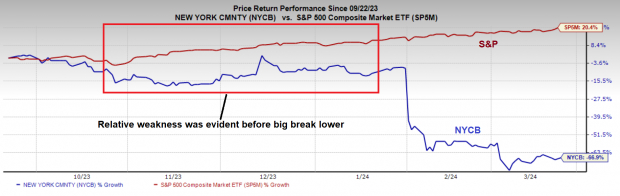

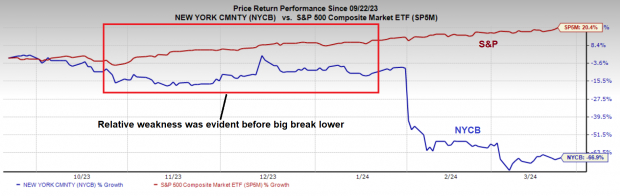

Apple: One of America’s Great CompaniesZacks Rank #3 (Hold) stock Apple (AAPL) stands out as one of the great American companies due to its relentless innovation, iconic design, and unwavering brand loyalty. Apple has consistently set industry standards and reshaped technology landscapes from groundbreaking products like the iPhone to its sleekly designed laptops. Its financial success, with a market capitalization exceeding $2 trillion, underscores its influence and prowess in global markets. Chinks in the Armor?Thursday, the U.S. Department of Justice (DOJ) announced that it sued Apple in an antitrust case over its landmark iPhone product. The DOJ alleges that Apple has a monopoly over the phone market that has harmed consumers, developers, and rival companies. Though I am normally a “free market” person, I believe the DOJ has a good case. Apple can indiscriminately ban apps on its Appstore, and with its overwhelming stranglehold on the smartphone market, it can kill businesses and innovation. Relative WeaknessWeakness tends to beget weakness in the stock market. For example, while the S&P 500 Index was putting in an intermediate bottom in October 2023, New York Community Bank (NYCB) was underperforming – a subtle clue of the damage to come.  Image Source: Zacks Investment ResearchCurrently, AAPL shares have been stuck in the mud for months and are flashing the same kind of clue.

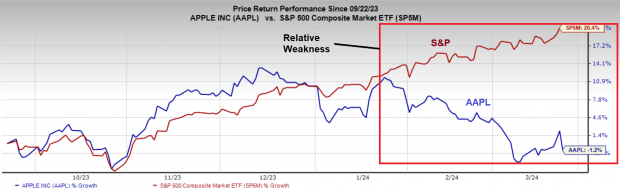

Image Source: Zacks Investment ResearchCurrently, AAPL shares have been stuck in the mud for months and are flashing the same kind of clue.  Image Source: Zacks Investment Research Bear Flag PatternAAPL shares are breaking down out of a daily bear flag pattern on heavy volume – a bearish sign.

Image Source: Zacks Investment Research Bear Flag PatternAAPL shares are breaking down out of a daily bear flag pattern on heavy volume – a bearish sign.  Image Source: TradingView Lack of InnovationApple became a powerhouse stock due to its innovation and growth. However, without iconic CEO Steve Jobs at the helm, innovation has come to a standstill. The company killed its multi-year attempt to build an electric car, is behind in the AI race, and has been unimpressive in delivering the “wow” factor in new iPhone releases. Buffett Souring on AAPL Shares?Berkshire Hathaway’s 13F disclosure saw Buffett decreasing his massive AAPL position for the first time in years. Furthermore, AAPL was only mentioned once in Berkshire’s annual letter to shareholders, a hint that Buffett may be selling more stock soon. Bottom LineFlat iPhone revenue, regulatory scrutiny, and a lack of innovation are convincing reasons to avoid AAPL and look elsewhere in the market for growth.More By This Author:Bull Of The Day: Li Auto

Image Source: TradingView Lack of InnovationApple became a powerhouse stock due to its innovation and growth. However, without iconic CEO Steve Jobs at the helm, innovation has come to a standstill. The company killed its multi-year attempt to build an electric car, is behind in the AI race, and has been unimpressive in delivering the “wow” factor in new iPhone releases. Buffett Souring on AAPL Shares?Berkshire Hathaway’s 13F disclosure saw Buffett decreasing his massive AAPL position for the first time in years. Furthermore, AAPL was only mentioned once in Berkshire’s annual letter to shareholders, a hint that Buffett may be selling more stock soon. Bottom LineFlat iPhone revenue, regulatory scrutiny, and a lack of innovation are convincing reasons to avoid AAPL and look elsewhere in the market for growth.More By This Author:Bull Of The Day: Li Auto

AI’s Winning Duos: BBAI & PLTR, SOUN & NVDA

Small but Mighty: Is the Russell 2000 Signaling a Comeback?