Image Source: Pixabay

Image Source: Pixabay

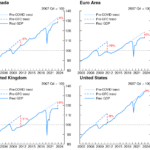

Saving is necessary and normal, but doesn’t saving too much indicate a fear of the future? This seems to be the inclination of Europeans, according to a recent study by the research department of Natixis (Why are consumers in the eurozone so cautious?).”US consumers have a very dynamic spending behavior, while euro-zone consumers prefer to save”, underlines its director Patrick Artus. Excessive consumption, with the credit that goes with it, is certainly not an example either, and Americans often fall into this trap. However, the study does note the excessive caution of eurozone consumers.Several reasons, which we can only endorse, are given to explain this excessive saving:Concerns about fiscal deficits, which lead to “Ricardian neutral” behavior (precautionary saving in anticipation of a future correction of the fiscal deficit) in the eurozone and not in the United States;

The demographic situation (much greater ageing in the eurozone than in the United States);

The situation of pension schemes: capital gains for funded schemes in the United States, difficulties in balancing pay-as-you-go schemes in the eurozone;

The rapid rise in labor productivity in the United States, while it is falling in the eurozone, leads to a widening gap in expected future earnings.

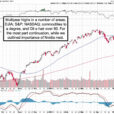

On the first point, the United States also has a massive budget deficit… but it has the dollar, which it can print massively because the world needs it (for international trade, to pay for raw materials). That said, with the BRICS seeking to free themselves from the American currency, we’re beginning to see the limits of this system… even if there’s still time. The demographic situation is also to the advantage of the United States, and is weighing on Europe’s dominant pay-as-you-go pension system: who is going to pay for retirement? It’s inevitable that retirees will have to accept a drop in their pensions.Last but not least, and this is the most serious, labor productivity is falling in the EU while it is rising in the United States. Downgrading and impoverishment await us. The study doesn’t go into the causes of this huge gap between labor productivity on the two sides of the Atlantic, but for us it’s clear, and we’ve already said so here: the rising cost of energy due to an “energy transition” that’s being pursued with great vigor (wind turbines aren’t much use, they just raise the cost of electricity) and the boomerang sanctions against Russia (goodbye cheap gas! Hello, American LNG four times more expensive). And beyond that, the destructive effects of this policy: the compulsory electric car by 2035 (RIP the European automotive sector), the 50% reduction in phytosanitary products by 2030 envisaged by the Green Deal (RIP European agriculture), and so on. Let’s finish by adding a legitimate reason for fear: the sound of boots in Ukraine (by NATO? by the French army? Macron is considering it). That’s right, all we need is a full-scale war (conventional, let’s not even imagine the worst) to really sink the European economy…Looking at this chart, compelling yourself to put money aside is indeed prudent. The future is worrying, and the Europeans are unfortunately right, but we’ll be avoiding euro-denominated products (who will be swept away in the continent’s fall), real estate (who will buy back what you’ve acquired at current value?), and equities (except for a few highly internationalized companies). So what to choose? Assets whose value depends on the world, not Europe, and which are easily transportable (let’s be cautious): physical gold, bitcoin, or eventually a few assets here or there in the world if you have the info and the right contacts… In short, gold, real and/or digital. Yes, it’s wise to save.More By This Author:Fed Not Yet Pivoting Despite Deteriorating US EconomyThe Impossible Equation Of Global Debt Stagflation In The United States, Monetary Crisis In Japan