Macro (ugly wholesale sales print, implied gasoline demand at decade-lows ex-COVID, GDPNOW up at 4.18%?),

Micro (TRIP exposed as M&A premium evaporates exposing the reality of tourism business, UBER hinting at consumer pain, SHOP signaled more consumer pain, AFRM cut revenues forecasts as BNPL schemes falter – more consumer pain, TSLA tumbled on DoJ probe of FSD),

Geopolitical (Rafah invasion begins).

But perhaps the most important thing was Fedspeak, which continues to lean hawkish with Collins saying:

“The recent upward surprises to activity and inflation suggest the likely need to keep policy at its current level until we have greater confidence that inflation is moving sustainably toward 2%,” Collins said Wednesday at the Massachusetts Institute of Technology.

“The recent data lead me to believe this will take more time than previously thought,” she said.

In a moderated conversation following her remarks, Collins added:

“I do think that holding in this restrictive range for longer will — in an orderly way in my baseline — would slow the economy.”

Artist’s impression of FedSpeak today… Which pushed rate-cut expectations lower…

Which pushed rate-cut expectations lower… Source: BloombergTreasury yields were up across the curve with the long-end underperforming (30Y +4bps, 2Y +1bps). Only the 2Y yield is higher on the week though…

Source: BloombergTreasury yields were up across the curve with the long-end underperforming (30Y +4bps, 2Y +1bps). Only the 2Y yield is higher on the week though… Source: BloombergInterestingly, The Dow managed to shrug this off and rose for the sixth straight day while Small Caps lagged The S&P and Nasdaq ended the day around lunch…

Source: BloombergInterestingly, The Dow managed to shrug this off and rose for the sixth straight day while Small Caps lagged The S&P and Nasdaq ended the day around lunch… The dollar continued to rebound off Friday’s payrolls plunge lows…

The dollar continued to rebound off Friday’s payrolls plunge lows… Source: BloombergDespite the dollar trend higher, gold chopped around in a very narrow range today…

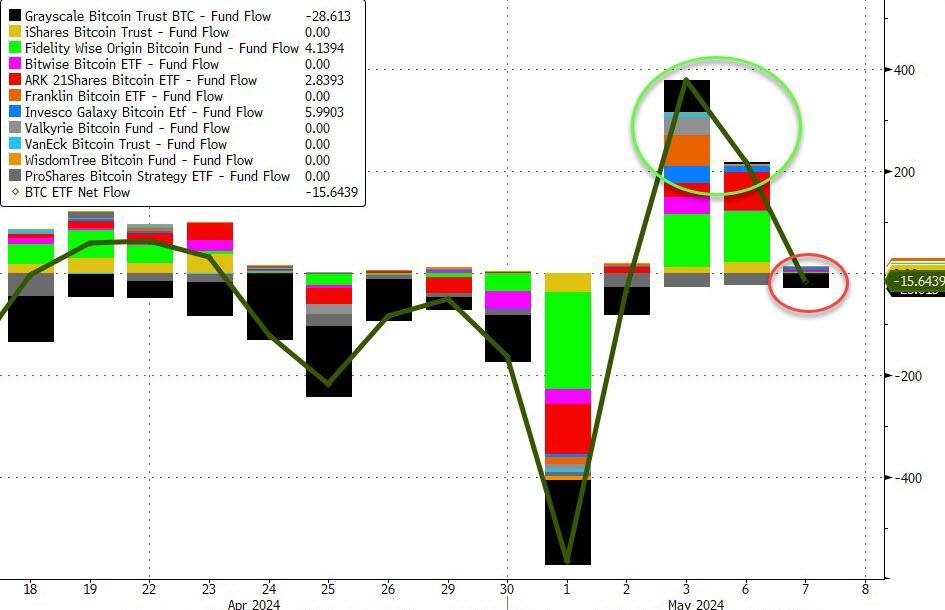

Source: BloombergDespite the dollar trend higher, gold chopped around in a very narrow range today… Source: BloombergBitcoin ETFs returned to net outflows yesterday (though very small)…

Source: BloombergBitcoin ETFs returned to net outflows yesterday (though very small)… Source: Bloomberg…and spot bitcoin prices drifted lower (thanks to another slam down overnight from the perp futures market)…

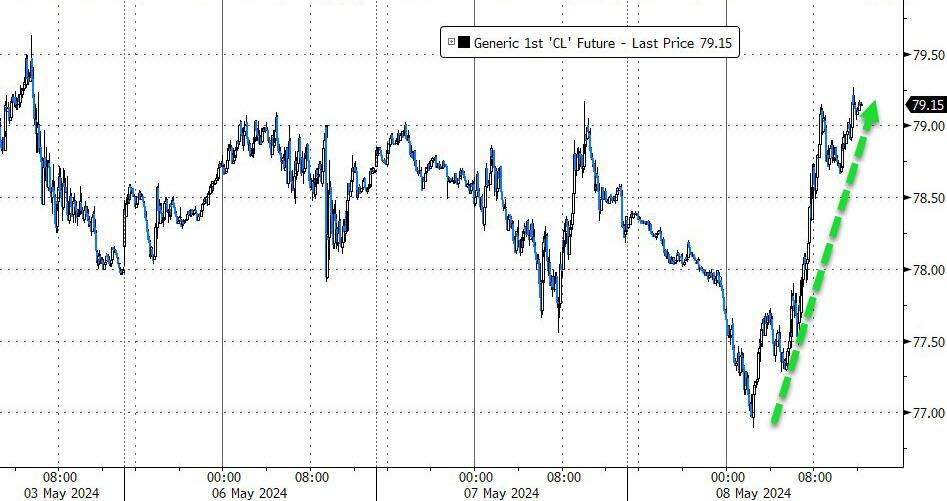

Source: Bloomberg…and spot bitcoin prices drifted lower (thanks to another slam down overnight from the perp futures market)… Source: BloombergBut today’s big winner was crude oil, with WTI surging back from below $77 to above $79 after a surprise crude draw and MidEast tensions (theoretically) hotting up again as Israel enters Rafah…

Source: BloombergBut today’s big winner was crude oil, with WTI surging back from below $77 to above $79 after a surprise crude draw and MidEast tensions (theoretically) hotting up again as Israel enters Rafah… Source: BloombergCrucially, this was the fourth day in a row that crude found support at its 100DMA…

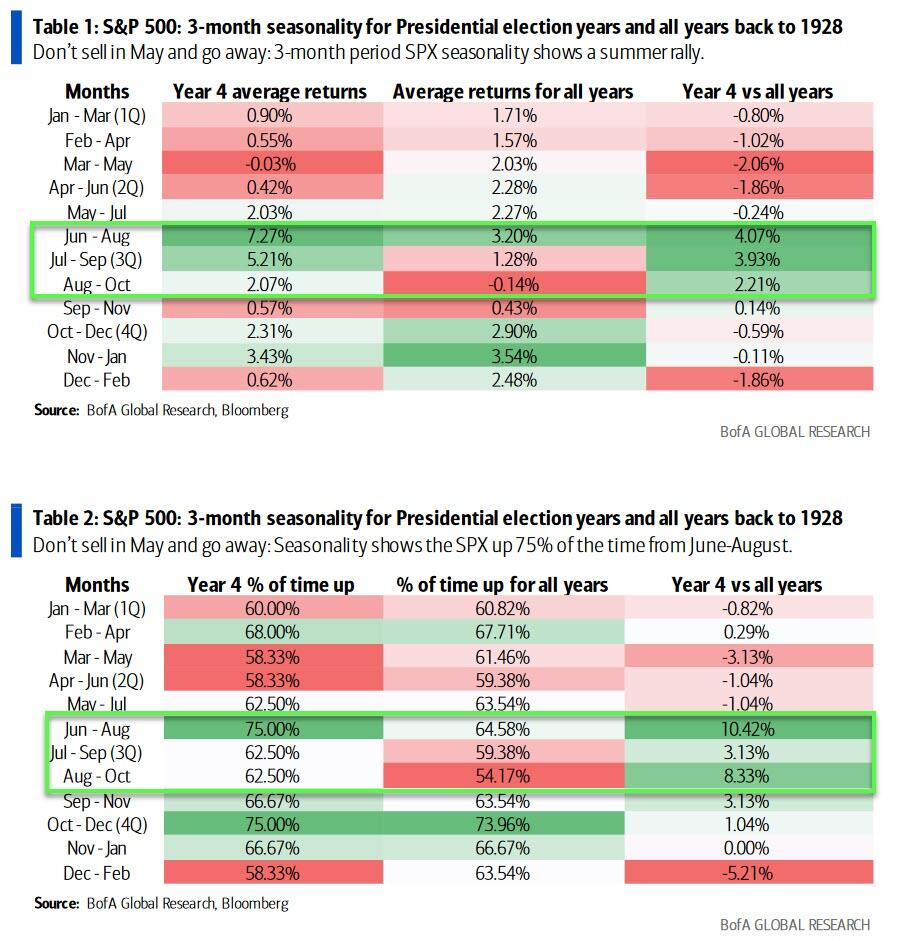

Source: BloombergCrucially, this was the fourth day in a row that crude found support at its 100DMA… Source: BloombergFinally, don’t ‘Sell in May, and Go Away” this year, according to BofA’s technical analysts… because Presidential election years can see big summer rallies…June-August is the second strongest 3-month period of the year for all years going back to 1928 with the SPX up 65% of the time on an average return of 3.2%.

Source: BloombergFinally, don’t ‘Sell in May, and Go Away” this year, according to BofA’s technical analysts… because Presidential election years can see big summer rallies…June-August is the second strongest 3-month period of the year for all years going back to 1928 with the SPX up 65% of the time on an average return of 3.2%. In Presidential election years, the SPX is up 75% of the time from June-August on an average return of 7.3%.More By This Author:WTI Dips After API Reports Across-The-Board Inventory Builds

In Presidential election years, the SPX is up 75% of the time from June-August on an average return of 7.3%.More By This Author:WTI Dips After API Reports Across-The-Board Inventory Builds

Stellar 3Y Auction Stops-Through Thanks To Jump In Foreign Demand

India Leads Global Inbound Remittances