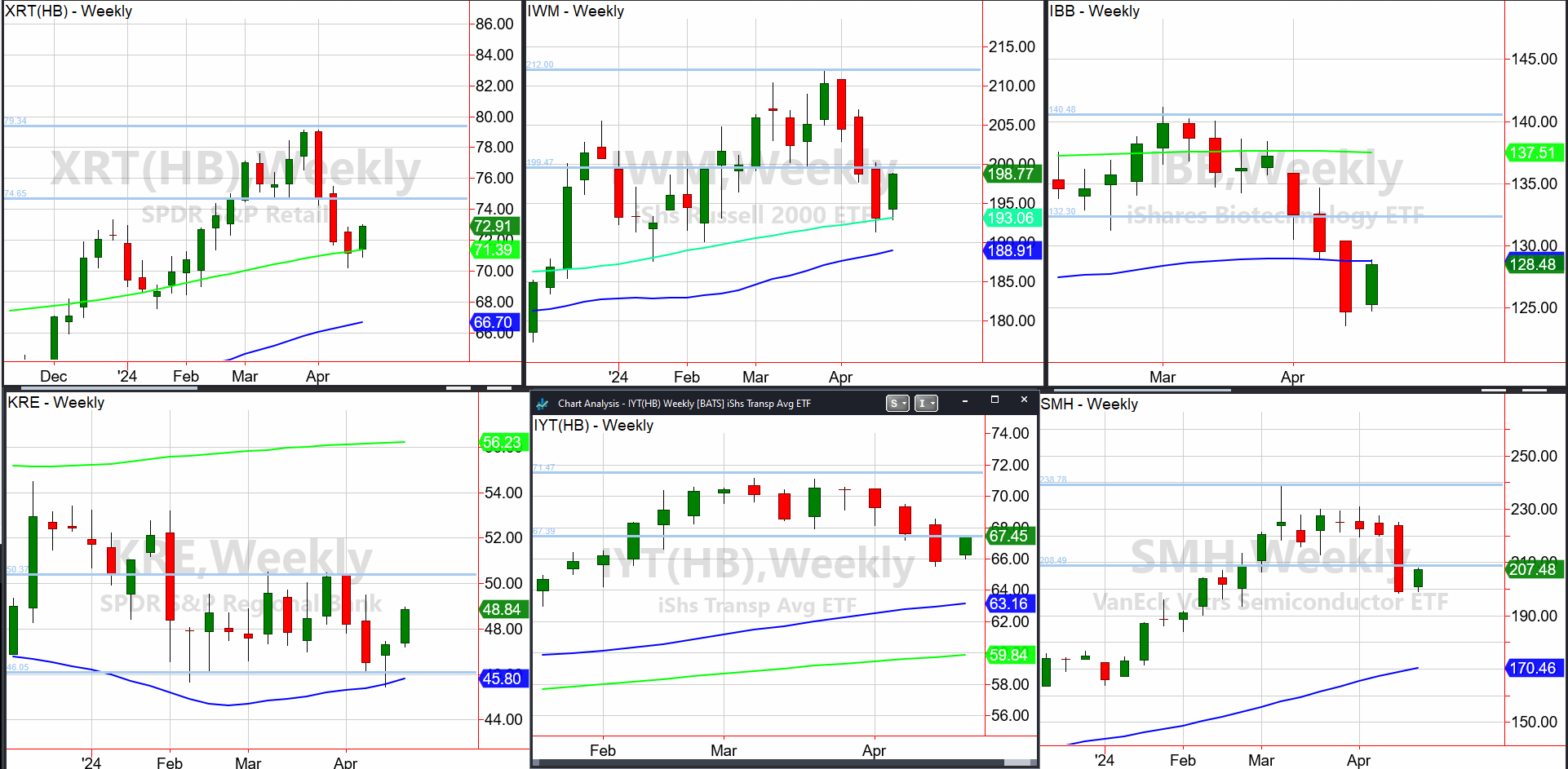

While I am extremely focused on commodities as outlined in Monday’s Daily, my viewpoint for most equities remains cautious to neutral.What might turn us to be more bullish?I love these weekly charts.Let’s analyze.Going from the top row left to right we start with Granny Retail.3 weeks ago, XRT failed the weekly channel giving us a fair warning.Then last week, XRT closed right on the 200-week moving average.This week, XRT has popped off that support. Bulls want to see a weekly close above 72.87, last week’s high.Then we will be back to watching the 75 area or where it originally broke down from.A weekly close under 71.40 would be a reason to exercise more caution.A very similar story with Granddad Russell 2000 IWM.IWM, after breaking under the channel, held the 200-WMA and now is testing the bottom of that channel.Brother Biotechnology IBB failed its channel 3 weeks ago and also failed the 50-WMA. This week, that 50-WMA becomes key.I focused on KRE in interviews and on X.As the weakest member, KRE last week held both the weekly channel low and the 50-WMA to become a relative outperformer.This week, KRE trades back to the middle of its recent trading range.With the top of the channel line the biggest hurdle, that is the most exciting place to watch for KRE to clear or not.Transportation IYT currently tests the bottom of the channel it failed last week. Worth a watch!Finally, Sister Semiconductors, like IYT, only failed the channel bottom last week and is also testing that breakdown area this week.Plus, with lots of earnings on tap, we should know her next direction very soon.Keep your eyes on the weekly charts and the phases…it will keep you on the right side of the market.More By This Author:New Opportunities Are Emerging In Commodities Swiss Franc-Remembering That DreamPowell And The Great Indecision

While I am extremely focused on commodities as outlined in Monday’s Daily, my viewpoint for most equities remains cautious to neutral.What might turn us to be more bullish?I love these weekly charts.Let’s analyze.Going from the top row left to right we start with Granny Retail.3 weeks ago, XRT failed the weekly channel giving us a fair warning.Then last week, XRT closed right on the 200-week moving average.This week, XRT has popped off that support. Bulls want to see a weekly close above 72.87, last week’s high.Then we will be back to watching the 75 area or where it originally broke down from.A weekly close under 71.40 would be a reason to exercise more caution.A very similar story with Granddad Russell 2000 IWM.IWM, after breaking under the channel, held the 200-WMA and now is testing the bottom of that channel.Brother Biotechnology IBB failed its channel 3 weeks ago and also failed the 50-WMA. This week, that 50-WMA becomes key.I focused on KRE in interviews and on X.As the weakest member, KRE last week held both the weekly channel low and the 50-WMA to become a relative outperformer.This week, KRE trades back to the middle of its recent trading range.With the top of the channel line the biggest hurdle, that is the most exciting place to watch for KRE to clear or not.Transportation IYT currently tests the bottom of the channel it failed last week. Worth a watch!Finally, Sister Semiconductors, like IYT, only failed the channel bottom last week and is also testing that breakdown area this week.Plus, with lots of earnings on tap, we should know her next direction very soon.Keep your eyes on the weekly charts and the phases…it will keep you on the right side of the market.More By This Author:New Opportunities Are Emerging In Commodities Swiss Franc-Remembering That DreamPowell And The Great Indecision