Data has been hawkish – enough to keep traders jittery about the future as regards monetary policy / interest rate loosening. Simply enough: high Oil has been sufficient to reflect why there’s no particular relief on inflation or of news that would ‘justifiably’ cause the Fed to cut rates (meaning they could, but not with a particular data justification, essentially more political and trying to assist consumers if they move that way). But for now ‘helmets on’.. mega-cap risks.  Pixabay Also, I think fairly high interest rates ‘alone’ have contributed to inflation, while the Fed is unlikely to acknowledge that. Basically this was a boring session, but the fireworks occurred after the Close with some ‘heavy’ selling that helps set-up the ‘C’ wave decline (META down 70+) which might be a mega-plunge.

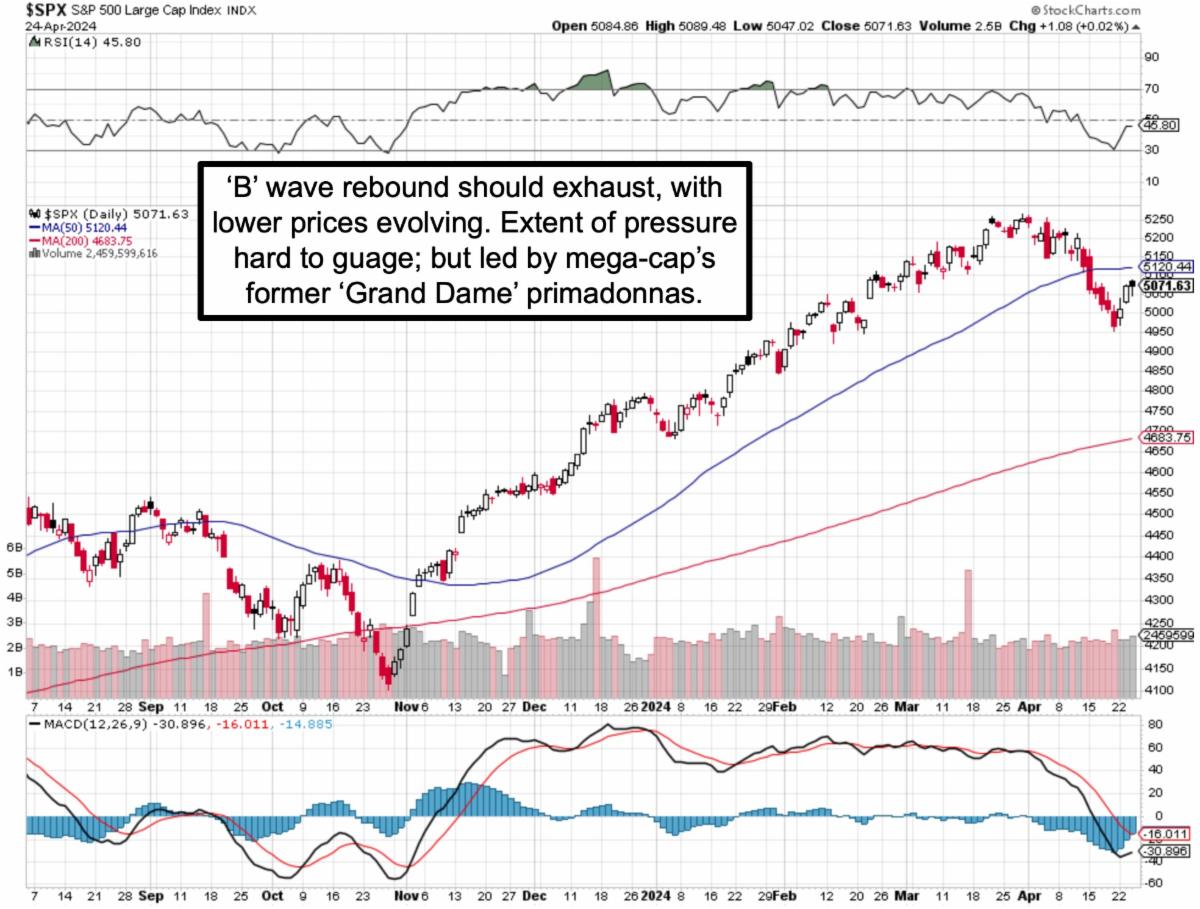

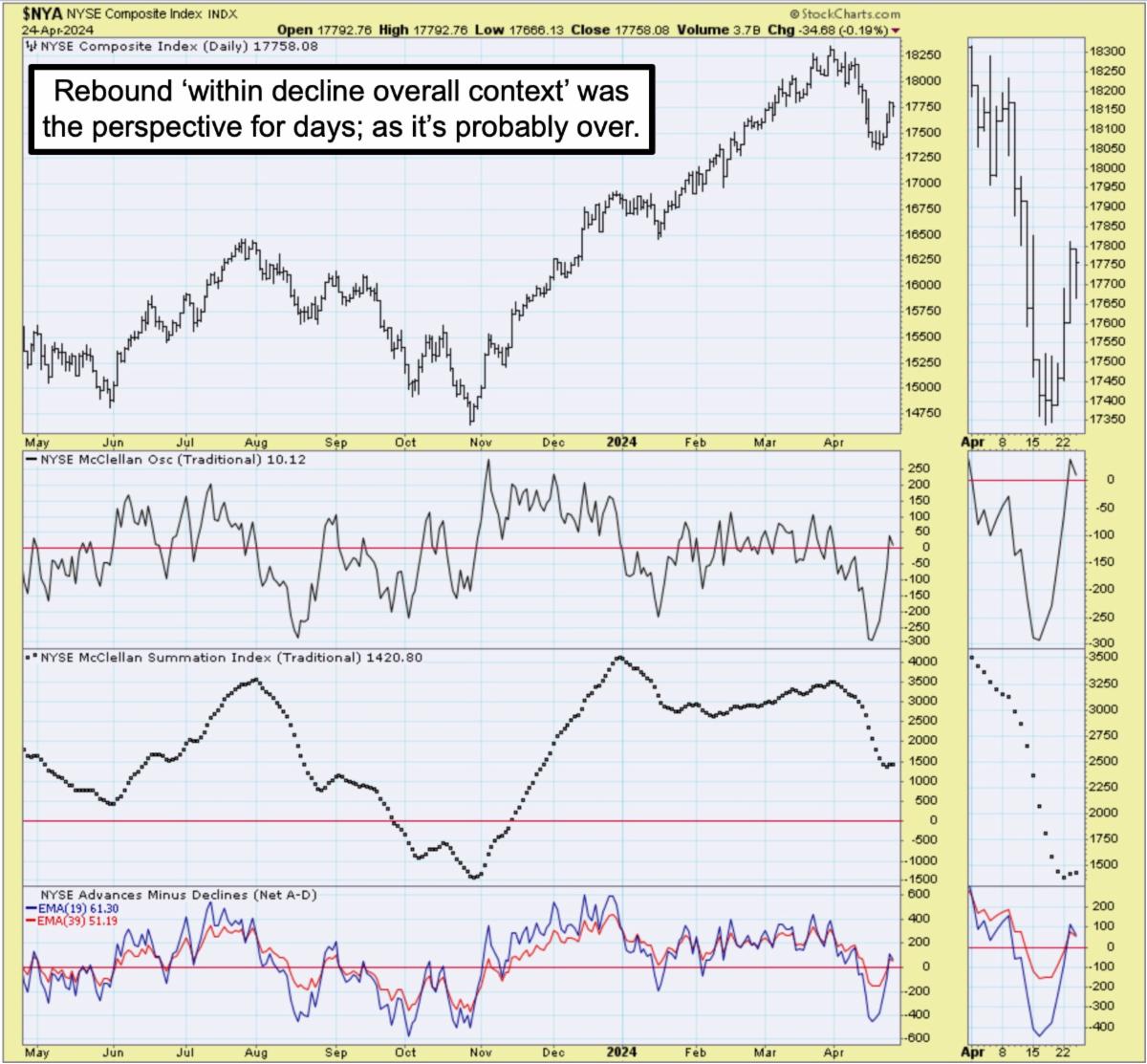

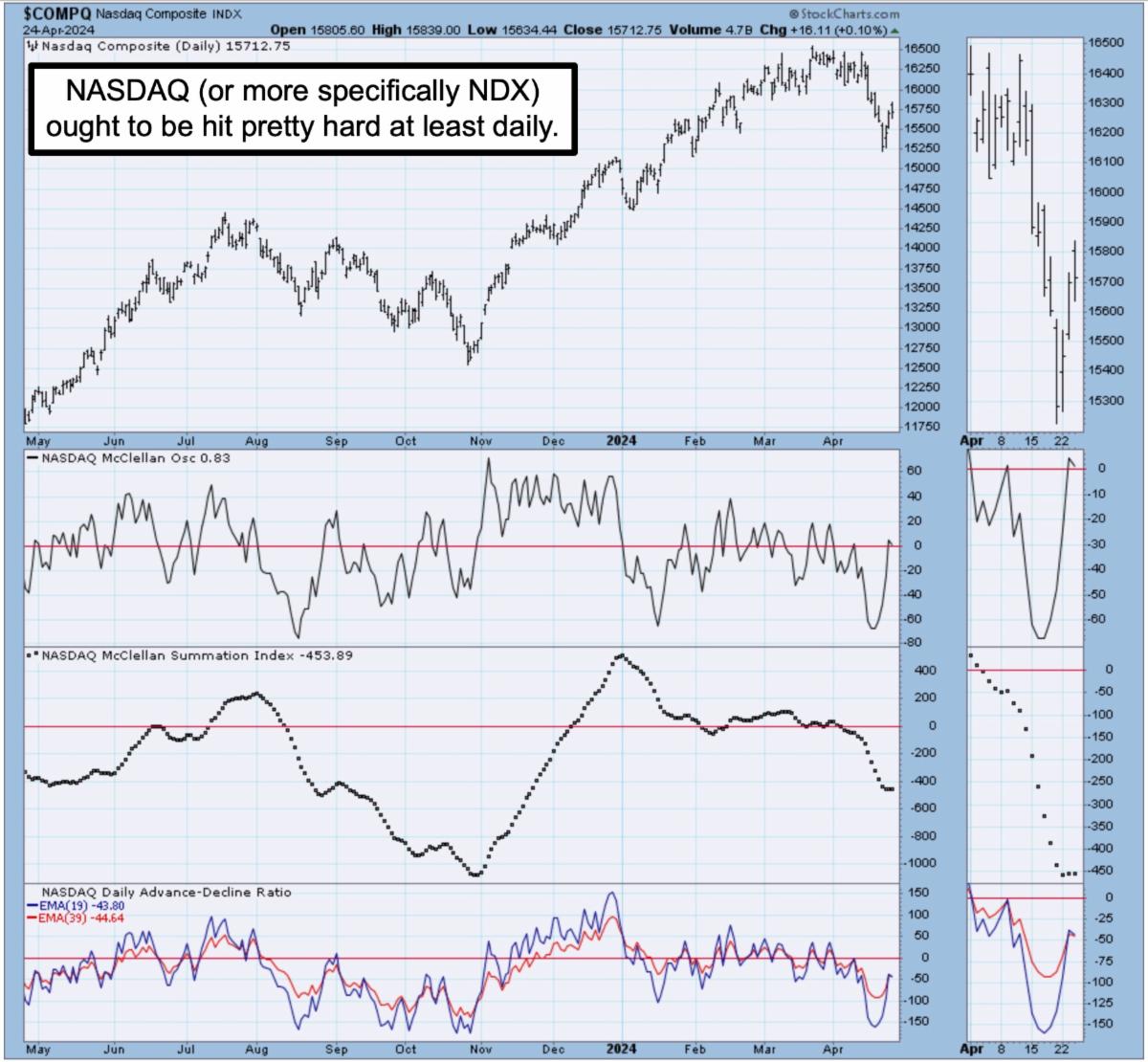

Pixabay Also, I think fairly high interest rates ‘alone’ have contributed to inflation, while the Fed is unlikely to acknowledge that. Basically this was a boring session, but the fireworks occurred after the Close with some ‘heavy’ selling that helps set-up the ‘C’ wave decline (META down 70+) which might be a mega-plunge.  Market X-ray: It’s almost ‘as if’ trading were halted due to an influx of apathy as we scan the majority of Wednesday’s trade, after an early morning ‘bump’. The ‘apathy’ was obviously the ‘calm before the storm’ that’s ongoing now. We suspected (per morning ‘tweet/post’) a bit more upside then on-hold as of course everyone awaits the PCE on Friday. But we’ll drop Thursday given the post-Close reports, nothing indecisive about it. Late action Wednesday was extremely neutral until the Bell, then of course it all changed after the NYSE Close, with several smashed reports.I think META will rock folks the most (we do not own it), given the lower China demand, but I don’t know why that’s surprising as they kicked-out Instagram and apparently WhatsApp… which internationally is heavily relied-upon. So it may be the expenses Cousin Zuck talked about related to embracing ‘AI’ that is hitting it this hard. Also a miss by Service Now relates more to domestic economic concerns, or IBM, which is down 13 near press-time.Actually S&P won’t merely be on-hold anticipating PCE (possibly not friendly if you go by Oil price levels), plus concerns of what we’ve talked of, a ‘B’ wave within an ‘A-B-C’ decline essentially. We still envision a ‘C’ wave down ahead. And the mega-purge sets-the-stage for semi-panic pummeling some prices.Treasuries are near their highs too, with the S&P so far generally ignoring that and high Oil, possibly some short-covering in equities involved with this too.But so many ‘players’ are sufficiently bearish (short), that you get rallies such as we called for earlier this week, and might see more efforts, it all depends. I basically think there was the decent trading buy during pressure last week, a move that followed wasn’t expected to have much sustainability, and doesn’t.

Market X-ray: It’s almost ‘as if’ trading were halted due to an influx of apathy as we scan the majority of Wednesday’s trade, after an early morning ‘bump’. The ‘apathy’ was obviously the ‘calm before the storm’ that’s ongoing now. We suspected (per morning ‘tweet/post’) a bit more upside then on-hold as of course everyone awaits the PCE on Friday. But we’ll drop Thursday given the post-Close reports, nothing indecisive about it. Late action Wednesday was extremely neutral until the Bell, then of course it all changed after the NYSE Close, with several smashed reports.I think META will rock folks the most (we do not own it), given the lower China demand, but I don’t know why that’s surprising as they kicked-out Instagram and apparently WhatsApp… which internationally is heavily relied-upon. So it may be the expenses Cousin Zuck talked about related to embracing ‘AI’ that is hitting it this hard. Also a miss by Service Now relates more to domestic economic concerns, or IBM, which is down 13 near press-time.Actually S&P won’t merely be on-hold anticipating PCE (possibly not friendly if you go by Oil price levels), plus concerns of what we’ve talked of, a ‘B’ wave within an ‘A-B-C’ decline essentially. We still envision a ‘C’ wave down ahead. And the mega-purge sets-the-stage for semi-panic pummeling some prices.Treasuries are near their highs too, with the S&P so far generally ignoring that and high Oil, possibly some short-covering in equities involved with this too.But so many ‘players’ are sufficiently bearish (short), that you get rallies such as we called for earlier this week, and might see more efforts, it all depends. I basically think there was the decent trading buy during pressure last week, a move that followed wasn’t expected to have much sustainability, and doesn’t.  Meanwhile . . . money managers are laser-focused on mega-cap earnings of course.. while I’m more focused on ‘space lasers’ that will transform earth and space communications (very important for almost all future communications). Or lasers that will make intercepting attacking ‘drones and cruise missiles’ not so expensive, since per-shot costs depend more on electricity than weapons.I might note we have our eyes on a couple companies that may benefit in the ‘space’ (meaning sector in this reference), including one I’ve not yet reflected on and may or may not in the future. Our existing speculative plays, like long held LightPath (LPTH) is ‘sort of’ in that space (infrared aspect, but we think satellite linkage too… and maybe not just SpaceX, but we don’t know).There are a couple companies making satellites (what is called a bus system on the ‘birds’) that will make use of laser communications, and the US Navy is gradually adding ‘laser weaponry’ to warships, for an affordable interception method to address incoming ordnance. Such laser weapons are a natural for the Navy, as there is almost unlimited electrical power available for multiple ’rounds’. The current cost of firing Standard 3 or 6 interceptor missiles is just ridiculous relative to the cost to make adversary weapons, especially drones.Managing both U.S. Navy or ‘possibly’ space-based systems is complex and requires ‘top engineering’ talent (target acquisition software essentially) with a focus on coordinating defending against ‘swarms’ of enemy drones (the small ones that cost almost nothing to build, but a fortune to stop with preexisting or kinetic intercepting methods). Israel certainly learned of cost with Iron Dome, which did a great job against basic rockets (barely guided though some drone attacks did have mounted cameras and rudimentary guidance). Now there is ‘Iron Beam’, which will aim to intercept these terror weapons with lasers, low cost way and effective against swarms ‘if there’s enough electricity’ do run it. I think managing and coordinating all this ‘laser power’ on land or space is key.

Meanwhile . . . money managers are laser-focused on mega-cap earnings of course.. while I’m more focused on ‘space lasers’ that will transform earth and space communications (very important for almost all future communications). Or lasers that will make intercepting attacking ‘drones and cruise missiles’ not so expensive, since per-shot costs depend more on electricity than weapons.I might note we have our eyes on a couple companies that may benefit in the ‘space’ (meaning sector in this reference), including one I’ve not yet reflected on and may or may not in the future. Our existing speculative plays, like long held LightPath (LPTH) is ‘sort of’ in that space (infrared aspect, but we think satellite linkage too… and maybe not just SpaceX, but we don’t know).There are a couple companies making satellites (what is called a bus system on the ‘birds’) that will make use of laser communications, and the US Navy is gradually adding ‘laser weaponry’ to warships, for an affordable interception method to address incoming ordnance. Such laser weapons are a natural for the Navy, as there is almost unlimited electrical power available for multiple ’rounds’. The current cost of firing Standard 3 or 6 interceptor missiles is just ridiculous relative to the cost to make adversary weapons, especially drones.Managing both U.S. Navy or ‘possibly’ space-based systems is complex and requires ‘top engineering’ talent (target acquisition software essentially) with a focus on coordinating defending against ‘swarms’ of enemy drones (the small ones that cost almost nothing to build, but a fortune to stop with preexisting or kinetic intercepting methods). Israel certainly learned of cost with Iron Dome, which did a great job against basic rockets (barely guided though some drone attacks did have mounted cameras and rudimentary guidance). Now there is ‘Iron Beam’, which will aim to intercept these terror weapons with lasers, low cost way and effective against swarms ‘if there’s enough electricity’ do run it. I think managing and coordinating all this ‘laser power’ on land or space is key.  Bottom-line: Very much on-hold ahead of PCE Friday, or for dramatic ripples in the global geopolitical matrix. S&P was up, but unlikely for early Thursday.The ‘creaming’ (remember my forewarning of ‘sell the news’ on mega results) .. well we got that late Wednesday ‘in spades’, with ServiceNow (NOW) off 36, IBM off 13 or META down a ‘wowser’ 81 points (poor guidance). Only Chipolte (it isn’t too important but up 98) and Ford (not bad) were up a bit on Quarterly Reports. Obviously I’m frustrated with smaller stocks, but relieved that we got pretty adamant about ‘not chasing’ absurd higher guidance some analysts in the mega-caps were giving over a month ago, which made no valuation logic.And oh yes I’ve disparaged Netflix (NFLX) enough, it is down 27 this late afternoon, and Nvidia (NVDA) off 43. I think some of this is ‘algorithmic selling’ in the mega-caps overall, and certainly there is few if any ‘Pacific’ bids for much of such stocks.Sorry but it’s what I’ve suggested as the bizarre world of mega-cap leadership rolled-over, bounced and now basically tanks. Most mundane stocks will tend to erode slightly, because most investors won’t differentiate, but for not it’s the ‘grand dame’ primadonnas punishing late-blooming chasers we warned of.More By This Author:Market Briefing For Monday, April 22ndMarket Briefing For Thursday, April 18 Market Briefing For Wednesday, April 17

Bottom-line: Very much on-hold ahead of PCE Friday, or for dramatic ripples in the global geopolitical matrix. S&P was up, but unlikely for early Thursday.The ‘creaming’ (remember my forewarning of ‘sell the news’ on mega results) .. well we got that late Wednesday ‘in spades’, with ServiceNow (NOW) off 36, IBM off 13 or META down a ‘wowser’ 81 points (poor guidance). Only Chipolte (it isn’t too important but up 98) and Ford (not bad) were up a bit on Quarterly Reports. Obviously I’m frustrated with smaller stocks, but relieved that we got pretty adamant about ‘not chasing’ absurd higher guidance some analysts in the mega-caps were giving over a month ago, which made no valuation logic.And oh yes I’ve disparaged Netflix (NFLX) enough, it is down 27 this late afternoon, and Nvidia (NVDA) off 43. I think some of this is ‘algorithmic selling’ in the mega-caps overall, and certainly there is few if any ‘Pacific’ bids for much of such stocks.Sorry but it’s what I’ve suggested as the bizarre world of mega-cap leadership rolled-over, bounced and now basically tanks. Most mundane stocks will tend to erode slightly, because most investors won’t differentiate, but for not it’s the ‘grand dame’ primadonnas punishing late-blooming chasers we warned of.More By This Author:Market Briefing For Monday, April 22ndMarket Briefing For Thursday, April 18 Market Briefing For Wednesday, April 17