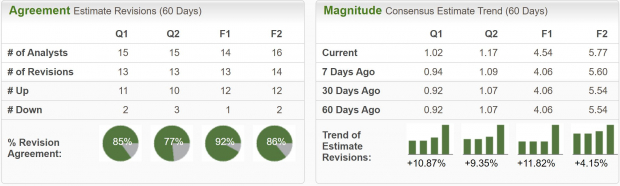

As earnings season begins to wind down, the standout performers are easier to identify. While some stocks posted adequate quarterly earnings, others really wowed Wall Street.These exceptional performers not only exceeded expectations but also provided compelling outlooks, signaling strong potential for future growth.As investors sift through the earnings reports to find winners, I must highlight three stocks that I have been impressed with and believe are poised for further upside potential.Amazon.comAmazon’s (AMZN – Free Report) recent earnings report painted a rosy picture, with profits exceeding expectations. The star of the show was their cloud computing division, Amazon Web Services (AWS), which saw significant growth fueled by the surging demand for AI capabilities. This strong performance in AWS underscores Amazon’s prime position to capitalize on the booming AI market.AWS grew an impressive 17% YoY and brought in $25 billion in revenue for the quarter. Even more impressive was the $9.4 billion profit earned from the segment, demonstrating the huge margins the business enjoys.Additionally, Amazon enjoys a Zacks Rank #2 (Buy) rating. Earnings estimates have been revised considerably higher over the last week and across timeframes. Furthermore, EPS are forecast to grow 29.6% annually, which is a very high pace of growth and among the highest of the mega-cap technology stocks. Image Source: Zacks Investment ResearchCoinbase GlobalCoinbase Global (COIN – Free Report) reported a stunning earnings beat last week, bringing in $4.40 of EPS, far exceeding analysts’ expectations of $1.28. Revenue was 20% above estimates as well.More than anything, Coinbase has a dominant role in the cryptocurrency ecosystem, especially in the United States. As long as cryptocurrencies and Bitcoin especially remain in a bull market, Coinbase should be one of the primary beneficiaries.Coinbase Global currently boasts a Zacks Rank #1 (Strong Buy) rating, reflected by strongly upward trending earnings revisions. Earnings expectations have been unanimously upgraded by 250%-300%!

Image Source: Zacks Investment ResearchCoinbase GlobalCoinbase Global (COIN – Free Report) reported a stunning earnings beat last week, bringing in $4.40 of EPS, far exceeding analysts’ expectations of $1.28. Revenue was 20% above estimates as well.More than anything, Coinbase has a dominant role in the cryptocurrency ecosystem, especially in the United States. As long as cryptocurrencies and Bitcoin especially remain in a bull market, Coinbase should be one of the primary beneficiaries.Coinbase Global currently boasts a Zacks Rank #1 (Strong Buy) rating, reflected by strongly upward trending earnings revisions. Earnings expectations have been unanimously upgraded by 250%-300%! Image Source: Zacks Investment ResearchCoinbase stock is also a powerful trading vehicle. The price action has regularly been consolidating and building out these descending wedges from which it breaks out aggressively from. If COIN stock can clear the $220 level it should make another attempt at its recent highs.

Image Source: Zacks Investment ResearchCoinbase stock is also a powerful trading vehicle. The price action has regularly been consolidating and building out these descending wedges from which it breaks out aggressively from. If COIN stock can clear the $220 level it should make another attempt at its recent highs. Image Source: TradingViewTransdigm GroupTransdigm Group (TDG – Free Report) soared in its second quarter, exceeding analysts’ expectations. Revenue jumped 20.5%, driven by strong demand across their aerospace platforms. Net income also rose significantly, with earnings per share up over 32% year-over-year. This positive performance reflects the ongoing recovery in the commercial aerospace industry, and TransDigm is well-positioned to benefit from continued growth in passenger traffic.Transdigm also has a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions.Transdigm Group is a lesser-followed stock that has consistently delivered exceptional long-term returns. As a leading manufacturer of aerospace components and systems, TransDigm specializes in producing highly engineered products for use in commercial and military aircraft.Despite flying under the radar for many investors, TransDigm’s unique business model and focus on high-quality, proprietary products have contributed to its impressive track record of growth and profitability. Over the years, TransDigm has demonstrated its ability to generate strong cash flow and consistently outperform market expectations, making it a compelling investment opportunity for those seeking exposure to the aerospace industry.

Image Source: TradingViewTransdigm GroupTransdigm Group (TDG – Free Report) soared in its second quarter, exceeding analysts’ expectations. Revenue jumped 20.5%, driven by strong demand across their aerospace platforms. Net income also rose significantly, with earnings per share up over 32% year-over-year. This positive performance reflects the ongoing recovery in the commercial aerospace industry, and TransDigm is well-positioned to benefit from continued growth in passenger traffic.Transdigm also has a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions.Transdigm Group is a lesser-followed stock that has consistently delivered exceptional long-term returns. As a leading manufacturer of aerospace components and systems, TransDigm specializes in producing highly engineered products for use in commercial and military aircraft.Despite flying under the radar for many investors, TransDigm’s unique business model and focus on high-quality, proprietary products have contributed to its impressive track record of growth and profitability. Over the years, TransDigm has demonstrated its ability to generate strong cash flow and consistently outperform market expectations, making it a compelling investment opportunity for those seeking exposure to the aerospace industry. Image Source: Zacks Investment ResearchBottom LineWhile there were a number of strong earnings reported this quarter, these three stocks really jumped out to me. Not only are all of them regular market outperformers but are further bolstered by the top Zacks Ranks.For investors looking to add exposure following earnings, these are three worthy considerations.More By This Author:Bull Of The Day: PDD Holdings Inc.Don’t Overlook These Top Medical Stocks As Q1 Earnings ApproachWhy Intellia Therapeutics, Inc. Outpaced the Stock Market

Image Source: Zacks Investment ResearchBottom LineWhile there were a number of strong earnings reported this quarter, these three stocks really jumped out to me. Not only are all of them regular market outperformers but are further bolstered by the top Zacks Ranks.For investors looking to add exposure following earnings, these are three worthy considerations.More By This Author:Bull Of The Day: PDD Holdings Inc.Don’t Overlook These Top Medical Stocks As Q1 Earnings ApproachWhy Intellia Therapeutics, Inc. Outpaced the Stock Market