Image Source: Pixabay

Image Source: Pixabay

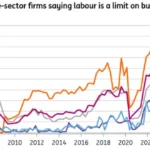

Asian stock markets are experiencing a mix of trading on Thursday, as they respond to the generally positive trends in global markets from the previous day. Some traders are taking profits following the recent market strength, while also waiting cautiously for key US inflation data and Fed Chair Jerome Powell’s speech, as the markets will be closed on Good Friday. At the same time, there is an optimistic atmosphere as several central banks are expected to begin cutting rates in the second half of the year. The Asian equity gauge saw minimal changes as gains in Hong Kong and mainland Chinese equities balanced out losses in Japan.The UK’s Q4 GDP growth data, which was released earlier today, remained unchanged, confirming a 0.3% quarter-on-quarter contraction. This decline represents the second consecutive quarterly decrease following a 0.1% drop in Q3, officially indicating a technical recession. However, recent business surveys present a more positive outlook, suggesting that the economy may already be showing signs of improvement. Bank of England Monetary Policy Committee (MPC) member Haskel, who is one of the two remaining policymakers advocating for interest rate hikes but has recently shifted to the no-change camp, cautioned that wage growth still appears to be too elevated. He expressed a preference for a gradual rather than swift approach to any potential rate cuts. Haskel’s remarks stand in contrast to Governor Bailey’s recent indication that all MPC meetings are “in play,” suggesting openness to potential changes in interest rates.In the Eurozone, today’s releases of the M3 money supply and German jobless claims figures are expected to garner relatively little attention. However, market focus will likely be on speeches by ECB policy makers Panetta and Villeroy, as they lay the groundwork for potential interest rate cuts, anticipated to occur in June. Eyes will then turn to Friday’s release of the latest March CPI inflation figures from France and Italy, which will be closely monitored ahead of next week’s estimates for Germany and the Eurozone as a whole. The early timing of Easter this year may introduce some volatility, but markets will be seeking evidence to support recent comments by ECB President Lagarde, who suggested that the decline in inflation is likely to persist.Later today, the US is set to release its latest update for Q4 GDP, with expectations that it will remain unrevised at 3.2% (annualized). However, the spotlight will be on Friday’s release of the personal consumption expenditure (PCE) deflator, which serves as the Federal Reserve’s preferred inflation gauge. Following recent unexpected increases in inflation, markets will closely monitor the core deflator, excluding energy and food prices. In February, the seasonally adjusted month-on-month change for the core deflator is anticipated to hover between 0.3% and 0.4%, look for a 0.4% increase compared to the consensus median forecast of 0.3%. The year-on-year rates for both headline and core PCE inflation are expected to slightly rise to 2.5% and 2.9%, respectively. Despite these modest inflation surprises, the Federal Reserve appears undeterred, maintaining its trajectory towards potential interest rate cuts, possibly by mid-year. Federal Reserve Chair Powell is slated to speak tomorrow, offering further insights into the central bank’s stance.

Overnight Newswire Updates of Note

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 22/03/24

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5200

EURUSD Bullish Above Bearish Below 1.09

EURUSD Bullish Above Bearish Below 1.09

GBPUSD Bullish Above Bearish Below 1.27

GBPUSD Bullish Above Bearish Below 1.27

USDJPY Bullish Above Bearish Below 150.25

USDJPY Bullish Above Bearish Below 150.25

AUDUSD Bullish Above Bearish Below .6570

AUDUSD Bullish Above Bearish Below .6570

BTCUSD Bullish Above Bearish below 68300

BTCUSD Bullish Above Bearish below 68300

More By This Author:FTSE Continues Constructive Consolidation

More By This Author:FTSE Continues Constructive Consolidation

Daily Market Outlook – Wednesday, March 27

FTSE Inches Higher After A Soft Start In A Slow Session