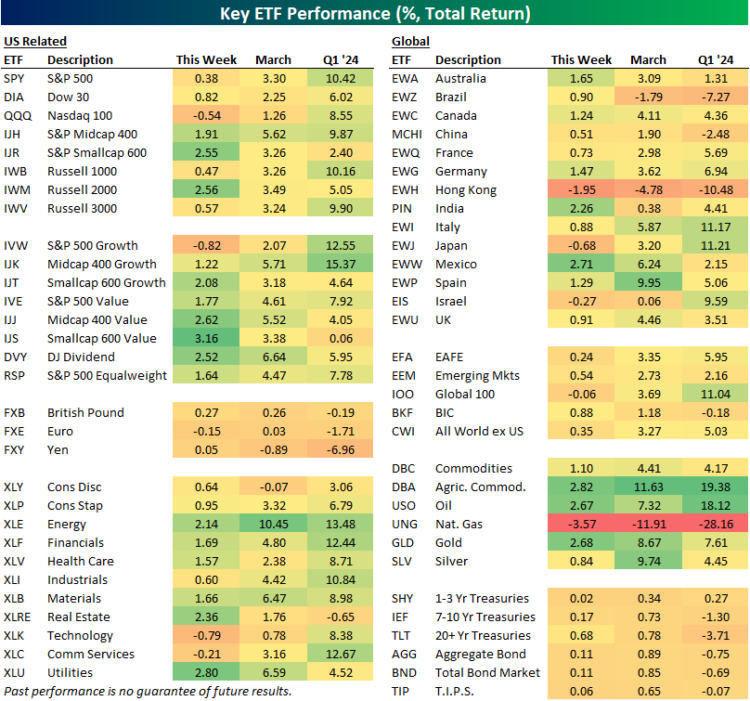

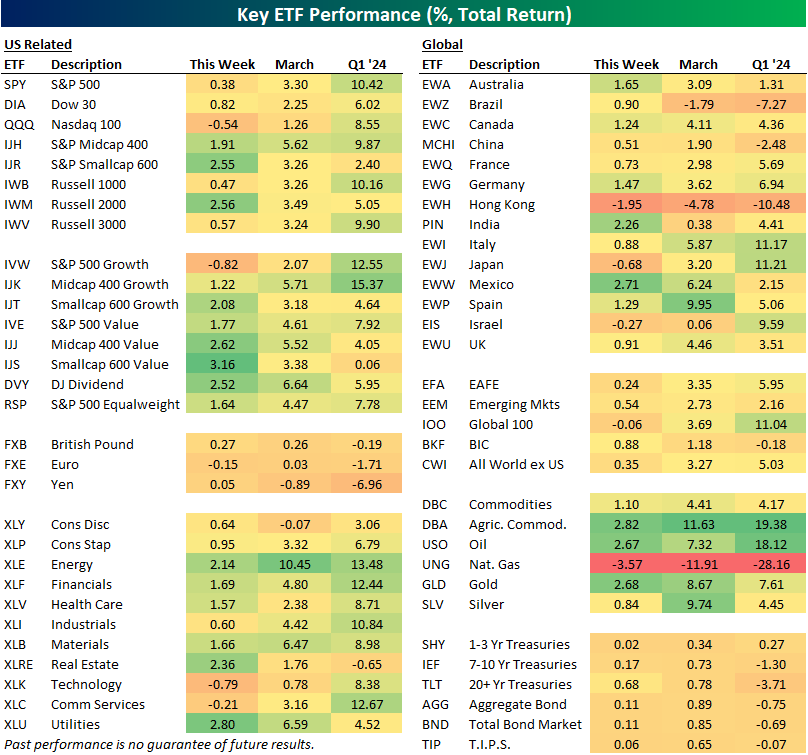

The first quarter of 2024 ended with the S&P 500 (SPY) posting a total return of 10.4%. That was good enough to beat the Tech-heavy Nasdaq 100 (QQQ) and the blue-chip Dow 30 (DIA) on the large-cap front, and it also beat both mid-caps (IJH) and small-caps (IWM). The weakest of the various US index ETFs in Q1 was the small-cap value ETF (IJS), which was up just 0.06%.

Looking at sectors, it was Energy (XLE), Financials (XLF), Communication Services (XLC), and Industrials (XLI) that posted double-digit percentage gains, while Real Estate (XLRE) was the only sector in the red with a decline of 0.65%.

Outside of the US, there were some winners like Italy (EWI) and Japan (EWJ) and losers like Brazil (EWZ), Hong Kong (EWH), and China (MCHI).

Commodity ETFs saw some big gains in Q1, although natural gas (UNG) fell sharply. While Treasury ETFs were up slightly in March, they finished Q1 slightly in the red.

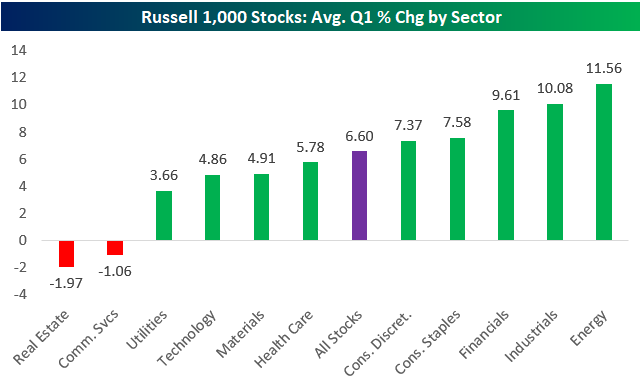

Below is a look at the average performance of Russell 1,000 stocks in Q1 broken out by sector. As shown, Energy stocks averaged the biggest gains in Q1 at 11.56%, followed by Industrials (10.08%) and Financials (9.61%). Notably, Tech stocks averaged a gain of just 4.86%, while Communication Services and Real Estate stocks averaged declines.

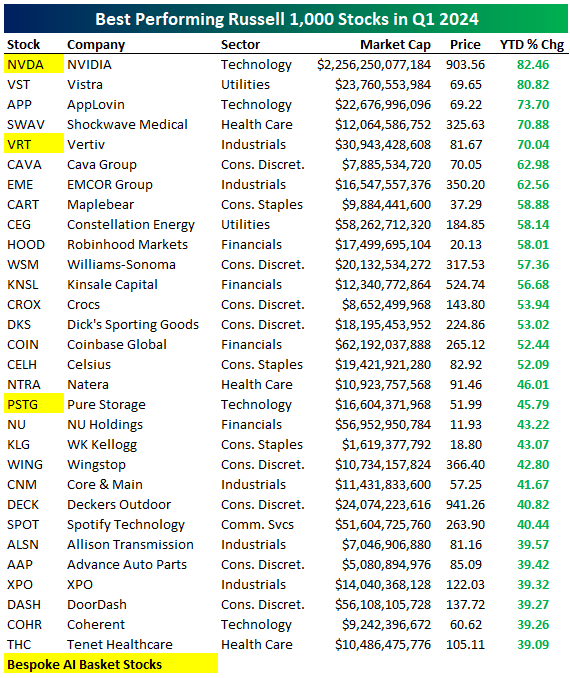

Below is a look at the 30 best-performing Russell 1,000 stocks in Q1.NVIDIA (NVDA) topped the list with an 82.5% gain, but surprisingly, a Utilities stock (VST) ranked second with a gain of 80.8%.AppLovin (APP), Shockwave Medical (SWAV), and Vertiv (VRT) rounded out the top five.

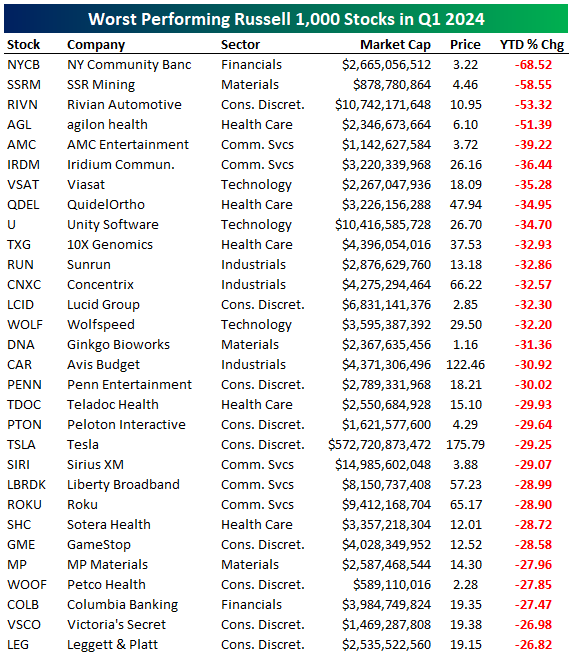

When we crossed the list of big Q1 winners with our Bespoke AI basket, it’s interesting that just three of the top thirty stocks are on our AI list: NVDA, VRT, and PSTG. There were plenty of non-AI and non-Tech stocks up big in Q1, like Williams-Sonoma (WSM), Crocs (CROX), Kellogg (KLG), Spotify (SPOT), and DoorDash (DASH). Not everything went up in Q1. Roughly a third of the Russell 1,000 finished the quarter in the red, while there were 49 stocks in the index that fell more than 20%. Below are the 30 stocks that did the worst in Q1, led by New York Community Bancorp’s (NYCB) decline of 68.5%.

Not everything went up in Q1. Roughly a third of the Russell 1,000 finished the quarter in the red, while there were 49 stocks in the index that fell more than 20%. Below are the 30 stocks that did the worst in Q1, led by New York Community Bancorp’s (NYCB) decline of 68.5%. More By This Author:Five Straight

More By This Author:Five Straight

All Or Nothing Comes Back

One Bad Apple