Image Source: Pexels

Image Source: Pexels

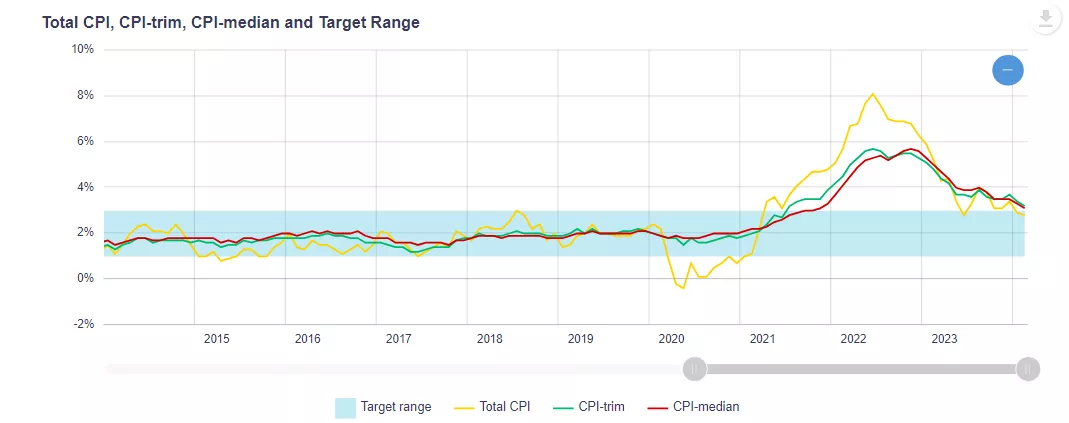

As if life is not complicated enough, central bankers employ several measures of inflation to guide decisions on rate changes. What exactly is the true tale of the trend in inflation is up to the reader. Take the Bank of Canada, as a perfect example. The inflation rate in Canada can be any one of the following:

No matter how one slices it, the rate of inflation has come down dramatically in rather short order. Of special note is the CPI- ex-shelter is clearly below the 2% target set by the BoC. So, what is holding back the BoC from starting a rate-cutting policy next month? Just because the consensus among analysts and bank economists calls for rate cuts to start in June or July, does not mean that the BoC is right in holding off. Groupthink can be highly misleading.

Unlike the Federal Reserve, the BoC does not have a mandate to promote full employment. Its sole responsibility is to maintain price stability. But this is a far too narrow obligation, one which ignores the benefits of higher economic growth and an improvement of living standards across the country. From the recent cycle low, the Canadian unemployment rate has increased to 5.8%. More troubling is that GDP growth is a miserly 0.9%, even when fuelled by a surge in immigration over the past year. The restrictions on economic growth have been largely brought upon by a restrictive monetary policy, all in the name of hitting an arbitrary inflation target. Depending on which inflation measure one adopts, this target has been either met or exceeded. It is time to acknowledge that and unwind rate increases that have more than done their job.More By This Author:It Is The End Of An Era For Negative Interest Rates

Central Banks Don’t Like To Told When To Cut Rates

Growth Of The Public Sector Keeps The Canadian Economy Above Water