Image Source: PixabayThanks to the Magnificent Seven, tech stocks have led the Q1 earnings season. In fact, as Sheraz Mian the Director of Zacks Investment Research points out, had it not been for the substantial earnings contribution of the Mag 7, Q1 earnings growth for the rest of the S&P 500 index would be in negative territory.That said, several top-rated Zacks Medical sector stocks are standing out ahead of their Q1 reports on Tuesday, May 7. With now looking like an ideal to invest in their growth, here are three of these top healthcare companies to consider as earnings approach.Ligand Pharmaceuticals (LGND – Free Report)Zacks Rank #1 (Strong Buy)Focused on the development and licensing of biopharmaceutical assets, Ligand Pharmaceuticals has been able to enter several licensing deals and generate royalties through its Captisol formulation technology which improves the safety and overall use of drugs including their solubility, bioavailability, smell, and taste.Ligand Pharmaceuticals’ Q1 earnings are expected at $1.13 a share following a very tough-to-compete against prior year quarter that saw EPS at $2.28. Still, annual earnings are projected to jump 12% this year and are forecasted to climb another 15% in fiscal 2025 to $5.27 per share. More compelling and attributing to Ligand Pharmaceuticals strong buy rating is that earnings estimates for the current quarter, FY24, and FY25 are noticeably higher over the last 60 days.

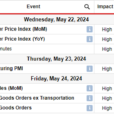

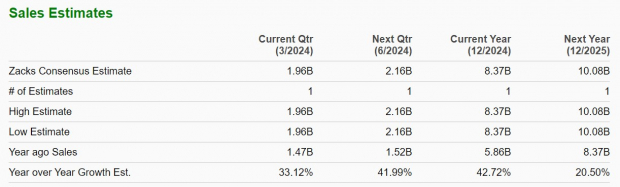

Image Source: PixabayThanks to the Magnificent Seven, tech stocks have led the Q1 earnings season. In fact, as Sheraz Mian the Director of Zacks Investment Research points out, had it not been for the substantial earnings contribution of the Mag 7, Q1 earnings growth for the rest of the S&P 500 index would be in negative territory.That said, several top-rated Zacks Medical sector stocks are standing out ahead of their Q1 reports on Tuesday, May 7. With now looking like an ideal to invest in their growth, here are three of these top healthcare companies to consider as earnings approach.Ligand Pharmaceuticals (LGND – Free Report)Zacks Rank #1 (Strong Buy)Focused on the development and licensing of biopharmaceutical assets, Ligand Pharmaceuticals has been able to enter several licensing deals and generate royalties through its Captisol formulation technology which improves the safety and overall use of drugs including their solubility, bioavailability, smell, and taste.Ligand Pharmaceuticals’ Q1 earnings are expected at $1.13 a share following a very tough-to-compete against prior year quarter that saw EPS at $2.28. Still, annual earnings are projected to jump 12% this year and are forecasted to climb another 15% in fiscal 2025 to $5.27 per share. More compelling and attributing to Ligand Pharmaceuticals strong buy rating is that earnings estimates for the current quarter, FY24, and FY25 are noticeably higher over the last 60 days. Image Source: Zacks Investment ResearchOscar Health (OSCR – Free Report)Zacks Rank #2 (Buy)As a digital health insurance company, Oscar Health’s top-line growth is hard to overlook and suggests the company should be very profitable down the line after going public in 2021. Trading under $20 a share, the risk to reward looks favorable to invest in Oscar Health’s stock with Q1 sales thought to have climbed 33% to $1.96 billion versus $1.47 billion in the comparative quarter.Even better, Q1 EPS is expected at $0.28 compared to an adjusted loss of -$0.18 a share in the prior-year quarter. More impressive, total sales are now projected to soar 43% in FY24 and are slated to climb another 20% in FY25 to $10.08 billion. Plus, Oscar Health is expected to turn its first annual earnings profit next year.at $0.42 a share.

Image Source: Zacks Investment ResearchOscar Health (OSCR – Free Report)Zacks Rank #2 (Buy)As a digital health insurance company, Oscar Health’s top-line growth is hard to overlook and suggests the company should be very profitable down the line after going public in 2021. Trading under $20 a share, the risk to reward looks favorable to invest in Oscar Health’s stock with Q1 sales thought to have climbed 33% to $1.96 billion versus $1.47 billion in the comparative quarter.Even better, Q1 EPS is expected at $0.28 compared to an adjusted loss of -$0.18 a share in the prior-year quarter. More impressive, total sales are now projected to soar 43% in FY24 and are slated to climb another 20% in FY25 to $10.08 billion. Plus, Oscar Health is expected to turn its first annual earnings profit next year.at $0.42 a share. Image Source: Zacks Investment ResearchPenumbra (PEN – Free Report)Zacks Rank #2 (Buy)With a very attractive growth trajectory, Penumbra is a global healthcare company offering innovative products for the neurovascular, vascular, and neurosurgical markets. Penumbra’s Q1 earnings are expected to soar 82% to $0.42 a share with sales expected to rise 14% to $274.82 million.Better still, Penumbra is projected to post high double-digit percentage growth on its top and bottom lines in FY24 and FY25.

Image Source: Zacks Investment ResearchPenumbra (PEN – Free Report)Zacks Rank #2 (Buy)With a very attractive growth trajectory, Penumbra is a global healthcare company offering innovative products for the neurovascular, vascular, and neurosurgical markets. Penumbra’s Q1 earnings are expected to soar 82% to $0.42 a share with sales expected to rise 14% to $274.82 million.Better still, Penumbra is projected to post high double-digit percentage growth on its top and bottom lines in FY24 and FY25.  Image Source: Zacks Investment ResearchTakeawayWhile the tech sector has led the Q1 earnings season, investors shouldn’t overlook these top medical stocks. To that point, the growth and expansion of Ligand Pharmaceuticals, Oscar Health, and Penumbra is hard to ignore and now looks like an ideal time to buy as they are shaping up to be viable investments for 2024 and beyond.More By This Author:Why Intellia Therapeutics, Inc. Outpaced the Stock MarketTime To Buy Apple’s Stock After Record Q2 EPS?3 Intriguing Stocks To Buy After Beating Q1 Earnings Expectations

Image Source: Zacks Investment ResearchTakeawayWhile the tech sector has led the Q1 earnings season, investors shouldn’t overlook these top medical stocks. To that point, the growth and expansion of Ligand Pharmaceuticals, Oscar Health, and Penumbra is hard to ignore and now looks like an ideal time to buy as they are shaping up to be viable investments for 2024 and beyond.More By This Author:Why Intellia Therapeutics, Inc. Outpaced the Stock MarketTime To Buy Apple’s Stock After Record Q2 EPS?3 Intriguing Stocks To Buy After Beating Q1 Earnings Expectations