Case-Shiller updated is home price data for January this week. Here are the key charts and a discussion of why it’s hard to tell if prices are rising or falling. Case-Shiller, OER and CPI data from St. Louis Fed, chart by Mish Chart Notes

Case-Shiller, OER and CPI data from St. Louis Fed, chart by Mish Chart Notes

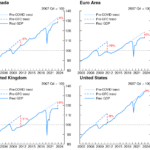

Case-Shiller measures repeat sales of the same home over time and the indexes attempt to weed out major home improvements.Case-Shiller is a far better measure of home prices than median or average prices which do not factor in the number of rooms, location, lot size, or amenities.Case-Shiller Home Price Index National and Top 10 Case-Shiller data from St. Louis Fed, chart by Mish Not every city is at record highs although the national and 10-city indexes are.CS National, Top 10 Metro ,CPI, OER, Primary Rent Percent Change

Case-Shiller data from St. Louis Fed, chart by Mish Not every city is at record highs although the national and 10-city indexes are.CS National, Top 10 Metro ,CPI, OER, Primary Rent Percent Change Year-Over-Year Prices

Year-Over-Year Prices

Rent inflation is outpacing home price inflation. Case-Shiller data lags as does rent.I suspect home prices are about to roll over. Nationally, the home price index only rose 0.3 percent, from 491.3 to 493.0. The 10-city index rose 0.2 percent.New Home Sales Since 1963 New Home Sales from the Census Bureau New Residential Construction report, chart by Mish. On March 25, I noted New Home Sales Little Changed in FebruaryNew home sales are about where they were in July of 1963 (blue highlights).Sales are down 35.7 percent from the August 2020 seasonally-adjusted annualized peak of 1,029.Consumer Stress is EvidentTo entice buyers, home builders are building cheaper and cheaper houses. But what are you getting for your money?

New Home Sales from the Census Bureau New Residential Construction report, chart by Mish. On March 25, I noted New Home Sales Little Changed in FebruaryNew home sales are about where they were in July of 1963 (blue highlights).Sales are down 35.7 percent from the August 2020 seasonally-adjusted annualized peak of 1,029.Consumer Stress is EvidentTo entice buyers, home builders are building cheaper and cheaper houses. But what are you getting for your money? New Home Sales Prices from the Commerce Department, chart by Mish.Also on March 25, I reported Consumer Stress is Evident in the Declining Price of New HomesOn reflection, that is a misleading title although the chart is accurate.One cannot judge from the data whether prices are rising or falling. It is accurate to say median and average new home prices are falling.I noted the issue in my post.

New Home Sales Prices from the Commerce Department, chart by Mish.Also on March 25, I reported Consumer Stress is Evident in the Declining Price of New HomesOn reflection, that is a misleading title although the chart is accurate.One cannot judge from the data whether prices are rising or falling. It is accurate to say median and average new home prices are falling.I noted the issue in my post.

What Are You Getting?

Price is down but so are room sizes, the number of rooms, lot sizes, amenities, and landscaping.

You are not getting the same house for $400,500 as you did for $496,800. I question the claim that houses are now more affordable.

It’s like saying a bicycle is more affordable than a motorcycle.

In contrast, Case-Shiller is a measure of the same house over time, adjusted for improvements. If the same houses sell for more repeatedly prices are rising.If the median home has 4 bedrooms six months ago and only 3 bedrooms now, a direct comparison is no longer valid. Room size and yard size is important too, even if the number bedrooms is the same.Given that Case-Shiller data lags, new home prices may be falling, and I suspect they are, but price alone is not a good way to tell except on the same house.More By This Author:Apartment List Reports Rent Prices Increase For The Second Month Real GDP For The Fourth Quarter Revised Up, GDI JumpsExpect A Financial Crisis In Europe With France At The Epicenter