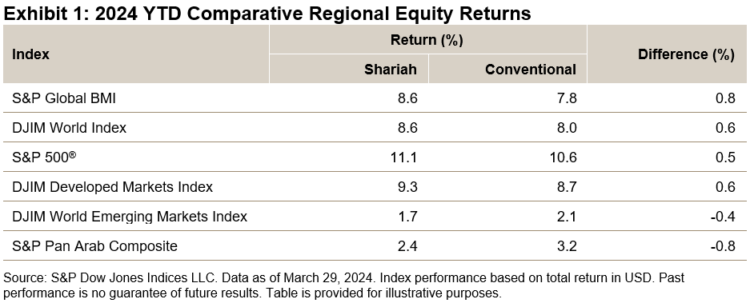

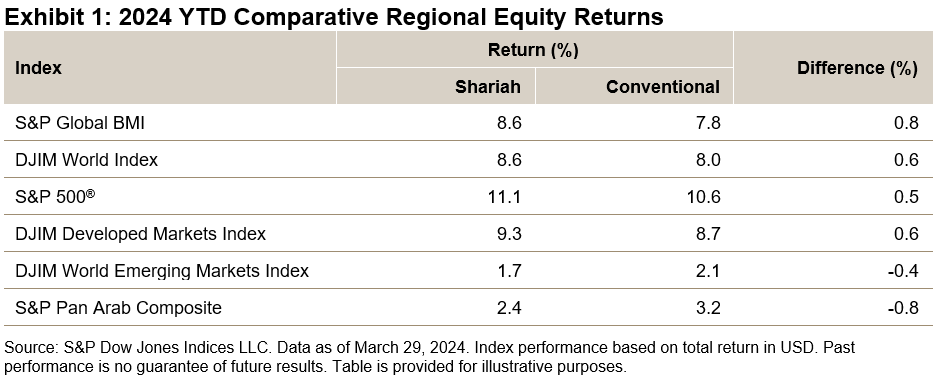

Global equities had a strong start to the year as economic resilience and diminishing recession fears boosted risky assets overall. The S&P Global BMI surged 7.8% in the first quarter, led by developed markets; notably, the S&P 500® finished the quarter up 10.6%, at a new record high. Shariah-compliant global benchmarks beat their conventional counterparts, with the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index generating an outperformance of 0.8% and 0.6%, respectively, during the quarter. The DJIM World Emerging Markets Index was a laggard, trailing behind the conventional benchmark as well as the developed market counterpart (see Exhibit 1).

MENA equities lagged along with emerging markets, with the S&P Pan Arab Composite posting a modest gain of 3.2%. Egypt was among the worst performers, with the S&P Egypt BMI falling 27.4% in U.S. dollar terms. The Egyptian pound shed over one-third of its value against the U.S. dollar during the quarter, as the country agreed on a USD 8 billion support program with the International Monetary Fund and let go of control on its currency in a bid for economic stability. GCC countries largely posted gains led by Kuwait (8.1%) and Bahrain (8.0%), while Qatar was an exception, with a 3.3% loss.

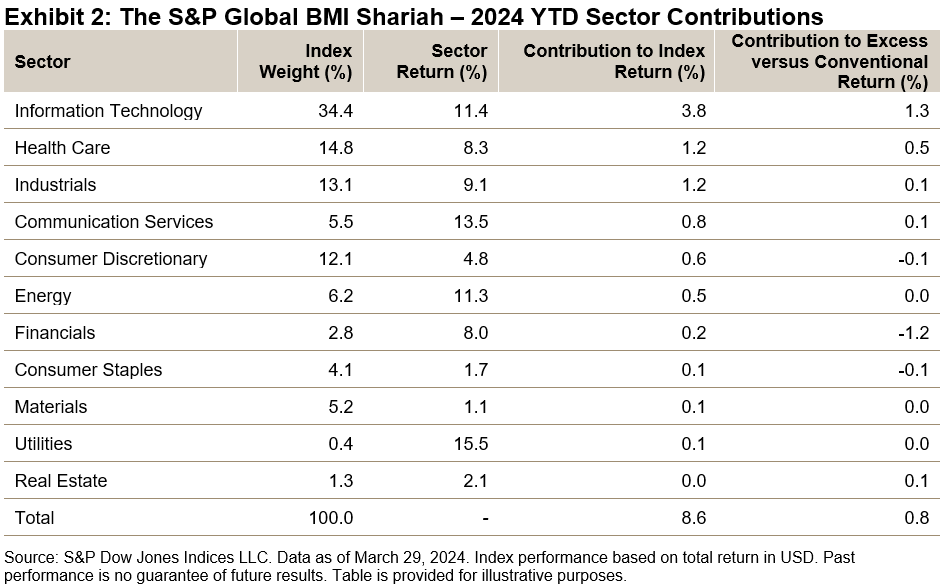

Drivers of Shariah Index Performance in Q1 2024

All sectors contributed positively to the S&P Global BMI Shariah in the first quarter. Extending the trend in 2023, Information Technology continued to be the largest contributor, accounting for 44% of the index return and generating an excess return of 1.3% versus the conventional benchmark. On the other hand, Financials contributed most negatively to the relative performance, with an excess return of -1.2%, due to its lower weightings as compared to the conventional benchmark (see Exhibit 2).

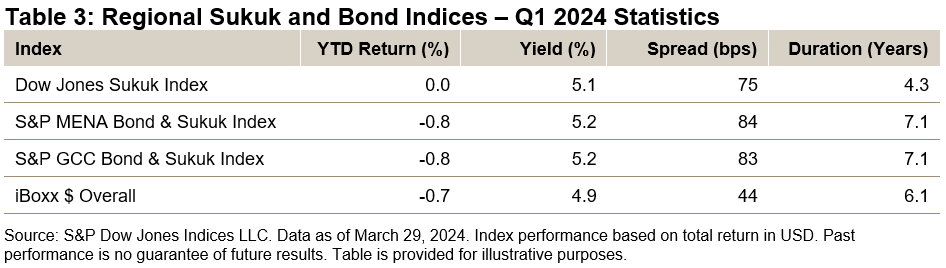

Global Sukuk Fared Better than Bonds in Q1 2024

The Sukuk market was largely muted, with a close-to-zero gain in the first quarter as measured by the Dow Jones Sukuk Index. The benchmark outperformed the regional MENA and GCC Bond & Sukuk benchmarks as well as the global iBoxx USD Overall, as shorter-dated securities generally outperformed longer-dated ones during the quarter.  More By This Author:Commodities Deliver Double-Digit Returns In The Face Of Stubborn Inflation

More By This Author:Commodities Deliver Double-Digit Returns In The Face Of Stubborn Inflation

Balancing Growth And Value In The Mid-Cap And Small-Cap Spaces

Energy Pumps Up The S&P GSCI And Markets Go Cuckoo For Cocoa