Recap of the Recent Most Important Stories

1 American Airlines’ first-quarter 2024 loss (excluding 14 cents from non-recurring items) of 34 cents per share was wider than the Zacks Consensus Estimate of a loss of 28 cents. In the year-ago quarter, AAL had reported earnings of 5 cents. Operating revenues of $12.57 billion fell short of the Zacks Consensus Estimate of $12.59 billion but increased 3.1% year over year. AAL projects the June-end quarter’s earnings per share (excluding net special items) to be in the $1.15-$1.45 range. 2. Southwest Airlines reported first-quarter 2024 loss of 36 cents per share, which was wider than the Zacks Consensus Estimate of a loss of 34 cents. In the year-ago reported quarter, LUV incurred a loss of 27 cents per share. Revenues of $6,329 million missed the Zacks Consensus Estimate of $6,451 million. For second-quarter 2024, economic fuel costs per gallon are expected to be between $2.70 and $2.80. Currently, LUV carries a Zacks Rank #3 (Hold).3 JetBlue Airways’ first-quarter 2024 loss (excluding $1.68 from non-recurring items) of 43 cents per share was narrower than the Zacks Consensus Estimate of a loss of 53 cents. In the year-ago quarter, JBLU had reported a loss of 34 cents. Operating revenues of $2.21 billion edged past the Zacks Consensus Estimate of $2.2 billion. However, the top line decreased 5.11% year over year. Passenger revenues, accounting for the bulk of the top line (93.03%), declined to $2.06 billion from $2.18 billion a year ago. For second-quarter 2024, capacity is anticipated to decline in the 2-5% band. CASM, excluding fuel and special items, is predicted to climb 5.5-7.5%.4. Hawaiian Holdings’ first-quarter 2024 loss (excluding 12 cents from non-recurring items) of $2.77 per share was wider than the Zacks Consensus Estimate of a loss of $2.75. HA incurred a loss of $2.17 per share in the year-ago quarter. The results were aided by strong air travel demand. Passenger revenues increased 6.4% year over year. Driven by upbeat passenger revenues, the top line increased 5.4% to $645.6 million, surpassing the Zacks Consensus Estimate of $630.6 million.For the second quarter of 2024, available seat miles or ASM are projected to increase 3.5-6.5% from second-quarter 2023 levels. Total revenues per available seat miles are anticipated to be down 1.5% to up 1.5% compared with the year-ago level. Costs per ASM (excluding fuel & non-recurring items) are expected to rise 5-8% from second-quarter 2023 numbers. Gallons of jet fuel consumed is expected to increase 2.5-5.5% from the second-quarter 2023 level. Adjusted fuel price per gallon is expected to be $2.85 in the second quarter of 2024. The effective tax rate is anticipated to be 10% in the June quarter.ASMs are projected to increase in the 4.5-7.5% band for full year 2024. Costs per ASM (excluding fuel & non-recurring items) for 2024 are expected to rise 1-4% from 2023 actuals. Adjusted fuel price per gallon is expected to be $2.83 in the current year. Gallons of jet fuel consumed are expected to increase by 3-6% from the 2023 level. Current-year capex is still expected in the $500-$550 million range.

Performance

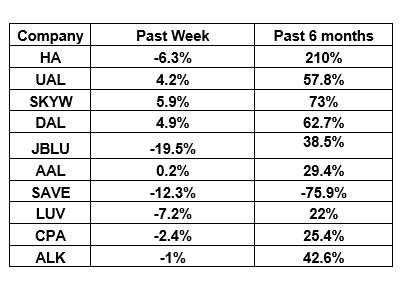

The following table shows the price movement of the major airline players over the past week and during the last six months.  Image Source: Zacks Investment ResearchThe table above shows that most airline stocks traded in the red over the past week. The NYSE ARCA Airline Index decreased 3.1% $62.03. Over the course of past six months, the NYSE ARCA Airline Index gained 29.3%.

Image Source: Zacks Investment ResearchThe table above shows that most airline stocks traded in the red over the past week. The NYSE ARCA Airline Index decreased 3.1% $62.03. Over the course of past six months, the NYSE ARCA Airline Index gained 29.3%.

What’s Next in the Airline Space?

While the major industry players have already reported, there are a few other companies that are expected to report in the coming days. Watch this space for the upcoming earnings releases and other developments like the March traffic results of Allegiant Travel (ALGT – Free Report) .More By This Author:4 ETF Areas To Play Amid Slower Growth & Rising Inflation

DoorDash To Report Q1 Earnings: What’s In Store?

ETSY Gears Up to Report Q1 Earnings: What’s In The Cards?