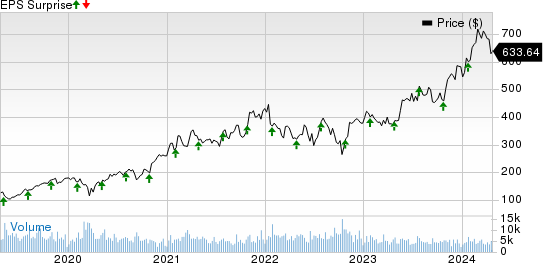

KLA Corporation (KLAC – Free Report) is scheduled to report its third-quarter fiscal 2024 results on Apr 25.For the fiscal third quarter, KLAC expects revenues to be $2.34 billion, plus/minus $125 million. The Zacks Consensus Estimate for revenues is pegged at $2.30 billion, indicating a decrease of 5.39% from the year-ago fiscal quarter’s reported figure.KLA expects non-GAAP earnings of $5.26 per share, plus/minus 60 cents. The consensus mark for earnings is pegged at $4.94 per share, down 4% over the past 30 days, indicating a decline of 10.02% from the previous-year fiscal quarter’s reported figure.KLAC’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 6.72%.

KLA Corporation Price and EPS Surprise

KLA Corporation price-eps-surprise | KLA Corporation QuoteLet’s see how things have shaped up for the upcoming announcement:

KLA Corporation price-eps-surprise | KLA Corporation QuoteLet’s see how things have shaped up for the upcoming announcement:

Factors to Consider

KLA’s fiscal third-quarter results are expected to have benefited from the strong performance of the wafer inspection business, owing to strong demand for advanced wafer inspection applications in leading-edge technology development.Growing adoption of KLA’s 8900 series platform for high throughput macro inspection, increased demand in the legacy node and advanced packaging categories made the platform one of the best-performing product lines in its optical inspection portfolio in 2023. The trend is expected to have continued in the fiscal third quarter.Increased investments across multiple nodes, and rising capital intensity in Foundry & Logic are expected to have driven the top-line growth. KLA’s emphasis on the integration of AI into its solutions has driven its outperformance in the semiconductor market.However, weakness in the PCB, Display and Component Inspection remains a headwind. Softness in memory and leading-edge, logic and foundry investments have been a concern.

What Our Model Says

According to the Zacks model, the combination of a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.KLA has an Earnings ESP of -2.04% and carries a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.More By This Author:Altair (ALTR) Buys Cambridge Semantics, Enhances AI Technology (Revised)

3 Energy Stocks To Buy Pre Earnings

Ford Gears Up To Report Q1 Earnings: What’s In The Cards?