Image: ShutterstockWall Street’s impressive bull run for the last 15 months has been facing severe hurdles in April. Historically, this month is known as being favorable to equity investors. However, it is turning out to be different this year. Month-to-date, the three major stock indexes — the Dow, the S&P 500, and the Nasdaq Composite — have tumbled 3.4%, 3.5%, and 4.1%, respectively.On April 19, both the S&P 500 and the Nasdaq Composite recorded the sixth straight day of negative closing, the longest losing streak for both benchmarks since October 2022. Last week, the S&P 500 fell more than 3%, marking its third straight negative week.The Nasdaq Composite plunged 5.5%, reflecting the tech-heavy index’s fourth straight declining week, its longest negative streak since December 2022. Last week, the tech-laden index posted its worst week since November 2022.The sticky inflation rate pushed investors’ expectations to June. Following the release of the March CPI data, the CME FedWatch shows just a 15% chance of a rate cut in June. The majority of respondents are now expecting the first reduction of the benchmark lending rate in September. What is more important is that 16% of respondents are expecting no rate cut in 2024.

Image: ShutterstockWall Street’s impressive bull run for the last 15 months has been facing severe hurdles in April. Historically, this month is known as being favorable to equity investors. However, it is turning out to be different this year. Month-to-date, the three major stock indexes — the Dow, the S&P 500, and the Nasdaq Composite — have tumbled 3.4%, 3.5%, and 4.1%, respectively.On April 19, both the S&P 500 and the Nasdaq Composite recorded the sixth straight day of negative closing, the longest losing streak for both benchmarks since October 2022. Last week, the S&P 500 fell more than 3%, marking its third straight negative week.The Nasdaq Composite plunged 5.5%, reflecting the tech-heavy index’s fourth straight declining week, its longest negative streak since December 2022. Last week, the tech-laden index posted its worst week since November 2022.The sticky inflation rate pushed investors’ expectations to June. Following the release of the March CPI data, the CME FedWatch shows just a 15% chance of a rate cut in June. The majority of respondents are now expecting the first reduction of the benchmark lending rate in September. What is more important is that 16% of respondents are expecting no rate cut in 2024.

Stocks in Focus

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments.Five such companies are — Johnson & Johnson (JNJ – Free Report), The Travelers Companies Inc. (TRV – Free Report), Sonoco Products Co. (SON – Free Report), KB Home (KBH – Free Report), and South Plains Financial Inc. (SPFI – Free Report).

Johnson & Johnson

The company’s Innovative Medicine unit is performing at above-market levels. Johnson & Johnson’s growth is being driven by existing products like Darzalex, Stelara, Tremfya, and Erleada, and by the continued uptake of new launches, including Spravato, Carvykti, and Tecvayli.Johnson & Johnson’s MedTech unit is showing improving trends, driven by a recovery in surgical procedures and contribution from new products. Johnson & Johnson is making rapid progress with its pipeline and line extensions. The stock currently carries a Zacks Rank #3 (Hold) rating.On April 16, 2024, Johnson & Johnson declared that its shareholders would receive a dividend of $1.24 per share on June 4, 2024. It has a dividend yield of 3.4%. Over the past five years, Johnson & Johnson has increased its dividend six times, and its payout ratio presently stays at 46% of earnings.

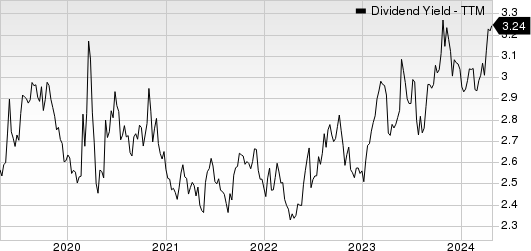

Johnson & Johnson Dividend Yield (TTM)

Image Source: Zacks Investment Research | Johnson & Johnson Quote

Image Source: Zacks Investment Research | Johnson & Johnson Quote

The Travelers Companies, Inc.

This next company boasts a strong market presence in auto, homeowners’ insurance, and commercial U.S. property-casualty insurance with solid inorganic growth. A high retention rate, a rise in new business, and positive renewal premium change all bode well. Travelers’ commercial businesses should perform well due to market stability.The company remains optimistic about the personal line of business, given growth at profitable agencies like auto and homeowners businesses. Strong and reliable returns from the growing fixed-income portfolio should drive net investment income. Sufficient capital boosts shareholder value. The Travelers Companies aims for a mid-teens core return on equity over time. The stock currently carries a Zacks Rank #3 (Hold) rating.On April 17, 2024, The Travelers Companies declared that its shareholders would receive a dividend of $1.05 per share on June 28, 2024. It has a dividend yield of 2.1%. Over the past five years, the company has increased its dividend six times, and its payout ratio presently stays at 29% of earnings.

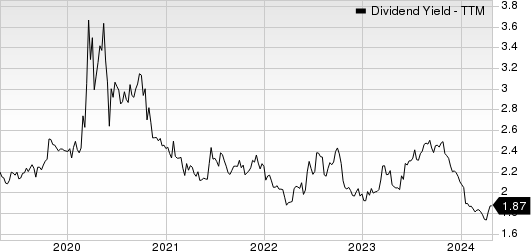

The Travelers Companies, Inc. Dividend Yield (TTM)

Image Source: Zacks Investment Research | The Travelers Companies, Inc. Quote

Image Source: Zacks Investment Research | The Travelers Companies, Inc. Quote

Sonoco Products

This company has benefited from the Ball Metalpack acquisition, and the strong recovery in price across most of its businesses will help somewhat offset any headwinds. Sonoco’s ongoing focus on increasing investment in its core consumer and industrial businesses will aid growth in the upcoming quarters. As previously mentioned, the company’s recent acquisitions will also aid its performance. The stock currently carries a Zacks Rank #3 (Hold) rating.On April 17, 2024, Sonoco Products declared that its shareholders would receive a dividend of $0.52 per share on June 10, 2024. It has a dividend yield of 3.7%. Over the past five years, the company has increased its dividend five times, and its payout ratio presently stays at 39% of earnings.

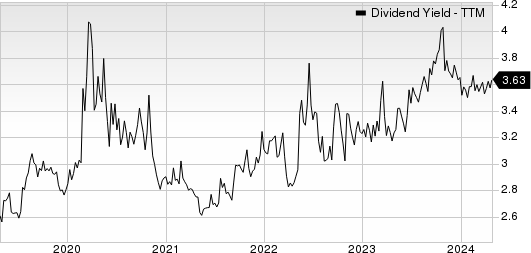

Sonoco Products Company Dividend Yield (TTM)

Image Source: Zacks Investment Research | Sonoco Products Company Quote

Image Source: Zacks Investment Research | Sonoco Products Company Quote

KB Home

This next company saw a 9% increase in homes delivered year-over-year in first-quarter 2024. KB Home has been further benefiting from its intent focus on implementing the built-to-order model, reducing cycle times, and offering various forms of mortgage concessions.Owing to these tailwinds, KB Home witnessed 55% year-over-year net orders growth in the last quarter. The stock currently carries a Zacks Rank #1 (Strong Buy) rating.On April 18, 2024, KB Home declared that its shareholders would receive a dividend of $0.25 per share on May 23, 2024. It has a dividend yield of 1.3%. Over the past five years, KB Home has increased its dividend five times, and its payout ratio presently stays at 11% of earnings..

KB Home Dividend Yield (TTM)

Image Source: Zacks Investment Research | KB Home Quote

Image Source: Zacks Investment Research | KB Home Quote

South Plains Financial

Finally, this is the bank holding company for City Bank, a chartered bank. South Plains Financial provides commercial and consumer financial services to small and mid-sized businesses and individuals. The company’s principal business activities include commercial and retail banking along with insurance, investment trust, and mortgage services. The stock currently carries a Zacks Rank #3 (Hold) rating.On April 18, 2024, South Plains Financial declared that its shareholders would receive a dividend of $0.14 per share on May 13, 2024. It has a dividend yield of 2.2%. Over the past five years, the company has increased its dividend seven times, and its payout ratio presently stays at 21% of earnings.

South Plains Financial, Inc. Dividend Yield (TTM)

Image Source: Zacks Investment Research | South Plains Financial, Inc. QuoteMore By This Author:Airline Stock Roundup: AAL, LUV, JBLU & HA Incur Q1 Loss4 ETF Areas To Play Amid Slower Growth & Rising InflationDoorDash To Report Q1 Earnings: What’s In Store?

Image Source: Zacks Investment Research | South Plains Financial, Inc. QuoteMore By This Author:Airline Stock Roundup: AAL, LUV, JBLU & HA Incur Q1 Loss4 ETF Areas To Play Amid Slower Growth & Rising InflationDoorDash To Report Q1 Earnings: What’s In Store?