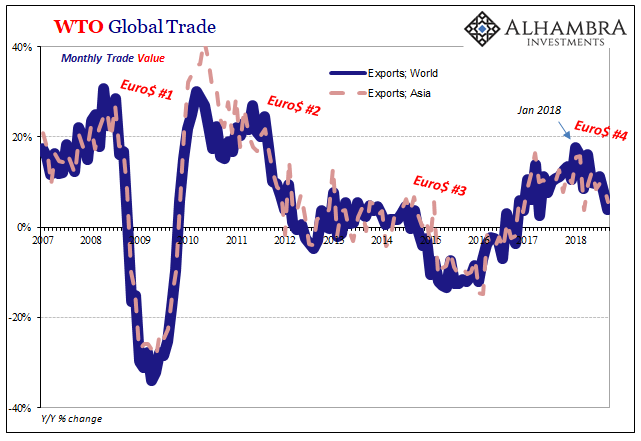

We can add this to the list of all the things going wrong in October. If it felt like a wave of renewed deflation built up and swept over markets and the global economy, it’s because that’s just what had happened. I don’t think it a random coincidence the WTI curve went contango and oil prices globally crashed when they did. Golden Weeks in China is always interesting, especially on the reopening.

There are two facts as they pertain to China in 2018. The first is the nation’s clear monetary trouble. The second is why it has (re)emerged.

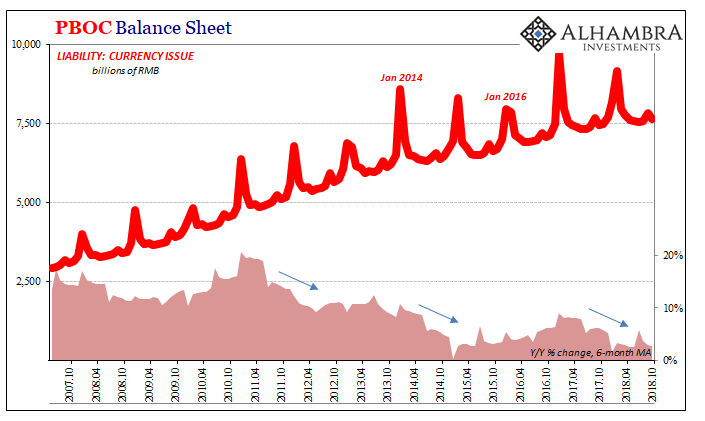

The statistics for the first part were pretty grim last month, accounting for much of why October was such a major global mess. The People’s Bank of China has been forced into cutting back on monetary growth in base measures all year. This all changed in January, the same time the global economy began to come crashing back down from its low-level reflation in 2017.

Without foreign assets, eurodollars, flowing onto its balance sheet on the asset side the central bank can only restrict growth on the money (liability) side. Factoring the cash needs for the central government, the result has been an increasing squeeze on the RMB base. This includes, ominously, actual cash in circulation.

In October, currency issue expanded by just 2.6% year-over-year. That brings the 6-month average down to 2.7%, which is the lowest average (not counting New Year January/February distortions) in all of the published PBOC data. They’ve just about turned off the literal printing press in China.

For the banking system, the external monetary noose tightened much more. This, of course, was perfectly predictable. China’s central bank practically announced what was going to happen when it cut the RRR during this very month in question. I wrote when the country reopened from its National Holiday week last month:

The RRR cut signals that the reserve problem therefore dollar problem is anticipated to grow worse. The PBOC is actually telling us that they expect in the months ahead the same or perhaps bigger commitment to “stepped up support.” CNY doesn’t need support if there is no worsening “capital outflow” situation of retreating eurodollar funding.

This will require more monetary contraction in bank reserves than we’ve already seen. The central bank is forecasting more problems ahead.