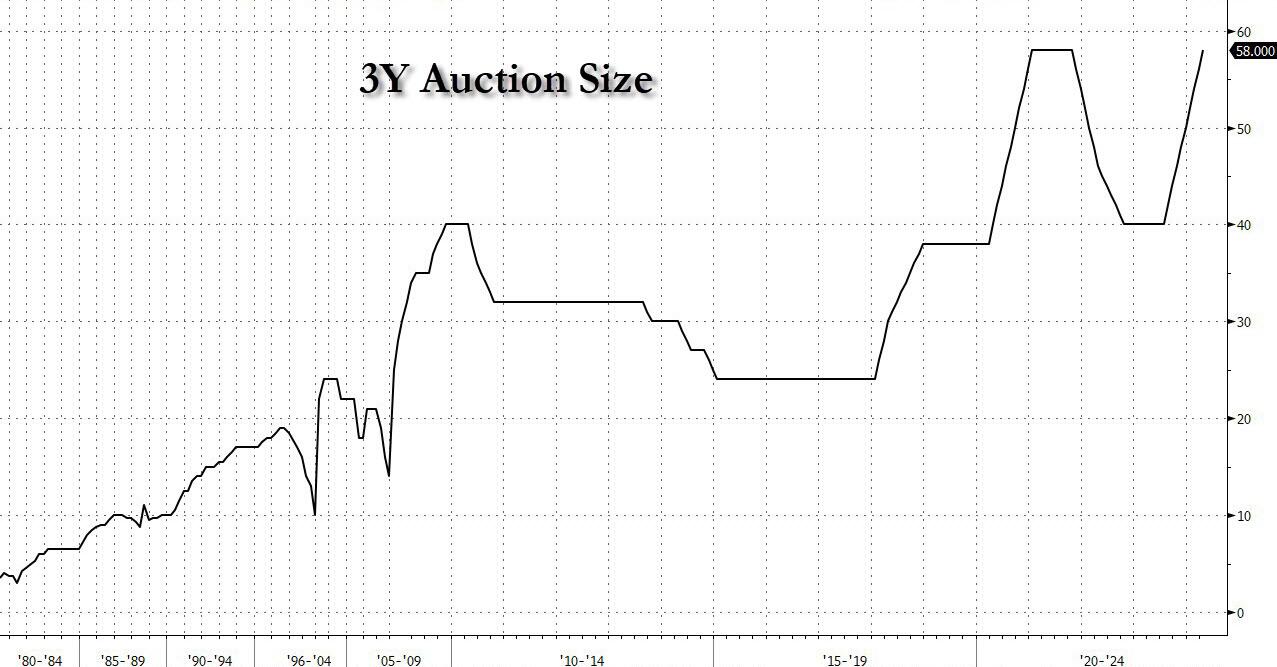

The first coupon auction of the week and the month is in the history books and boy, was it ugly: maybe it was nerves ahead of tomorrow’s CPI, maybe it was the realization that there is a lot more where this came from. A LOT more.With $58 billion in 3Y paper for sale today, tied for the biggest amount on record for sale in the tenor…

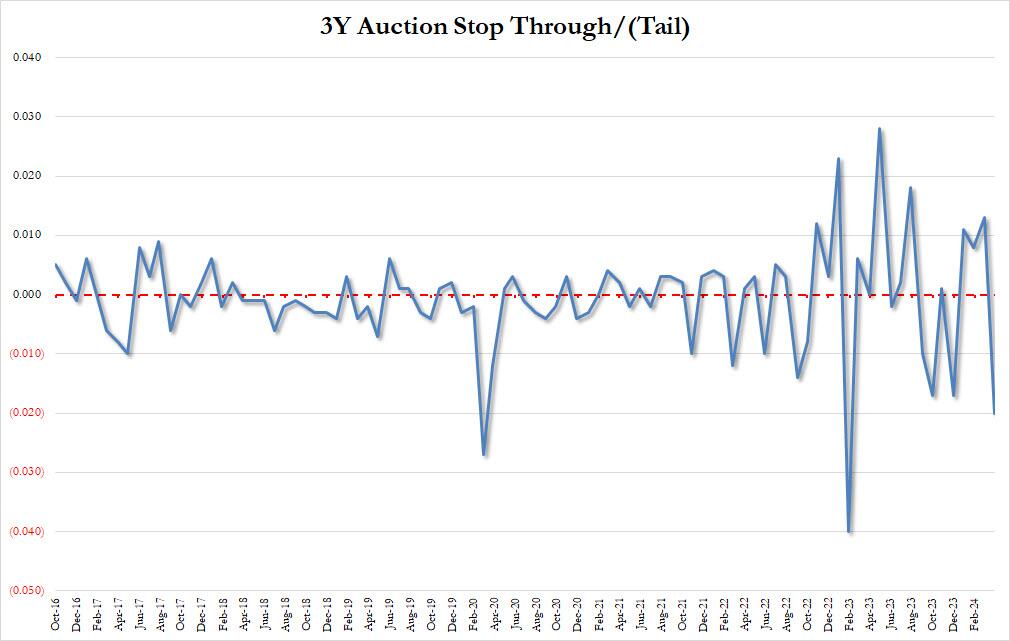

… the reception was anything but warm.The high yield of today’s auction was 4.548%, up markedly from last month’s 4.256% and the highest since November’s 4.701%, the auction tailed the When Issued 4.528% by 2.0bps, which was not only the first tail after 3 stopping though auction, but the biggest tail since February 2023.

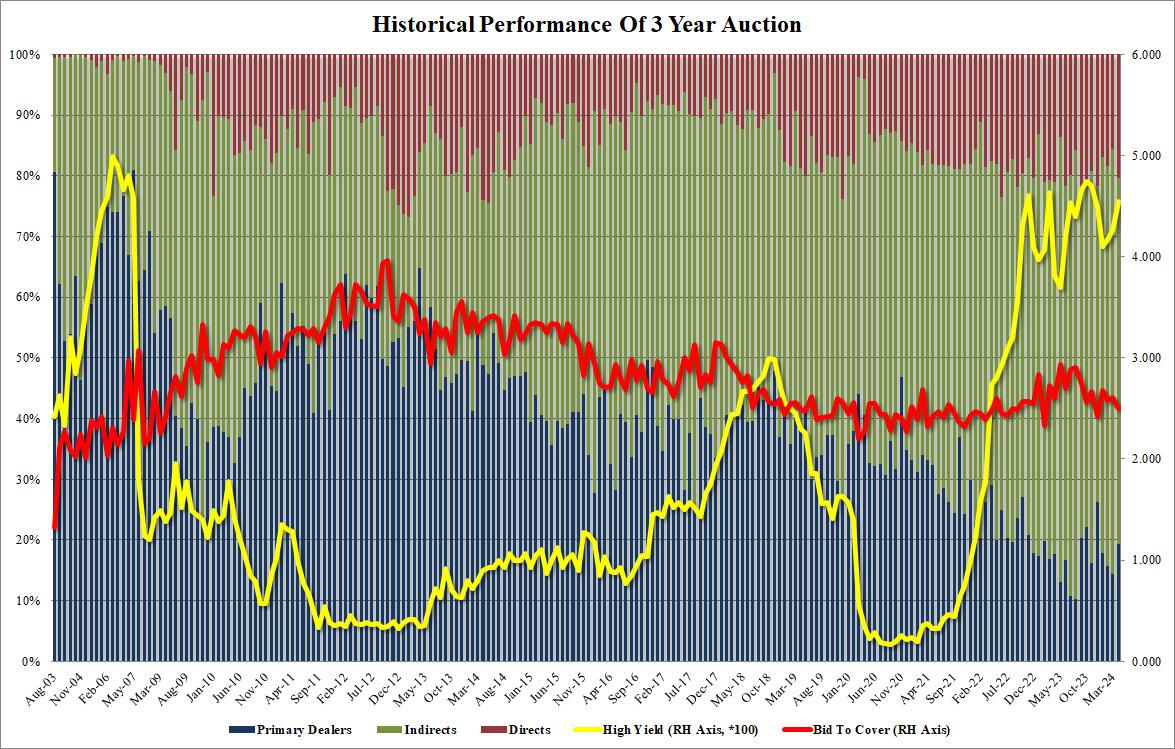

The bid to cover dropped to 2.50% from 2.60%; it was the lowest since December’s 2.42 and well below the six-auction average of 2.584%.The internals were also ugly, with foreign demand fading as Indirects took down just 60.3%, the lowest since December’s 52.1 (and below the 62.3 recent average), leaving 20.4 to Directs, the most since December, and Dealers awarded 19.31T, the most since, you guessed it, December.

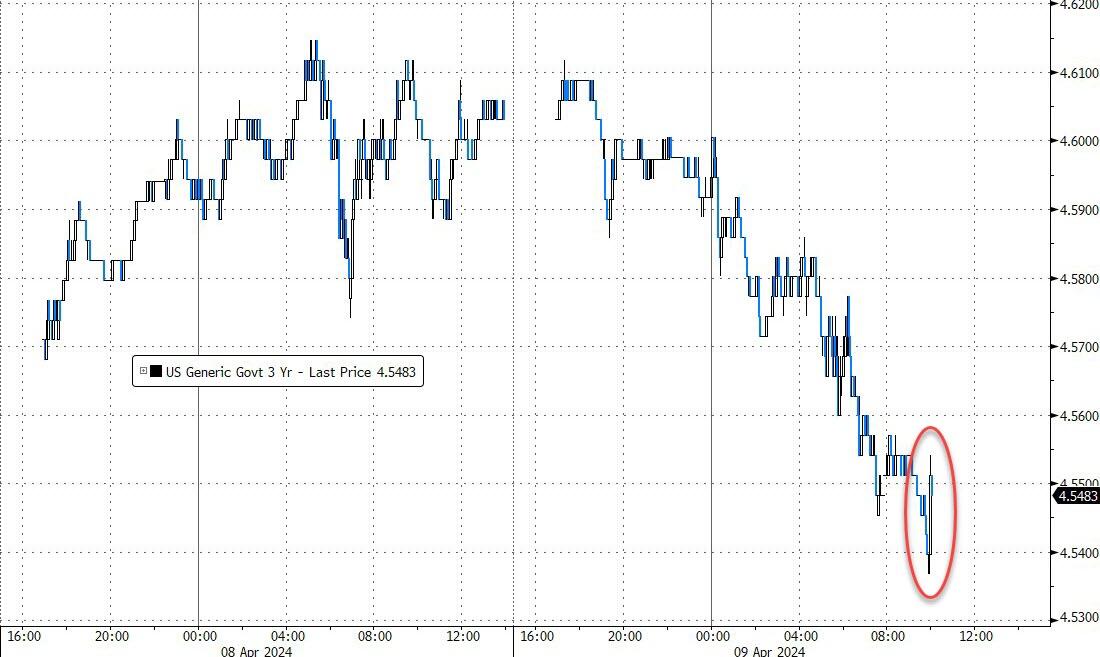

In response to the auction, yields – which were sliding all day in a flight to safety as stocks dumped – moved higher by about 2 bps although remained near session lows amid the general selling everywhere else.  That said, if tomorrow’s CPI ends up being hot again, watch out below as all of today’s buyers end up being deeply underwater in less than 24 hours.More By This Author:Bitcoin & Bullion Back Near Record Highs As Rate-Cut Bets BatteredGoldman Offers “Burst Of Bullish Coverage” On Soaring Uranium StocksCredit Card Debt Surges To New All-Time High, Just As Card APR Rates Hit Fresh Record

That said, if tomorrow’s CPI ends up being hot again, watch out below as all of today’s buyers end up being deeply underwater in less than 24 hours.More By This Author:Bitcoin & Bullion Back Near Record Highs As Rate-Cut Bets BatteredGoldman Offers “Burst Of Bullish Coverage” On Soaring Uranium StocksCredit Card Debt Surges To New All-Time High, Just As Card APR Rates Hit Fresh Record