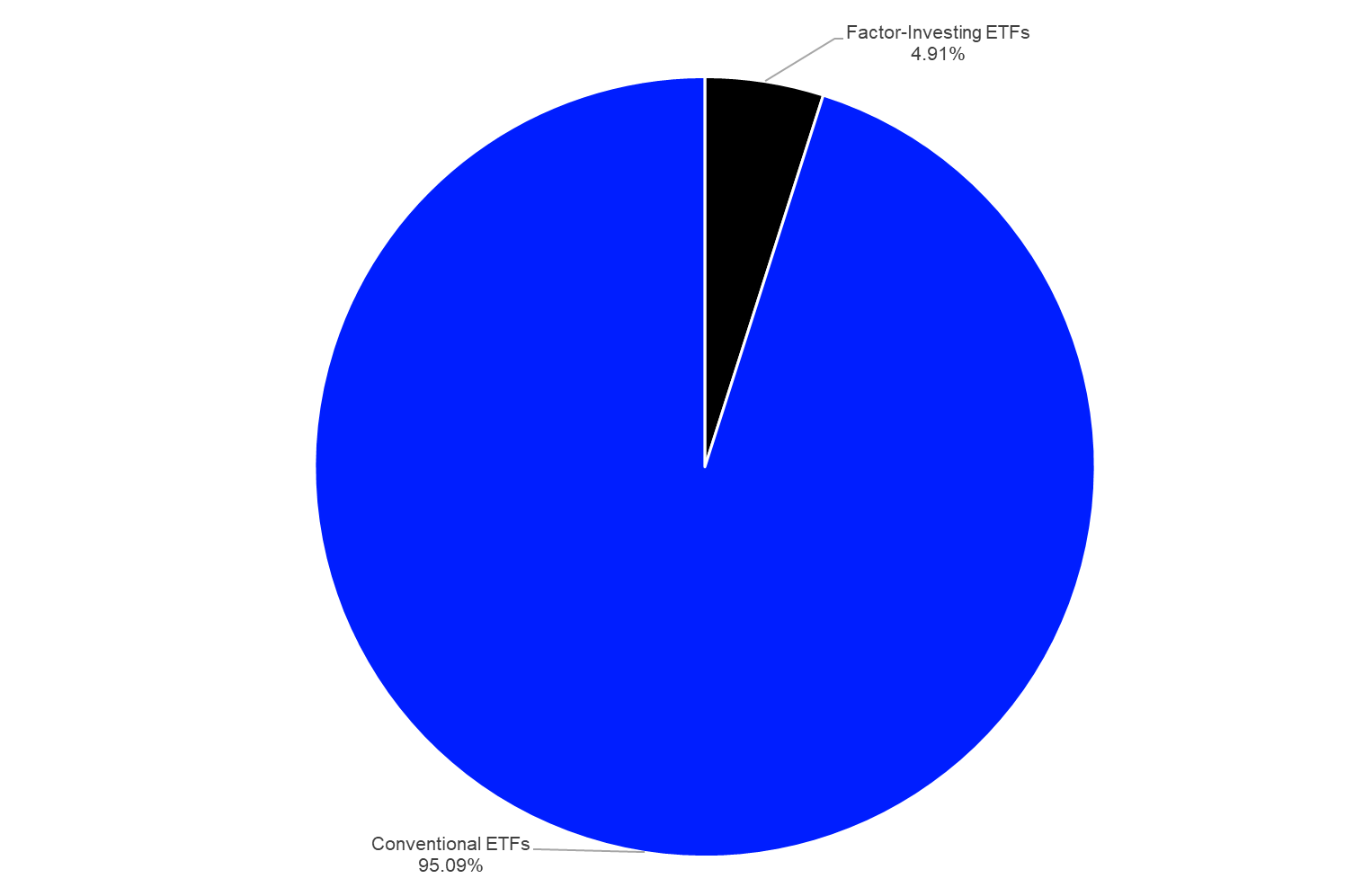

Image Source: PixabayFactor investing ETFs are ETFs that replicate an index that uses one of the scientifically proven factors (dividends, growth, liquidity, momentum, quality/credit quality, size, value, volatility, and yield) to determine its constituents.As a result, from this process, the portfolio of the factor investing index may vary significantly from the portfolio of the parent index, even while investing in the same market(s).Since there is scientific proof that the factors mentioned above are able to generate alpha compared to their parent index over a full investment cycle, some investors and market observers used the term smart beta for these factor investing ETFs when they were entering the market. Even as it sounded fancy, this nickname vanished over time as marketers and market observers were urged to become more professional in their comments on factor investing ETFs.More generally, factors are seen as market inefficiencies that can enable investors to harvest excess returns over a full investment cycle. Investors, therefore, need to be patient when using single factors because it is hard to predict when a given factor will start to out or underperform compared to its parent index. In addition, it is noteworthy that factor investing can be seen as an arbitrage strategies, which have the potential to eliminate a factor over time, if there is enough money invested with regard to a given factor (illiquid stocks can become liquid, small caps can grow to mid- or even large caps, value stocks can become expensive, etc.). As a result, the excess returns will get smaller the more money is invested into the same factor (strategy).Given that factor investing strategies do not generate a consistent outperformance, the asset management industry has introduced multifactor strategies which combine single factors in a static or dynamic way to generate a more consistent outperformance and to help investors with the market timing of factors.According to the Lipper database, there are 197-factor investing ETFs (primary share classes) registered for sales in Europe. These factor investing ETFs held 4.91% of the overall assets under management in the European ETF industry at the end of March 2024. This means the market share of factor investing ETFs in Europe is way below the market share of factor investing ETFs on a global basis (20.58%).Graph 1: Market Share of Assets Under Management in the European ETF Industry (March 31, 2024)

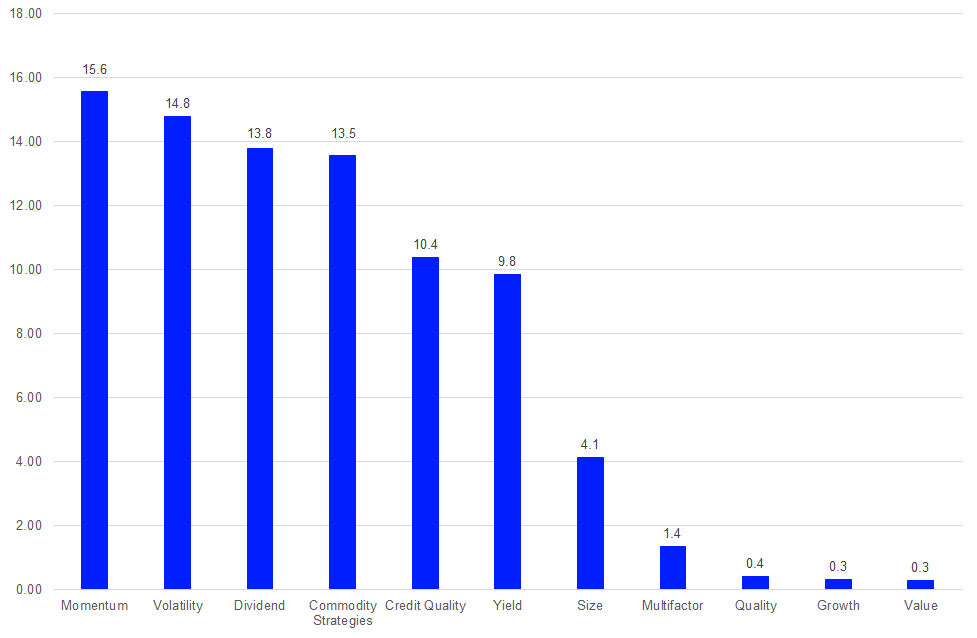

Image Source: PixabayFactor investing ETFs are ETFs that replicate an index that uses one of the scientifically proven factors (dividends, growth, liquidity, momentum, quality/credit quality, size, value, volatility, and yield) to determine its constituents.As a result, from this process, the portfolio of the factor investing index may vary significantly from the portfolio of the parent index, even while investing in the same market(s).Since there is scientific proof that the factors mentioned above are able to generate alpha compared to their parent index over a full investment cycle, some investors and market observers used the term smart beta for these factor investing ETFs when they were entering the market. Even as it sounded fancy, this nickname vanished over time as marketers and market observers were urged to become more professional in their comments on factor investing ETFs.More generally, factors are seen as market inefficiencies that can enable investors to harvest excess returns over a full investment cycle. Investors, therefore, need to be patient when using single factors because it is hard to predict when a given factor will start to out or underperform compared to its parent index. In addition, it is noteworthy that factor investing can be seen as an arbitrage strategies, which have the potential to eliminate a factor over time, if there is enough money invested with regard to a given factor (illiquid stocks can become liquid, small caps can grow to mid- or even large caps, value stocks can become expensive, etc.). As a result, the excess returns will get smaller the more money is invested into the same factor (strategy).Given that factor investing strategies do not generate a consistent outperformance, the asset management industry has introduced multifactor strategies which combine single factors in a static or dynamic way to generate a more consistent outperformance and to help investors with the market timing of factors.According to the Lipper database, there are 197-factor investing ETFs (primary share classes) registered for sales in Europe. These factor investing ETFs held 4.91% of the overall assets under management in the European ETF industry at the end of March 2024. This means the market share of factor investing ETFs in Europe is way below the market share of factor investing ETFs on a global basis (20.58%).Graph 1: Market Share of Assets Under Management in the European ETF Industry (March 31, 2024) Source: LSEG LipperThe highest assets under management were held by ETFs using the momentum factor (€15.6 bn). They were followed by ETFs using the volatility factor (€14.8 bn), dividend factor (€13.8 bn), commodities strategies (€13.6 bn), credit quality (€10.4 bn), yield (€9.8 bn), size (€4.1 bn), multifactor (€1.4 bn), quality (€0.4 bn), growth (€0.3 bn), and value factor (€0.3 bn).Graph 2: Assets Under Management of Factor-Investing ETFs by Factor– in bn EUR (March 31, 2024)

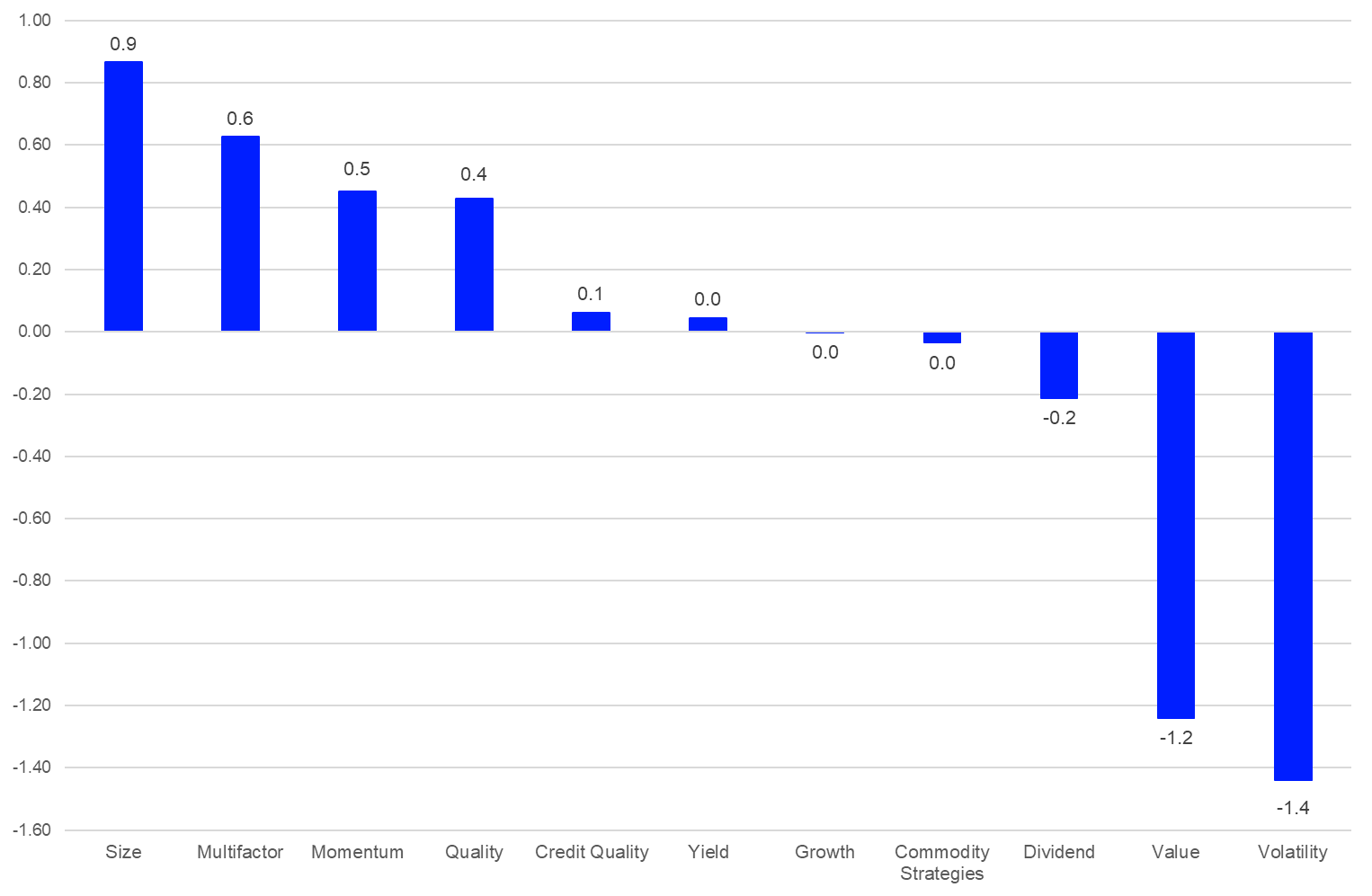

Source: LSEG LipperThe highest assets under management were held by ETFs using the momentum factor (€15.6 bn). They were followed by ETFs using the volatility factor (€14.8 bn), dividend factor (€13.8 bn), commodities strategies (€13.6 bn), credit quality (€10.4 bn), yield (€9.8 bn), size (€4.1 bn), multifactor (€1.4 bn), quality (€0.4 bn), growth (€0.3 bn), and value factor (€0.3 bn).Graph 2: Assets Under Management of Factor-Investing ETFs by Factor– in bn EUR (March 31, 2024) Source: LSEG LipperOpposite to the overall trend in the European ETF industry, factor investing ETFs faced estimated net outflows of €0.2 bn over the course of 2023. These outflows repeated a trend that started in 2023. This may mean that factor investing ETFs are out of favor with European investors.Graph 3: Estimated Net Flows in Factor-Investing ETFs by Factor (January 1 – March 31, 2024)

Source: LSEG LipperOpposite to the overall trend in the European ETF industry, factor investing ETFs faced estimated net outflows of €0.2 bn over the course of 2023. These outflows repeated a trend that started in 2023. This may mean that factor investing ETFs are out of favor with European investors.Graph 3: Estimated Net Flows in Factor-Investing ETFs by Factor (January 1 – March 31, 2024) Source: LSEG LipperETFs using the size factor (+€0.9 bn) enjoyed the highest estimated net inflows over the course of the first quarter of 2024. They were followed by ETFs using a multifactor approach (+€0.6 bn), momentum factor (+€0.5 bn), quality (+€0.4 bn), credit quality (+€0.1 bn), and the yield factor (+€0.1 bn). On the other side of the table, ETFs using the growth factor (-€0.0002 bn), commodities strategies (-€0.03 bn), dividends (-€0.2 bn), value (-€1.2 bn), and the volatility factor (-€1.4 bn) faced outflows.More By This Author:Russell 2000 Earnings Dashboard 24Q1 – Thursday, April 25S&P 500 Earnings Dashboard 24Q1 – Thursday, April 25S&P 500 Earnings Dashboard 24Q1 – Tuesday, April 23

Source: LSEG LipperETFs using the size factor (+€0.9 bn) enjoyed the highest estimated net inflows over the course of the first quarter of 2024. They were followed by ETFs using a multifactor approach (+€0.6 bn), momentum factor (+€0.5 bn), quality (+€0.4 bn), credit quality (+€0.1 bn), and the yield factor (+€0.1 bn). On the other side of the table, ETFs using the growth factor (-€0.0002 bn), commodities strategies (-€0.03 bn), dividends (-€0.2 bn), value (-€1.2 bn), and the volatility factor (-€1.4 bn) faced outflows.More By This Author:Russell 2000 Earnings Dashboard 24Q1 – Thursday, April 25S&P 500 Earnings Dashboard 24Q1 – Thursday, April 25S&P 500 Earnings Dashboard 24Q1 – Tuesday, April 23