Increases in production were seen in PADDs 1, 2, 3, and 4, with the largest percentage increase in production seen in PADD 4, which comprises Colorado, Idaho, Montana, Utah, and Wyoming. The largest actual increase was seen in PADD 2, which includes North Dakota, Illinois, and Kentucky, among other states.Crude production in Texas in August – home to a large portion of the Permian Basin and where Exxon will soon be undisputed energy king after its merger with Pioneer closes – rose from 173.775 million barrels to 174.562 million barrels.Despite the record-breaking production levels seen in August, inventories of crude oil in the United States are estimated to be within 3 million barrels of where it began the year.The new record in crude production in the United States comes shortly after U.S. supermajor ExxonMobil spent $60B on purchasing another Permian player, Pioneer Natural Resources, although most oil companies in the United States have chosen fiscal restraint resulting in a slow and steady increase in output versus the no holds barred investment strategies during previous boom cycles.What is perhaps more remarkable is that in a recent report (available to pro subscribers) from Goldman commodity analyst Daan Dtruyven, the bank found that “the US has driven all the growth in global oil supply over the past decade and the past year, and the Permian basin has driven all growth in US crude supply since early 2020.”

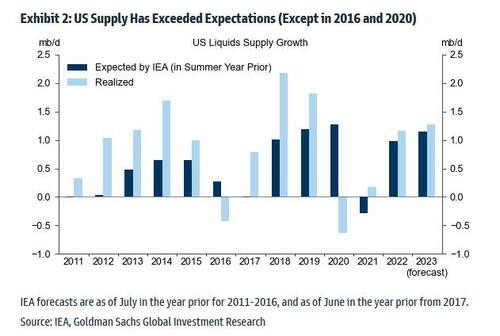

Increases in production were seen in PADDs 1, 2, 3, and 4, with the largest percentage increase in production seen in PADD 4, which comprises Colorado, Idaho, Montana, Utah, and Wyoming. The largest actual increase was seen in PADD 2, which includes North Dakota, Illinois, and Kentucky, among other states.Crude production in Texas in August – home to a large portion of the Permian Basin and where Exxon will soon be undisputed energy king after its merger with Pioneer closes – rose from 173.775 million barrels to 174.562 million barrels.Despite the record-breaking production levels seen in August, inventories of crude oil in the United States are estimated to be within 3 million barrels of where it began the year.The new record in crude production in the United States comes shortly after U.S. supermajor ExxonMobil spent $60B on purchasing another Permian player, Pioneer Natural Resources, although most oil companies in the United States have chosen fiscal restraint resulting in a slow and steady increase in output versus the no holds barred investment strategies during previous boom cycles.What is perhaps more remarkable is that in a recent report (available to pro subscribers) from Goldman commodity analyst Daan Dtruyven, the bank found that “the US has driven all the growth in global oil supply over the past decade and the past year, and the Permian basin has driven all growth in US crude supply since early 2020.” US supply has also grown faster than expected. According to Goldman, US liquids supply is on track to exceed IEA expectations for the 13th consecutive year, except for 2016 and 2020. That said, the 2022 and 2023 forecast errors will likely be smaller than before the pandemic, and US total liquids supply has been roughly flat since June.

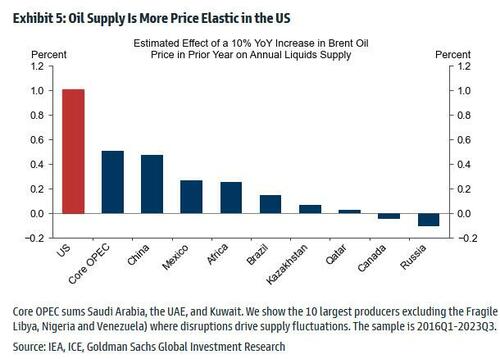

US supply has also grown faster than expected. According to Goldman, US liquids supply is on track to exceed IEA expectations for the 13th consecutive year, except for 2016 and 2020. That said, the 2022 and 2023 forecast errors will likely be smaller than before the pandemic, and US total liquids supply has been roughly flat since June. Furthermore, the US remains the key short-term marginal oil producer, where flexible short-cycle private producers sit high on the global cost curve.

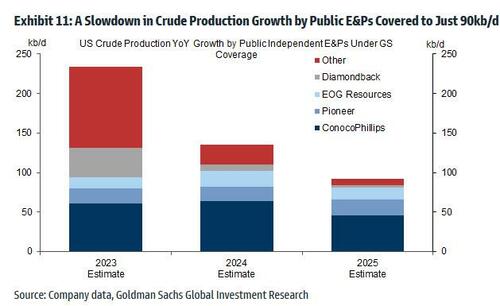

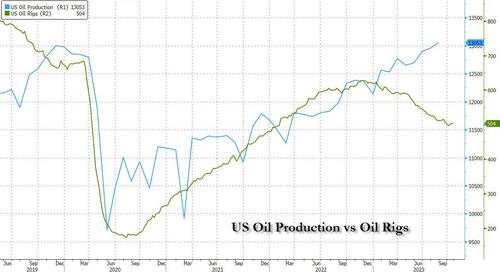

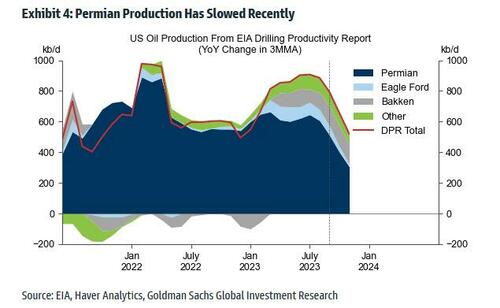

Furthermore, the US remains the key short-term marginal oil producer, where flexible short-cycle private producers sit high on the global cost curve. So is the US falling in the overproduction trap that marked much of the 2010s and which led to the defaulting of dozens of junk debt-funded US energy producers, and sharply oil prices?According to Goldman, the answer is no as crude output growth in the Permian has slowed from 1mb/d in 2019 to 0.5mb/d year-over-year in September given the drop in the rig count, and the stabilizing well productivity trend.

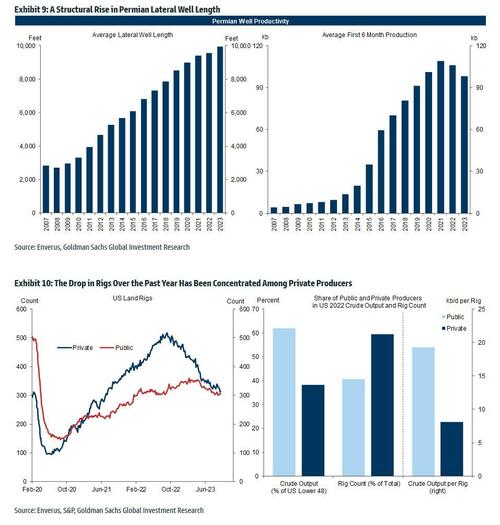

So is the US falling in the overproduction trap that marked much of the 2010s and which led to the defaulting of dozens of junk debt-funded US energy producers, and sharply oil prices?According to Goldman, the answer is no as crude output growth in the Permian has slowed from 1mb/d in 2019 to 0.5mb/d year-over-year in September given the drop in the rig count, and the stabilizing well productivity trend. However, Permian output is still edging up because of rises in the number of drilled wells per rig and well length. In other words, the Permian new well output per rig is still trending higher because of:

However, Permian output is still edging up because of rises in the number of drilled wells per rig and well length. In other words, the Permian new well output per rig is still trending higher because of:

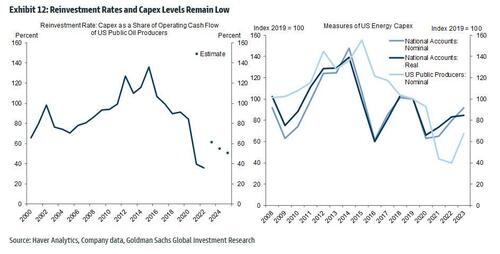

This is important because the lack of well productivity growth (which reflects an offset between deteriorating rock quality and improving technology) suggest that Permian output growth will slow further. In fact, the emergence of the Permian as the world’s key oil market variable may explain why Exxon recently purchased Pioneer: the new supergiant will have every opportunity to turn oil output in the US on (or off) as only it sees fit.Finally, a question that Wall Street would love answered: are US producers still capital disciplined?Goldman’s answer, “yes, three pieces of evidence show that the US upstream sector remains capital disciplined.”

This is important because the lack of well productivity growth (which reflects an offset between deteriorating rock quality and improving technology) suggest that Permian output growth will slow further. In fact, the emergence of the Permian as the world’s key oil market variable may explain why Exxon recently purchased Pioneer: the new supergiant will have every opportunity to turn oil output in the US on (or off) as only it sees fit.Finally, a question that Wall Street would love answered: are US producers still capital disciplined?Goldman’s answer, “yes, three pieces of evidence show that the US upstream sector remains capital disciplined.”

More By This Author:WeWork Craters 36% After Hours On WSJ Bankruptcy ReportAMD Tumbles On Disappointing Revenue Guidance, Drags Chip Names LowerYen & UST Yields Tumble After BoJ’s Mixed Messages, But…

More By This Author:WeWork Craters 36% After Hours On WSJ Bankruptcy ReportAMD Tumbles On Disappointing Revenue Guidance, Drags Chip Names LowerYen & UST Yields Tumble After BoJ’s Mixed Messages, But…