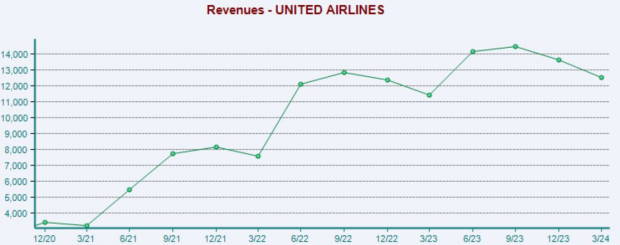

Image Source: Zacks Investment ResearchConsumers still have a strong interest in travel, with UAL’s capacity up 9.1% year-over-year. Lower fuel prices also aided profitability, with the $2.88 per gallon mark nicely beneath the $3.13 mark in the prior quarter.The company reaffirmed its prior guidance, expecting full-year 2024 adjusted EPS in a band of $9 – $11. Shares popped following the release, with the market impressed by the results.

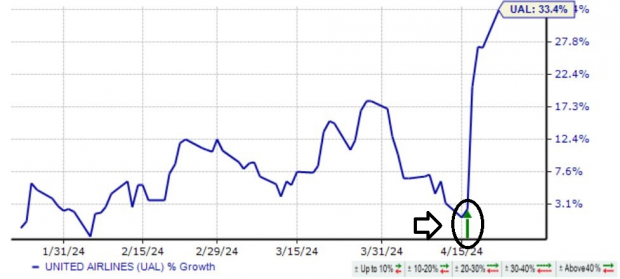

Image Source: Zacks Investment ResearchConsumers still have a strong interest in travel, with UAL’s capacity up 9.1% year-over-year. Lower fuel prices also aided profitability, with the $2.88 per gallon mark nicely beneath the $3.13 mark in the prior quarter.The company reaffirmed its prior guidance, expecting full-year 2024 adjusted EPS in a band of $9 – $11. Shares popped following the release, with the market impressed by the results. Image Source: Zacks Investment ResearchAmerican AirlinesAnalysts have reversed their earnings estimate revisions, with the current -$0.28 Zacks Consensus EPS estimate up from -$0.32 at the end of March. Revenue revisions have remained positive for nearly all year, with the $12.6 billion expected modestly higher than the $12.5 billion expected at the end of January.

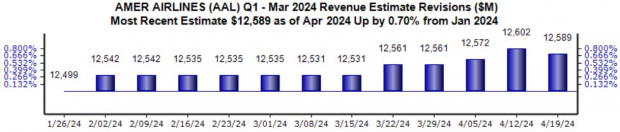

Image Source: Zacks Investment ResearchAmerican AirlinesAnalysts have reversed their earnings estimate revisions, with the current -$0.28 Zacks Consensus EPS estimate up from -$0.32 at the end of March. Revenue revisions have remained positive for nearly all year, with the $12.6 billion expected modestly higher than the $12.5 billion expected at the end of January. Image Source: Zacks Investment ResearchIt’s worth noting that the company has regularly exceeded our expectations in a big way as of late, beating our consensus EPS estimate by an average of 120% across its last four releases.Southwest AirlinesSouthwest’s earnings outlook hasn’t been as positive, with the -$0.31 Zacks Consensus EPS estimate down considerably from the -$0.19 mark in mid-March. Revenue revisions have been more bullish, as the $6.4 billion expected is up roughly 3%.

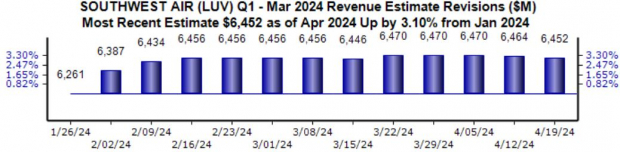

Image Source: Zacks Investment ResearchIt’s worth noting that the company has regularly exceeded our expectations in a big way as of late, beating our consensus EPS estimate by an average of 120% across its last four releases.Southwest AirlinesSouthwest’s earnings outlook hasn’t been as positive, with the -$0.31 Zacks Consensus EPS estimate down considerably from the -$0.19 mark in mid-March. Revenue revisions have been more bullish, as the $6.4 billion expected is up roughly 3%. Image Source: Zacks Investment ResearchLike AAL, the company has been on a solid earnings streak as of late, beating our consensus EPS expectations by an average of 52% across its last four releases.Bottom LineWith several airliners – American Airlines and Southwest Airlines – on the reporting docket this week, using the recent results we’ve received from United Airlines can provide a framework of what to expect concerning consumer behavior.UAL posted a solid quarterly release, with Capacity continuing to grow and lower fuel prices aiding results. Still, it’s critical to note that the grounding of Boeing 737 MAX does not affect LUV or AAL, as the companies do not fly this particular craft. More By This Author:3 Buy-Rated Stocks Fit For Value InvestorsThis Combination Of 3 Stocks Provides Monthly Income 3 Quarterly Releases To Watch Next Week

Image Source: Zacks Investment ResearchLike AAL, the company has been on a solid earnings streak as of late, beating our consensus EPS expectations by an average of 52% across its last four releases.Bottom LineWith several airliners – American Airlines and Southwest Airlines – on the reporting docket this week, using the recent results we’ve received from United Airlines can provide a framework of what to expect concerning consumer behavior.UAL posted a solid quarterly release, with Capacity continuing to grow and lower fuel prices aiding results. Still, it’s critical to note that the grounding of Boeing 737 MAX does not affect LUV or AAL, as the companies do not fly this particular craft. More By This Author:3 Buy-Rated Stocks Fit For Value InvestorsThis Combination Of 3 Stocks Provides Monthly Income 3 Quarterly Releases To Watch Next Week