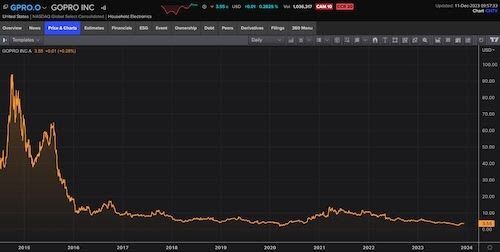

If there’s something we’ve learned in our decades in the markets, it’s that success in investing is not all about what to buy. It’s also about what NOT to buy.If you can stay away from what not to buy (where the odds are heavily weighted against you), then you greatly increase the chances of “being at the table when your turn to get lucky comes around.”Case in point: Beyond Meat.We first mentioned Beyond Meat (BYND) back in 2020 in the Insider Newsletter. We certainly made no friends with the woke crowd at the time. Beyond Meat, you might recall, was “saving the planet” (although it is still beyond us as to exactly how). If you remember when Beyond Meat came to the market, it listed at about $80, then quickly went to $230, but today, the stock languishes at $9 (and from a valuation perspective it is still expensive). That’s a -96% drop in share price — enough to make even the most hardened vegans cry for a piece of ribeye. More often than not hot stocks like Beyond Meat end in tragedies with their stock prices being down significantly from their listing price some three or so years after their listing.Now don’t get us wrong — that doesn’t automatically mean to say these stocks are a short on day one of their listing. Often these hotties go up significantly shortly after their listing. Just look at Beyond Meat’s stock price in 2019.Take a look at another “hottie” of days gone by: GoPro (GPRO). Sure, their products are great, but that doesn’t necessarily translate into a great stock.

More often than not hot stocks like Beyond Meat end in tragedies with their stock prices being down significantly from their listing price some three or so years after their listing.Now don’t get us wrong — that doesn’t automatically mean to say these stocks are a short on day one of their listing. Often these hotties go up significantly shortly after their listing. Just look at Beyond Meat’s stock price in 2019.Take a look at another “hottie” of days gone by: GoPro (GPRO). Sure, their products are great, but that doesn’t necessarily translate into a great stock. As we said earlier… knowing what NOT to buy is just as important as knowing what to buy. More often than not, staying away from “hot issues” (stocks that are the talk of the town) will serve you well as an investor.More By This Author:Charts: These Data Points Really Pop

As we said earlier… knowing what NOT to buy is just as important as knowing what to buy. More often than not, staying away from “hot issues” (stocks that are the talk of the town) will serve you well as an investor.More By This Author:Charts: These Data Points Really Pop

Buy Yield

Prepare For The Worst