Image Source: PixabayGlancing at the Zacks Rank #1 (Strong Buy) list, several consumer staples stocks were added this week with them sharing the commonality of being consumer food companies.Let’s take a look at why now appears to be a good time to buy these highly-ranked consumer food stocks.Tyson Foods (TSN – Free Report)As the largest chicken producer in the United States, Tyson Foods doesn’t need much of an introduction with the company also being a primary distributor of beef and pork. Tyson Foods has started to put labor and production struggles behind it and is now benefiting from a very strong business environment. To that point, Tyson Foods’ Zacks Food-Meat Products Industry is in the top 1% of over 250 Zacks industries.As a leader in the space, Tyson Foods’ bottom line is starting to rebound with fiscal 2024 earnings expected at $2.48 per share versus $1.34 a share in 2023. Plus, FY25 EPS is projected to climb another 56% to $3.86 and total sales projections remain over $50 billion for the foreseeable future. Better still, earnings estimate revisions for FY24 and FY25 have spiked in the last week and should trend higher after Tyson Foods blew away its fiscal second quarter earnings expectations on Monday. Tyson Foods posted Q2 EPS of $0.62 which beat the Zacks Consensus of $0.35 per share by 77% and swung from an adjusted loss of -$0.04 a share in the comparative quarter.

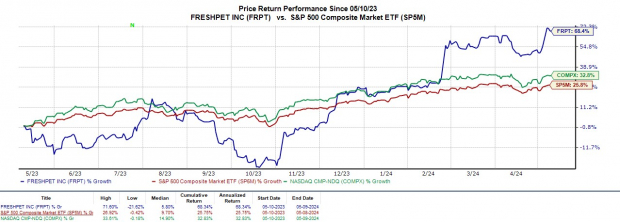

Image Source: PixabayGlancing at the Zacks Rank #1 (Strong Buy) list, several consumer staples stocks were added this week with them sharing the commonality of being consumer food companies.Let’s take a look at why now appears to be a good time to buy these highly-ranked consumer food stocks.Tyson Foods (TSN – Free Report)As the largest chicken producer in the United States, Tyson Foods doesn’t need much of an introduction with the company also being a primary distributor of beef and pork. Tyson Foods has started to put labor and production struggles behind it and is now benefiting from a very strong business environment. To that point, Tyson Foods’ Zacks Food-Meat Products Industry is in the top 1% of over 250 Zacks industries.As a leader in the space, Tyson Foods’ bottom line is starting to rebound with fiscal 2024 earnings expected at $2.48 per share versus $1.34 a share in 2023. Plus, FY25 EPS is projected to climb another 56% to $3.86 and total sales projections remain over $50 billion for the foreseeable future. Better still, earnings estimate revisions for FY24 and FY25 have spiked in the last week and should trend higher after Tyson Foods blew away its fiscal second quarter earnings expectations on Monday. Tyson Foods posted Q2 EPS of $0.62 which beat the Zacks Consensus of $0.35 per share by 77% and swung from an adjusted loss of -$0.04 a share in the comparative quarter. Image Source: Zacks Investment ResearchFreshpet (FRPT – Free Report)”Man’s” best friends have to eat too and Freshpet is a pet food company that is standing out after posting a surprise profit on Monday of $0.21 per share for the first quarter. This crushed estimates that called for an adjusted loss of -$0.22 per share and swung from -$0.52 a share in the prior-year quarter.Freshpet’s top-line growth has fueled belief in the company’s future earnings potential helping its stock soar over +30% year to date with FRPT now up +68% in the last year.

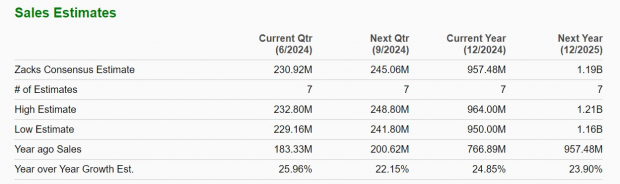

Image Source: Zacks Investment ResearchFreshpet (FRPT – Free Report)”Man’s” best friends have to eat too and Freshpet is a pet food company that is standing out after posting a surprise profit on Monday of $0.21 per share for the first quarter. This crushed estimates that called for an adjusted loss of -$0.22 per share and swung from -$0.52 a share in the prior-year quarter.Freshpet’s top-line growth has fueled belief in the company’s future earnings potential helping its stock soar over +30% year to date with FRPT now up +68% in the last year. Image Source: Zacks Investment ResearchThis makes it noteworthy that Q1 sales of $223.85 million beat estimates by 3% and climbed 33% from $167.52 million a year ago. Even better, Freshpet is now expected to post a profit of $0.23 per share in FY24 compared to an adjusted loss of -$0.70 a share last year. Plus, FY25 EPS is projected to soar to $0.80 with high double-digit total sales growth still in the forecast as well.

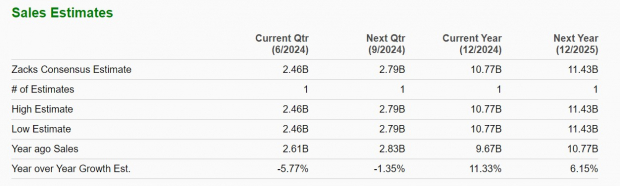

Image Source: Zacks Investment ResearchThis makes it noteworthy that Q1 sales of $223.85 million beat estimates by 3% and climbed 33% from $167.52 million a year ago. Even better, Freshpet is now expected to post a profit of $0.23 per share in FY24 compared to an adjusted loss of -$0.70 a share last year. Plus, FY25 EPS is projected to soar to $0.80 with high double-digit total sales growth still in the forecast as well. Image Source: Zacks Investment ResearchBRF (BRFS – Free Report)Lastly, BRF Brasil Foods SA received a strong buy rating as a Brazil-based company focused on the production and sale of poultry, pork, beef cuts, and dairy products. On Tuesday, BRF posted Q1 EPS of $0.06 which beat estimates of $0.04 per share and climbed from a loss of -$0.18 a share in the comparative quarter.Furthermore, with BRF’s stock trading at $3, the risk to reward looks favorable to invest as annual earnings are projected at $0.21 a share in FY24 and FY25. More reassuring is that total sales are forecasted to jump 11% this year and are projected to rise another 6% next year to $11.43 billion.

Image Source: Zacks Investment ResearchBRF (BRFS – Free Report)Lastly, BRF Brasil Foods SA received a strong buy rating as a Brazil-based company focused on the production and sale of poultry, pork, beef cuts, and dairy products. On Tuesday, BRF posted Q1 EPS of $0.06 which beat estimates of $0.04 per share and climbed from a loss of -$0.18 a share in the comparative quarter.Furthermore, with BRF’s stock trading at $3, the risk to reward looks favorable to invest as annual earnings are projected at $0.21 a share in FY24 and FY25. More reassuring is that total sales are forecasted to jump 11% this year and are projected to rise another 6% next year to $11.43 billion. Image Source: Zacks Investment ResearchBottom Line Beating earnings expectations and posting strong quarterly EPS growth is reason to believe Tyson Foods, Freshpet, and BRF’s stock could trend higher in the following weeks making now a good time to buy.More By This Author:2 Tech Stocks To Consider After Impressive Q1 Earnings Beats

Image Source: Zacks Investment ResearchBottom Line Beating earnings expectations and posting strong quarterly EPS growth is reason to believe Tyson Foods, Freshpet, and BRF’s stock could trend higher in the following weeks making now a good time to buy.More By This Author:2 Tech Stocks To Consider After Impressive Q1 Earnings Beats

Compared to Estimates, Snap One Q1 Earnings: A Look at Key Metrics

3 Must-Buy Stocks Buy Following Earnings