Source: BloombergWho could have seen that coming?

Source: BloombergWho could have seen that coming?

1. Dealer gamma turns deeply positive

2. $5BN in daily buybacks until mid-Dec

3. CTAs buying up to $200BN in global stocks over next month

4. Hedge Funds least net long since 2011

5. Seasonals pic.twitter.com/Rv3U1HLGHx

— zerohedge (@zerohedge) November 3, 2023

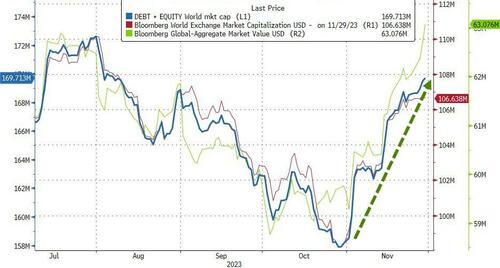

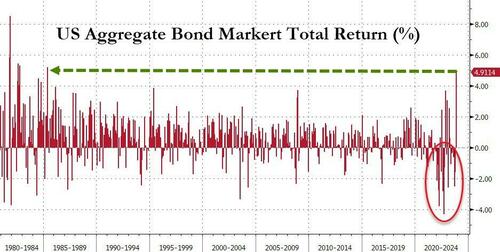

Global bonds had their best month since Dec 2008 with US bonds soaring to their best month since May 1985… Source: Bloomberg…and back into the green for the year…

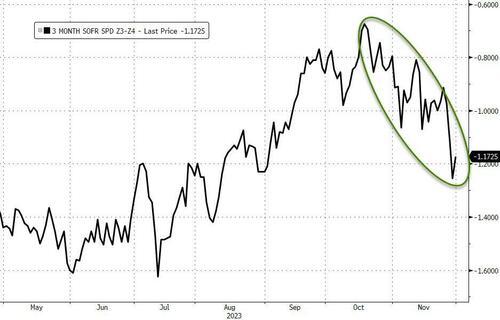

Source: Bloomberg…and back into the green for the year… Source: BloombergFor context, that is a 60bps or so collapse in yields for Treasury bonds on the month (with the short-end underperforming)…

Source: BloombergFor context, that is a 60bps or so collapse in yields for Treasury bonds on the month (with the short-end underperforming)… Source: BloombergDespite bull-steepening in the last few days, the yield curve (2s30s) is flatter (more inverted) for the second straight month…

Source: BloombergDespite bull-steepening in the last few days, the yield curve (2s30s) is flatter (more inverted) for the second straight month… Source: Bloomberg“There’s a little bit of the fear of missing out,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investment.“Suddenly 5% yields on the 10-year Treasury have become a distant memory.”No fear here in stock-land as all the US majors rallied almost non-stop (up around 8-10% on the month) led by Nasdaq…

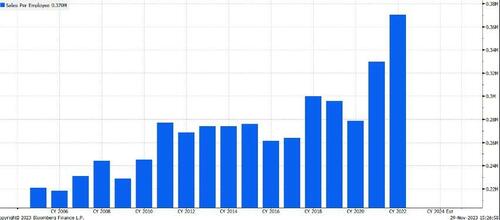

Source: Bloomberg“There’s a little bit of the fear of missing out,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investment.“Suddenly 5% yields on the 10-year Treasury have become a distant memory.”No fear here in stock-land as all the US majors rallied almost non-stop (up around 8-10% on the month) led by Nasdaq… Source: BloombergRandom but interesting… the sales per employee in the Russell 2000 (where people expect job cuts) has never been higher.

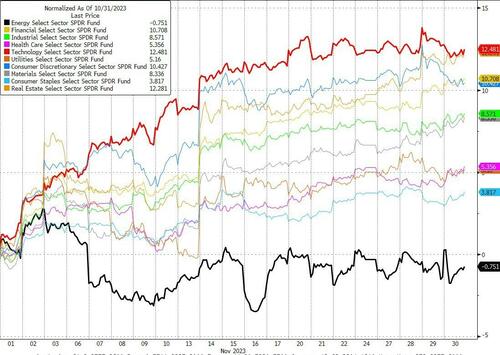

Source: BloombergRandom but interesting… the sales per employee in the Russell 2000 (where people expect job cuts) has never been higher. The energy sector was the only one to end the month red while Tech and Real Estate were the big winners…

The energy sector was the only one to end the month red while Tech and Real Estate were the big winners… Source: BloombergAnd VIX plunged to a 12 handle – its biggest absolute monthly decline since Nov 2022…

Source: BloombergAnd VIX plunged to a 12 handle – its biggest absolute monthly decline since Nov 2022… The rally in bonds and stocks sent financial conditions dramatically looser…

The rally in bonds and stocks sent financial conditions dramatically looser… Source: BloombergIn fact, October saw the biggest absolute monthly loosening of financial conditions in history (back to 1982)…

Source: BloombergIn fact, October saw the biggest absolute monthly loosening of financial conditions in history (back to 1982)… Source: BloombergThe dollar index tumbled 3% in November – its biggest monthly decline since Nov 2022 (and 2nd biggest since July 2020). Note that today’s bounce ripped up to its 200DMA and stalled…

Source: BloombergThe dollar index tumbled 3% in November – its biggest monthly decline since Nov 2022 (and 2nd biggest since July 2020). Note that today’s bounce ripped up to its 200DMA and stalled… Source: BloombergBitcoin rallied for the 3rd month in a row, back above $38,000…

Source: BloombergBitcoin rallied for the 3rd month in a row, back above $38,000… Source: BloombergEthereum soared over 12% in November – its best month since March and its first monthly outperformance of BTC since May – but as is obvious from the chart, it has stalled since the early surge…

Source: BloombergEthereum soared over 12% in November – its best month since March and its first monthly outperformance of BTC since May – but as is obvious from the chart, it has stalled since the early surge… Source: BloombergGold rallied for the 2nd straight month, back up to record highs…

Source: BloombergGold rallied for the 2nd straight month, back up to record highs… Source: BloombergSilver also soared back above $25…

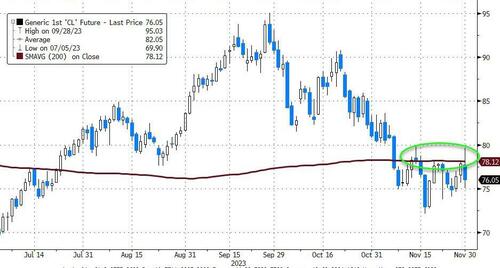

Source: BloombergSilver also soared back above $25… Source: BloombergOil prices fell for the second straight month, with WTI finding resistance at the 200DMA for the last week (including a stop-run that failed today)…

Source: BloombergOil prices fell for the second straight month, with WTI finding resistance at the 200DMA for the last week (including a stop-run that failed today)… Source: BloombergFinally, November was truly a month of “bad news” being “good news” for stocks…

Source: BloombergFinally, November was truly a month of “bad news” being “good news” for stocks… Source: Bloomberg‘Hard’ data hits a 14-month low as stocks surge back near record highs.

Source: Bloomberg‘Hard’ data hits a 14-month low as stocks surge back near record highs.

“We’ve been getting economic data recently that reinforces the idea of the Goldilocks slowdown,” said Rebecca Patterson, former chief investment strategist at Bridgewater Associates.

“Inflation is coming down, and at the same time it hasn’t been unduly impinging growth.”

But be careful what you wish for – if financial conditions loosen much more, The Fed will be forced to jawbone some reality back into market as November saw the biggest increase in rate-cut expectations for 2024 since Nov 2022. Do investors really think anything but a NOT-soft-landing would spark 5 x 25bps rate-cuts in an election year!More By This Author:Texas Sues Pfizer For “Misrepresenting COVID-19 Vaccine Efficacy” And “Conspiring To Censor Public Discourse””Double-Barrel Of Optimism”: Insider Buying And Buyback Activity Surges US Pending Home Sales Index Slumps To Record Low

Do investors really think anything but a NOT-soft-landing would spark 5 x 25bps rate-cuts in an election year!More By This Author:Texas Sues Pfizer For “Misrepresenting COVID-19 Vaccine Efficacy” And “Conspiring To Censor Public Discourse””Double-Barrel Of Optimism”: Insider Buying And Buyback Activity Surges US Pending Home Sales Index Slumps To Record Low