Key Takeaways

- Redacted Cartel is an emerging project that’s hoping to become the leading meta-governance protocol in DeFi.

- Since launching just over two months ago, the Cartel has become one of the largest holders of governance tokens like CRV, CVX, TOKE, and OHM.

- Its native governance and utility token BTRFLY represents an index of the vote-escrow tokens held in the protocols treasury.

Redacted Cartel is a decentralized autonomous organization that uniquely focuses on acquiring governance tokens and voting power across many of the most influential liquidity management protocols in DeFi with the aim of providing meta-governance services to other DAOs in the space.

The Race for Liquidity

Redacted Cartel is a DeFi project that requires a ton of context to fully understand. Ultimately, it boils down to a fight for control over the liquidity flow in DeFi—but that doesn’t mean anything without first having a clear picture of the space’s liquidity landscape.

Liquidity refers to the quantity of crypto assets available for trading on a specific trading venue. It’s important because it determines how easily an asset can be exchanged for another asset without impacting its market price. Deep liquidity lets market participants efficiently execute large trades without incurring slippage—a terms used to describe the difference between the expected price and the actual price of a trade. When liquidity is low, trading becomes inefficient and expensive. Low liquidity repels traders, leading to lower trading fees and profits for liquidity providers, which causes liquidity to dry up even more.

Liquidity, then, is highly reflexive with a strong flywheel effect. Deep liquidity leads to more trading activity, which attracts liquidity providers, and vice versa. Low liquidity leads to less trading activity, which encourages liquidity providers to move their capital elsewhere. Therefore, sourcing and securing liquidity is essential for DeFi projects, especially during their early stages.

That being said, liquidity sourcing and management in DeFi today is suboptimal. As a result, the space has recently seen a proliferation of so-called “DeFi 2.0” protocols that aim to solve this issue. Redacted Cartel is one of them.

DeFi protocols typically secure liquidity through liquidity mining programs. This means rewarding liquidity providers with governance tokens for the duration of their service. Theoretically, this is a great proposition for liquidity providers, who are often only looking to provide their service while the incentives are worthwhile. For the projects, however, this is a not a favorable proposition because, as some calculations estimate, securing $1 of liquidity can set them back up to $1.25 in their native tokens.

Additionally, project teams must spend a considerable amount of time and effort on managing the liquidity on behalf of their protocols. To ensure liquidity providers stick around, projects are often forced to perpetually issue token rewards, which puts significant inflationary sell pressure on their respective tokens and disincentivizes users from investing in or holding them.

In a bid to escape this race to the bottom, many notable DeFi projects have recently started experimenting with new ways of sourcing and securing liquidity, including bribing liquidity providers and owning their own liquidity. In return, this has spawned a separate subset of DeFi protocols that provide different tools and services to projects looking to go this route. Redacted Cartel plays a key role in this process, but to understand why we first need a short primer on the Curve Wars.

Curve, Convex, and the Liquidity Wars

Curve is the largest decentralized exchange for like-pegged assets such as stablecoins. With over $20 billion in total value locked, and liquidity pools churning some of the highest trading volumes between all decentralized exchanges on the market, Curve takes center stage in DeFi’s liquidity wars.

To attract and retain liquidity, Curve incentivizes liquidity providers with its CRV token through inflationary emissions. Due to the way Curve’s governance and tokenomics work, CRV has become an important treasury asset for many DeFi protocols searching for liquidity.

CRV tokens can either be sold, compounded, or locked up for a predefined period (one week to four years) in exchange for vote-escrowed CRV, otherwise known as veCRV. The difference between these two tokens is that the latter gives owners a portion of Curve’s trading fees, boosted CRV rewards, and governance rights over Curve’s future token emissions.

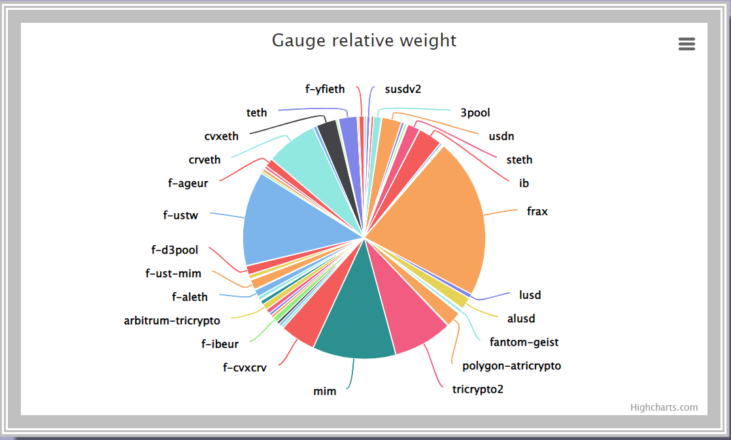

Buying and vote-locking CRV is a cheaper way of securing liquidity than spending governance tokens, which is why many DeFi projects are now waging wars for control over Curve’s gauge. Because the CRV supply is hard-capped, and projects can only acquire so many, the war has led to another interesting market dynamic: bribes.

Instead of fighting to acquire more veCRV, using tools like bribe.crv and Votium, projects have begun bribing existing veCRV holders to vote in favor of directing new CRV rewards toward their pools. This is currently the most efficient way of renting liquidity from Curve’s liquidity providers and a huge source of additional income for Curve’s veCRV and Convex’s vlCVX token holders.

Convex plays a big role in the liquidity wars. It’s built on top of Curve and allows liquidity providers and Curve investors to maximize their yield. It’s the largest protocol holder of veCRV. The holders of its own vote-locked vlCVX governance token decide how the protocol votes to direct CRV emissions on Curve. Because vlCVX holders have a say on where these rewards should go, DeFi protocols are incentivized to bribe them to sway their votes in their own favor.

Redacted Cartel Explained

Redacted is one of the newest entrants to the liquidity wars. The Cartel’s goal is to become a meta-governance protocol by acquiring as many influential governance tokens as possible, including veCRV, vlCVX, Tokemak’s TOKE, Frax Finance’s FXS, and others.

Similar to how some of the largest index funds and asset managers in traditional finance have influence over some of the world’s biggest and most profitable companies, Redacted Cartel is looking to do the same in DeFi.

By focusing specifically on influential governance tokens, Redacted is hoping to become a major player in the liquidity wars. The pseudonymous Redacted co-founder 0xSami sat down with Crypto Briefing to discuss the protocol’s mission, explaining that becoming a key player in DeFi’s liquidity wars can have huge upside. They said:

“We want to make Redacted Cartel the top revenue-generating protocol in DeFi by leveraging the concept of bribes and vote-escrow tokens. I believe that we came to market at just the right time and that we’ll be able to get ahead of everyone in this emerging trend in crypto.”

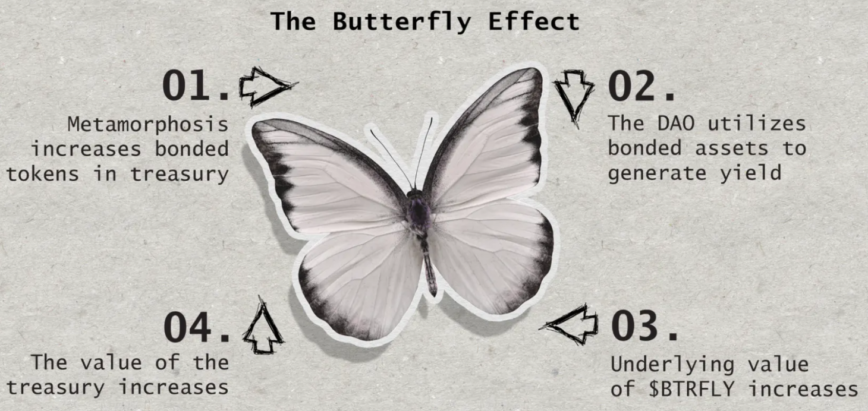

Redacted Cartel is a sub-DAO of another high-profile project, OlympusDAO. From a technical perspective, it borrows most of its protocol design principles from it. For example, to grow the protocol’s treasury or accumulate as many influential governance tokens as possible, Redacted uses a similar bonding system to the one Olympus pioneered. Through bonding, holders of CRV, CVX, and other governance tokens can lock their assets in Redacted’s treasury to get a discount on Redacted’s native BTRFLY token.

Token holders lock their assets because staking BTRFLY on the platform gives them access to incredibly high yields through rebasing, a mechanism through which stakers’ account balances are automatically increased based on pre-set protocol parameters. Rebasing is another system design borrowed from Olympus, but the similarities stop there. Where Olympus wants its OHM token to become a free-floating global reserve currency, Redacted sees BTRFLY as an index for influential vote-escrow governance tokens. Explaining how the Redacted team views its native token, 0xSami said:

“In a way, BTRFLY is an index of all vote-escrow tokens, which is a very big trend in DeFi this year. We see BTRFLY as a liquid wrapper for all vote-escrow tokens, and while it doesn’t follow a peg, using it would act as a meta-governance token for all of DeFi. Its value would be extracted based upon the governance power it holds over all of these protocols we’re looking to influence.”

While the so-called “(3,3)” token rebasing model served Redacted Cartel well during its bootstrapping stage, the team is now looking to steer away from it and introduce two types of BTRFLY derivatives: governance-locked (glBTRFLY) and bribe-locked (blBTRFLY). The purpose of this change is to further align the respective token holders with the protocol’s ultimate goals.

The bribe-locked BTRFLY token will be more suited to retail investors looking to earn a portion of all the profits the protocol generates. The governance-locked BTRFLY token, on the other hand, will be more of a protocol-facing product, allowing its holders to leverage Redacted’s voting power for their own internal needs. Explaining the value proposition of glBTRFLY, 0xSami said:

“Suppose you’re a new DeFi protocol, and you want to bootstrap liquidity for your token or protocol; you’ll want a Dopex SSOV vault, a heavily incentivized Curve pool, Convex rewards, a spot on OlympusPro—well glBTRFLY can get that for you. You’ll be able to use our token as a proxy and influence governance decision on all of these protocols to your favor.”

Redacted also plans to provide other DAOs and DeFi protocols with a special liquidity management tool called Computer-Aided Governance, which should help them automate their decision-making processes by leveraging big data and machine learning.

How Does Redacted Cartel Make Money?

With around $80 million in treasury assets, Redacted Cartel generates significant profits through multiple revenue streams.

One of the protocol’s revenue streams comes from selling bonds. When a user mints 100 BTRFLY by locking CRV, CVX, OHM, or other governance tokens into the protocol, Redacted will charge a 10% fee or add 10 BTRFLY tokens to its treasury. The second and most profitable revenue stream comes from yield farming with the treasury assets. “Our unique edge is that, behind the scenes, we’re using the treasury assets to yield farm by staking or accumulating bribes,” 0xSami said. “In this context, BTRFLY acts similar to a dividend coin.”

Redacted also acts as a decentralized pseudo-hedge fund, using its capital to acquire other cash flow-generating protocols. For example, the Cartel recently acquired Votemak, a platform that allows projects to influence where liquidity on the decentralized liquidity management protocol Tokemak goes by using bribes.

After the acquisition, Redacted expanded Votemak’s capabilities and created the Hidden Hand, a decentralized and permissionless marketplace for bribes. There, protocols with vote-escrow tokens will be able to accrue more value for their token holders by giving them access to a flexible marketplace for bribes for their tokens. Redacted will take a 4% fee from the value of each bribe on the platform and redistribute half of it to the treasury and the other half to BTRFLY stakers to boost the yield rate.

Besides acquisitions, Redacted has also made several seed investments, including $750,000 in Curvance and JonesDAO. Curvance is a lending platform built on top of Curve, while JonesDAO is a yield, strategy, and liquidity protocol for options built on top of Dopex.

According to 0xSami, Redacted’s goal is to turn the protocol into a cash cow. “With the actions we take, we want to become a very high revenue-generating protocol and pass the profits back to the treasury and directly to BTRFLY stakers.”

Final Thoughts

Since launching in December 2021, Redacted Cartel has built an $80 million treasury and become one of the largest holders of some of DeFi’s most influential governance tokens. It’s already the second-largest protocol holder of CVX and one of the largest CRV holders. Although the DAO has only just started expanding its product line, its operations are already profitable.

The project’s ambitious roadmap contains improvements including miner extractable value (MEV) and liquidations protections, a revised bonding mechanism, a revised tokenomics design, the Hidden Hand marketplace, and more acquisitions and seed investments.

Liquidity management is one of the most important aspects of running a DeFi project. Redacted Cartel is quickly shaping into a DAO that provides an immensely valuable service to other projects looking to source and manage their liquidity in the space with greater efficiency.

Disclosure: At the time of writing, the author of this feature held ETH, BTRFLY, and several other cryptocurrencies.