Image Source: PixabayIntroductionThe cloud computing SaaS market is expected to grow by a CAGR of 11.7% between now and 2030 with 98% of companies globally relying on the cloud for at least one part of their business applications. This increased demand is causing the average rental rate of data centers to increase substantially (+14.5% in 2022; +18.6% last year) with a continued major increase expected in 2024.There are 3 types of cloud computing service models, namely:

Image Source: PixabayIntroductionThe cloud computing SaaS market is expected to grow by a CAGR of 11.7% between now and 2030 with 98% of companies globally relying on the cloud for at least one part of their business applications. This increased demand is causing the average rental rate of data centers to increase substantially (+14.5% in 2022; +18.6% last year) with a continued major increase expected in 2024.There are 3 types of cloud computing service models, namely:

- IaaS, which accounts for 32.5% of cloud computing revenue (aka cloud infrastructure services) provides end users with cloud-based alternatives to on-premise, physical infrastructure, allowing businesses to purchase resources on-demand instead of the more costly venture of having to buy and manage hardware.

- PaaS, which accounts for 29.0% of cloud computing revenue (aka cloud platform services) provides developers with a framework, software and tools needed to build apps and software — all accessible through the internet.

- SaaS, which accounts for 38.5% of cloud computing revenue (aka cloud application services), are built on IaaS or PaaS platforms and provide ready-to-use, out-of-the-box solutions that meet a company’s particular need (such as a website or email). (Source)

- 70 of the 244 companies in the SaaS sector (see here) generate >65% of their revenue from recurring payments for cloud-based software (see here) of which 35 have market capitalizations of at least $10B with 10 of them having market capitalizations of $50B, or more, which accounts for 45% of the SaaS sector’s total revenue.

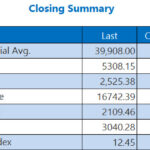

The munKNEE Cloud Computing (SaaS) PortfolioThe Portfolio (see below) consists of the 10 companies with minimum market capitalizations of $50B and they are listed below, in descending order, as to their stock performances last week and over the last 4 weeks, along with their company descriptions and any news, analyses or commentary related to their latest price action, where available:

- Company Description: provides a cutting-edge platform that not only serves as the backbone but also sparks a revolution in data management empowering users to effortlessly consolidate data.

- Article: Snowflake releases a flagship generative AI model of its own

- Company Description: stands out as a cybersecurity leader, delivering cloud-based protection for endpoints, cloud workloads, identity, and data through a software-as-a-service subscription model.

- Article: CrowdStrike Extends Cloud Security Leadership at Google Cloud Next ‘24

- Company Description: offers a comprehensive suite of financial management, compliance, and marketing solutions

- Article: Intuit Introduces Financial Literacy Courses and Tools for High Schools

- Company Description: offers a comprehensive suite of products and services catering to professionals, businesses, communicators, and consumers involved in creating, managing, delivering, and optimizing content across various digital media formats.

- Article: Adobe Launches AI-Powered Mobile App for Creating Content

- Company Description: a Canadian company that offers a comprehensive suite of tools designed to facilitate the initiation, expansion, marketing, and management of retail businesses of various sizes.

- Article: Shopify stock price forecast: Morgan Stanley sees a 20% upside

- Company Description: operates a platform enriched with artificial intelligence and machine learning capabilities.

- Article: ServiceNow Q1 2024 financial results beat EPS expectations by $0.28

- Company Description: a leading provider of customer relationship management (CRM) technology, operates through its comprehensive Customer 360 platform, encompassing sales, service, marketing, commerce, collaboration, integration, artificial intelligence, analytics, automation, and more. (Source for this and other company descriptions below)

- Article: Report: Salesforce-Informatica Deal Falls Apart

- Company Description: a leading provider of three-dimensional (3D) design, engineering, and entertainment technology solutions, offering a comprehensive range of services across various industries, including architecture, engineering, construction, product design, manufacturing, and media.

- Article: Autodesk receives expected notification of deficiency from Nasdaq

- Company Description: focused on finance and human resources, serving approximately 10,000 organizations with software-as-a-service solutions addressing diverse business challenges.

- Article: None

- Company Description: dedicated to designing, developing, licensing, and maintaining cutting-edge solutions while providing software hosting services.

- Article: Atlassian Announces Third Quarter Fiscal Year 2024 Results and CEO Transition

SummaryThe Cloud Computing SaaS Portfolio was up 2.5% this week but went down 6.0% during the month of April, is now down 5.4% YTD.More By This Author:April Recap: All 7 AI Category Portfolios Declined By 4%, On Average

Semiconductor Stocks Tanked Last Week Led By Nvidia’s 13.6% Decline

Clinical-Stage BioTech Drug Stocks Portfolio Went Down 9% Last Week