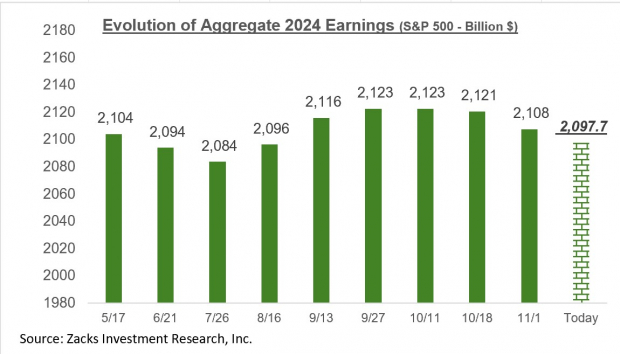

With results from nearly 97% of S&P 500 members already out, we can confidently say that the overall earnings picture remains stable and largely positive. Earnings growth for the S&P 500 index, which was negative for each of the preceding three quarters, turned positive in Q3.One major sector whose results really stood out this earnings season has been the Tech sector, with Q3 earnings for the sector on track to increase +23.3% from the same period last year on +4.7% higher revenues. The sector has had a profitability problem since the start of 2022, but it appears on track to resume its traditional growth attributes going forward, with double-digit earnings growth expected in each of the coming three periods.For the current period (2023 Q4), the expectation is for S&P 500 earnings to be flat from the same period last year on +2.4% higher revenues.The chart below shows how estimates for 2023 Q4 have evolved since the quarter got underway. Image Source: Zacks Investment ResearchThis is a bigger decline in quarterly estimates compared to what we had seen in the comparable periods to either of the preceding two quarters. This is a reversal of the favorable revisions trend we have spotlighted in this space since April 2023.Not only is there a bigger magnitude of cuts to Q4 estimates, but the pressure is also widespread, with estimates for 12 of the 16 Zacks getting cut since the start of October. The biggest cuts to estimates have been for the Autos, Medical, Consumer Discretionary, Transportation, and Basic Materials sectors.We noted Disney (DIS – Free Report) from the Consumer Discretionary sector and United Airlines (UAL – Free Report) from the Transportation sector as examples of the aforementioned negative revisions trend.The current Q4 Zacks Consensus EPS for Disney of $1.04 is down from $1.16 a month ago and $12.39 two months back. Disney shares were up following last week’s better-than-expected results, but the company’s near-term earnings outlook is under pressure.The negative revisions trend is even more pronounced for United Airlines, which is currently expected to bring in $1.73 per share, down from $2.46 per share in the year-earlier period.United’s $1.73 estimate is down from $2.31 a month ago and $2.94 three months back.You can see the pressure on full-year 2024 earnings estimates in the chart below, which shows the aggregate earnings estimates for the S&P 500 index since mid-May 2024.

Image Source: Zacks Investment ResearchThis is a bigger decline in quarterly estimates compared to what we had seen in the comparable periods to either of the preceding two quarters. This is a reversal of the favorable revisions trend we have spotlighted in this space since April 2023.Not only is there a bigger magnitude of cuts to Q4 estimates, but the pressure is also widespread, with estimates for 12 of the 16 Zacks getting cut since the start of October. The biggest cuts to estimates have been for the Autos, Medical, Consumer Discretionary, Transportation, and Basic Materials sectors.We noted Disney (DIS – Free Report) from the Consumer Discretionary sector and United Airlines (UAL – Free Report) from the Transportation sector as examples of the aforementioned negative revisions trend.The current Q4 Zacks Consensus EPS for Disney of $1.04 is down from $1.16 a month ago and $12.39 two months back. Disney shares were up following last week’s better-than-expected results, but the company’s near-term earnings outlook is under pressure.The negative revisions trend is even more pronounced for United Airlines, which is currently expected to bring in $1.73 per share, down from $2.46 per share in the year-earlier period.United’s $1.73 estimate is down from $2.31 a month ago and $2.94 three months back.You can see the pressure on full-year 2024 earnings estimates in the chart below, which shows the aggregate earnings estimates for the S&P 500 index since mid-May 2024. Image Source: Zacks Investment ResearchThe chart below shows the overall earnings picture on a quarterly basis.

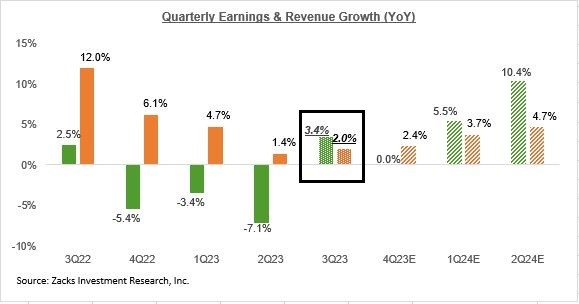

Image Source: Zacks Investment ResearchThe chart below shows the overall earnings picture on a quarterly basis. Image Source: Zacks Investment ResearchAs you can see from these quarterly earnings-growth expectations, the long-feared recession doesn’t appear in this near-term earnings outlook.Below, we show the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment ResearchAs you can see from these quarterly earnings-growth expectations, the long-feared recession doesn’t appear in this near-term earnings outlook.Below, we show the overall earnings picture for the S&P 500 index on an annual basis. Image Source: Zacks Investment ResearchThis big-picture view of corporate profitability doesn’t leave much room for that development either, as shown in the chart above. That said, we know that macroeconomic growth is moderating, which should have a negative impact on estimates. We showed earlier how estimates for the current and coming periods have started coming down lately, a trend that will most likely remain in place for some time.More By This Author:Top Analyst Reports For Amazon, Deere & Citigroup Has The Profit Cycle Bottomed? Earnings Estimates Moving Lower As Growth Moderates

Image Source: Zacks Investment ResearchThis big-picture view of corporate profitability doesn’t leave much room for that development either, as shown in the chart above. That said, we know that macroeconomic growth is moderating, which should have a negative impact on estimates. We showed earlier how estimates for the current and coming periods have started coming down lately, a trend that will most likely remain in place for some time.More By This Author:Top Analyst Reports For Amazon, Deere & Citigroup Has The Profit Cycle Bottomed? Earnings Estimates Moving Lower As Growth Moderates