Image Source: Pexels

Image Source: Pexels

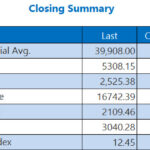

UK stocks remained subdued on Monday in a shortened holiday week as markets processed recent advances following dovish shifts from major central banks. Meanwhile, Direct Line saw a drop in its shares after Belgian insurer Ageas scrapped its plans to acquire the company. The FTSE 100 index, which includes leading British companies, remained steady trading flat on the session. Last week, UK stocks finished on a positive note, with the FTSE 100 index reaching its highest level in a year as investors reacted positively to the Bank of England and the U.S. Federal Reserve indicating potential interest rate cuts for this year. Attention will now turn to the U.S. core personal consumption expenditure price index, which is the Fed’s preferred measure of inflation, scheduled for release on Friday. This will provide further insight into the direction of inflation and interest rates.Kingfisher, a European home improvement retailer, has seen its shares risel by 2.7%, making it the top percentage gainer on the FTSE 100 index, even though the company has issued a profit warning for the third time in six months, stating that its current-year profit is expected to fall short of analysts’ expectations after reporting a 25% drop for 2023-24. Kingfisher is cautious about the overall market outlook due to the time lag between improving housing demand and home improvement demand. Analysts at Jefferies have expressed concerns about the weak macroeconomic conditions affecting the company’s estimates and anticipate continued pressure on its performance. As a result, Kingfisher’s shares have fallen by approximately 4% year-to-date as of the last close.Ocado’s stock price dropped after a weekend report suggested that the company is facing pressure regarding executive compensation. An influential proxy advisor has advised shareholders to vote against a new bonus plan that could result in CEO Tim Steiner being paid up to £14.8m. The Times reported that Institutional Shareholder Services has recommended that investors oppose the online grocer’s new pay policy and performance share plan at its upcoming annual meeting on April 29, citing significant concerns about the potential amount of money that executives could receive. ISS stated that the proposed amount is “significantly higher than market norms” and does not align with UK market standards or investor expectations. Leading Ocado to the bottom spot on the blue chip index today is Rightmove plc down 3.6% on the day, the board has revealed its plan to raise the dividend by 9.6% on May 24th to £0.057, compared to last year’s £0.052. This adjustment aligns the dividend yield with the industry average of 1.6%.

FTSE Bias: Bullish Above Bearish below 7800

More By This Author:Daily Market Outlook – Monday, March 25

More By This Author:Daily Market Outlook – Monday, March 25

FTSE 11 Month Highs

Daily Market Outlook – Friday, March 22