Image Source: Pixabay

Image Source: Pixabay

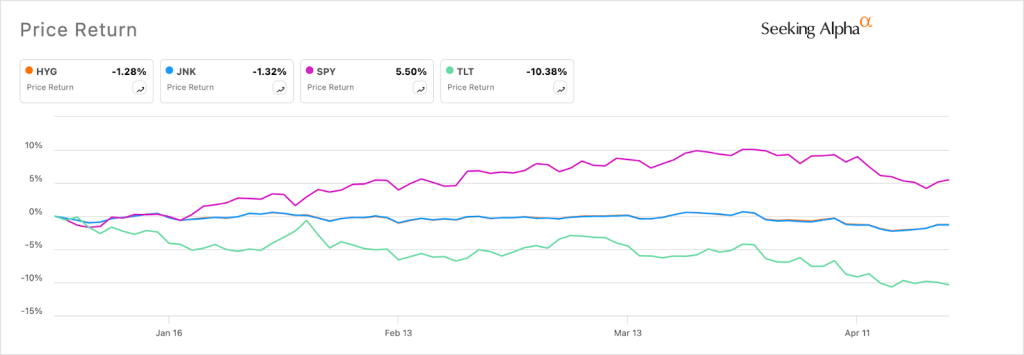

Investors are dumping corporate Exchange Traded Funds (ETFs) as signs emerge that the Federal Reserve will maintain higher rates for longer because of the stubbornly high inflation in the US.Data by ETF.com shows that the iShares iBoxx USD High Yield Corporate Bond ETF (IYG) has shed over $2.2 billion this month, reversing the gains it made in February. It now has over $14 billion in total assets and has a yield of 5.89%.Meanwhile, the popular SPDR Bloomberg High Yield Bond ETF (JNK) has shed $715 million this month after losing $792 million a month earlier. It now has $7.8 billion in assets and yields about 6.6%. The same trend is happening among the safer short-term corporate bonds. For example, the giant Vanguard Short-Term Corporate Bond ETF (VCSH) has shed assets in the past three straight months and now has over $42 billion in assets.This performance is happening at a time when these bond ETFs have continued to underperform the broader equities market. The HYG and JNK ETFs have all dropped by over 1.28% while the SPDR S&P 500 ETF (SPY) is up by over 5.5%.These funds are nonetheless doing better than long-term government bonds. The closely-watched TLT ETF has plunged by over 10% this year as concerns about the escalating US public debt continue.

These bond funds are being affected by the ongoing inflationary trends in the United States. Data released this month revealed that the headline Consumer Price Index (CPI) rose to 3.5% in March while the core CPI jumped to 3.8%.Energy and industrial metal prices have been in a strong bull run in the past few weeks. While they have pulled back this week, they are much higher than where they were in March and the geopolitical risks could push them higher.Therefore, the consensus is that the Federal Reserve will either leave interest rates unchanged between 5.25% and 5.50% for the rest of the year. Some analysts believe that the Fed will actually hike interest rates. This view is being supported by the performance of the bond market. The yield of the 10-year has moved to 4.6% while the 30-year has risen to 4.70%.More By This Author:BTC/USD Forex Signal: Bitcoin Price Could Retest $70k After Halving

5 U.S. Penny Stocks To Buy Now For Short-Term Gains

BTC/USD Forex Signal: Bitcoin Sits And Waits For Next Catalyst