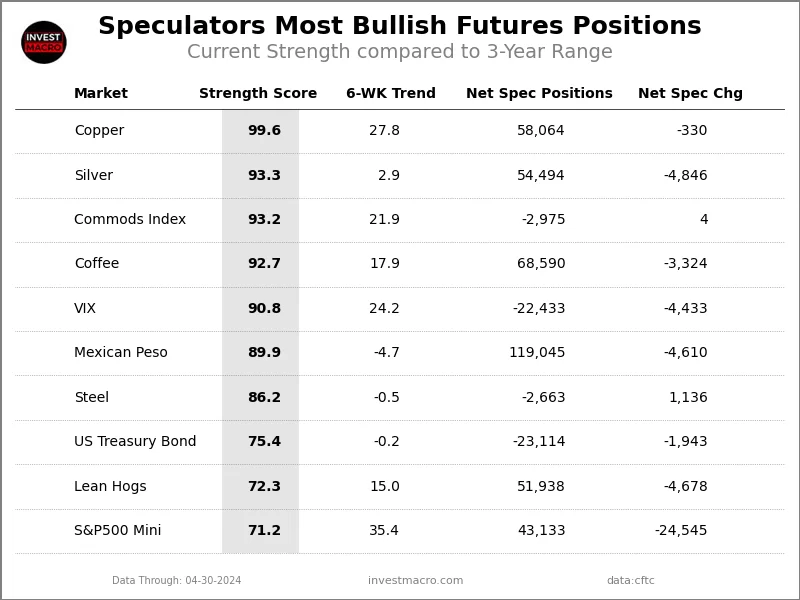

The latest update for the weekly Commitment of Traders (COT) report was released by the Commodity Futures Trading Commission (CFTC) on Friday for data ending on April 30th 2024.This weekly Extreme Positions report highlights the Most Bullish and Most Bearish Positions for the speculator category. Extreme positioning in these markets can foreshadow strong moves in the underlying market.To signify an extreme position, we use the Strength Index (also known as the COT Index) of each instrument, a common method of measuring COT data. The Strength Index is simply a comparison of current trader positions against the range of positions over the previous 3 years. We use over 80 percent as extremely bullish and under 20 percent as extremely bearish. (Compare Strength Index scores across all markets in the data table or cot leaders table)Here Are This Week’s Most Bullish Speculator Positions:Copper

The latest update for the weekly Commitment of Traders (COT) report was released by the Commodity Futures Trading Commission (CFTC) on Friday for data ending on April 30th 2024.This weekly Extreme Positions report highlights the Most Bullish and Most Bearish Positions for the speculator category. Extreme positioning in these markets can foreshadow strong moves in the underlying market.To signify an extreme position, we use the Strength Index (also known as the COT Index) of each instrument, a common method of measuring COT data. The Strength Index is simply a comparison of current trader positions against the range of positions over the previous 3 years. We use over 80 percent as extremely bullish and under 20 percent as extremely bearish. (Compare Strength Index scores across all markets in the data table or cot leaders table)Here Are This Week’s Most Bullish Speculator Positions:Copper

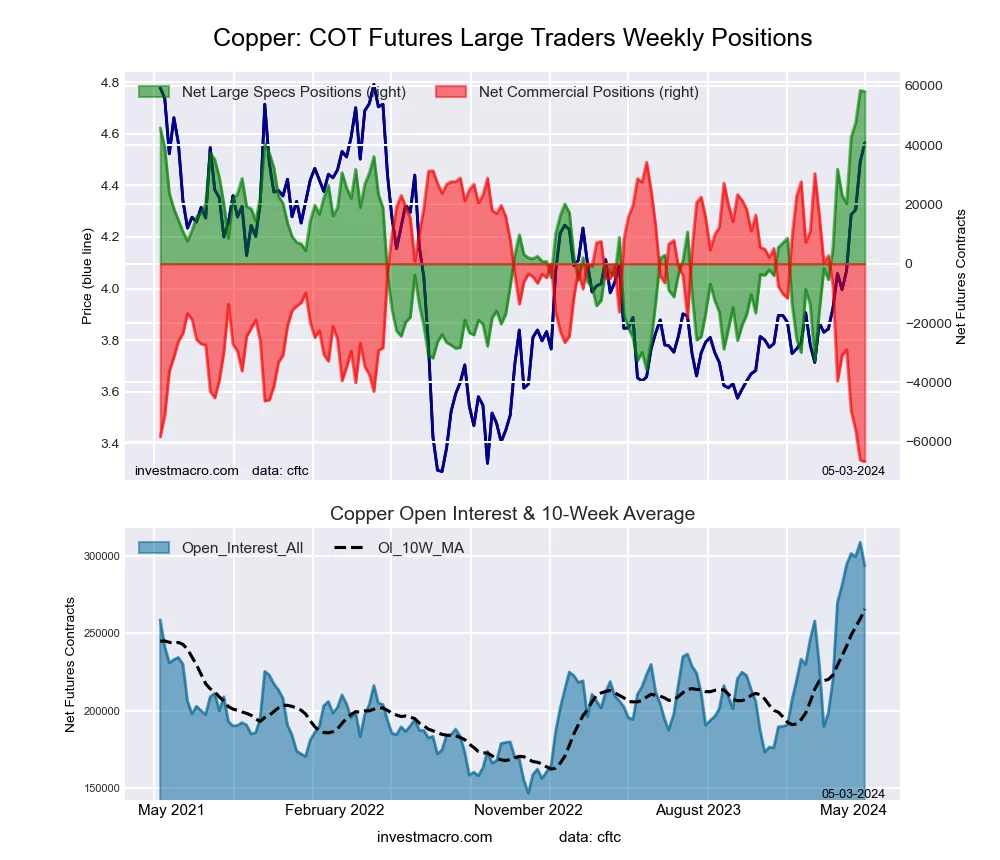

The Copper speculator position comes in as the most bullish extreme standing this week. The Copper speculator level is currently at a 99.6 percent score of its 3-year range.

The six-week trend for the percent strength score totaled 27.8 this week. The overall net speculator position was a total of 58,064 net contracts this week with a small decline of -330 contract in the weekly speculator bets.

Speculators or Non-Commercials Notes:

Speculators, classified as non-commercial traders by the CFTC, are made up of large commodity funds, hedge funds and other significant for-profit participants. The Specs are generally regarded as trend-followers in their behavior towards price action – net speculator bets and prices tend to go in the same directions. These traders often look to buy when prices are rising and sell when prices are falling. To illustrate this point, many times speculator contracts can be found at their most extremes (bullish or bearish) when prices are also close to their highest or lowest levels.

These extreme levels can be dangerous for the large speculators as the trade is most crowded, there is less trading ammunition still sitting on the sidelines to push the trend further and prices have moved a significant distance. When the trend becomes exhausted, some speculators take profits while others look to also exit positions when prices fail to continue in the same direction. This process usually plays out over many months to years and can ultimately create a reverse effect where prices start to fall and speculators start a process of selling when prices are falling.

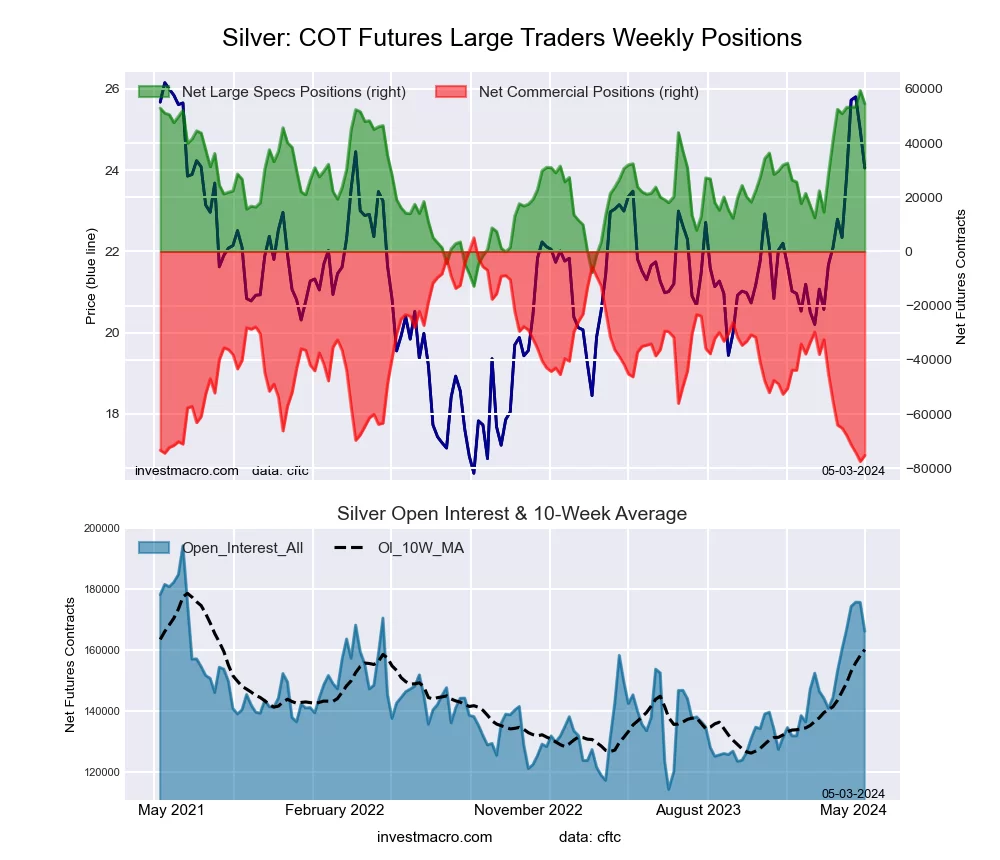

Silver

The Silver speculator position comes next in the extreme standings this week. The Silver speculator level is now at a 93.3 percent score of its 3-year range.

The six-week trend for the percent strength score was 2.9 this week. The speculator position registered 54,494 net contracts this week with a weekly drop of -4,846 contracts in speculator bets.

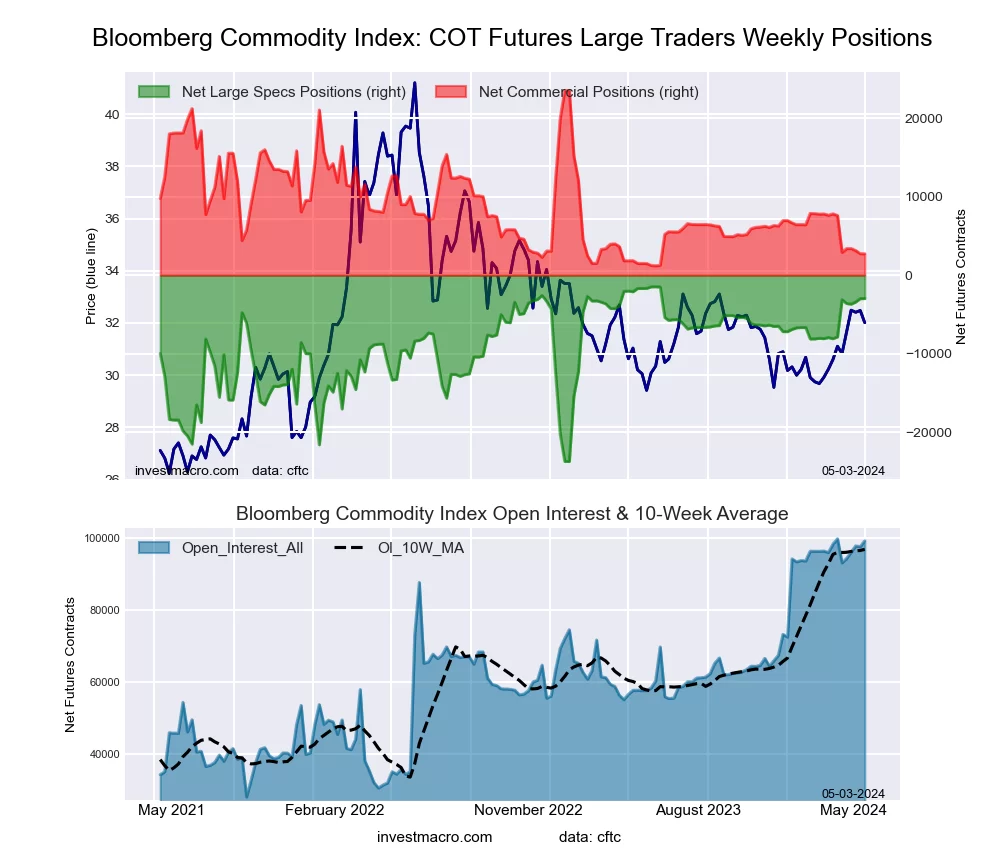

Bloomberg Commodity Index

The Bloomberg Commodity Index speculator position comes in third this week in the extreme standings. The Bloomberg Commodity Index speculator level resides at a 93.2 percent score of its 3-year range.

The six-week trend for the speculator strength score came in at 21.9 this week. The overall speculator position was -2,975 net contracts this week with an edge up by just 4 contracts in the weekly speculator bets.

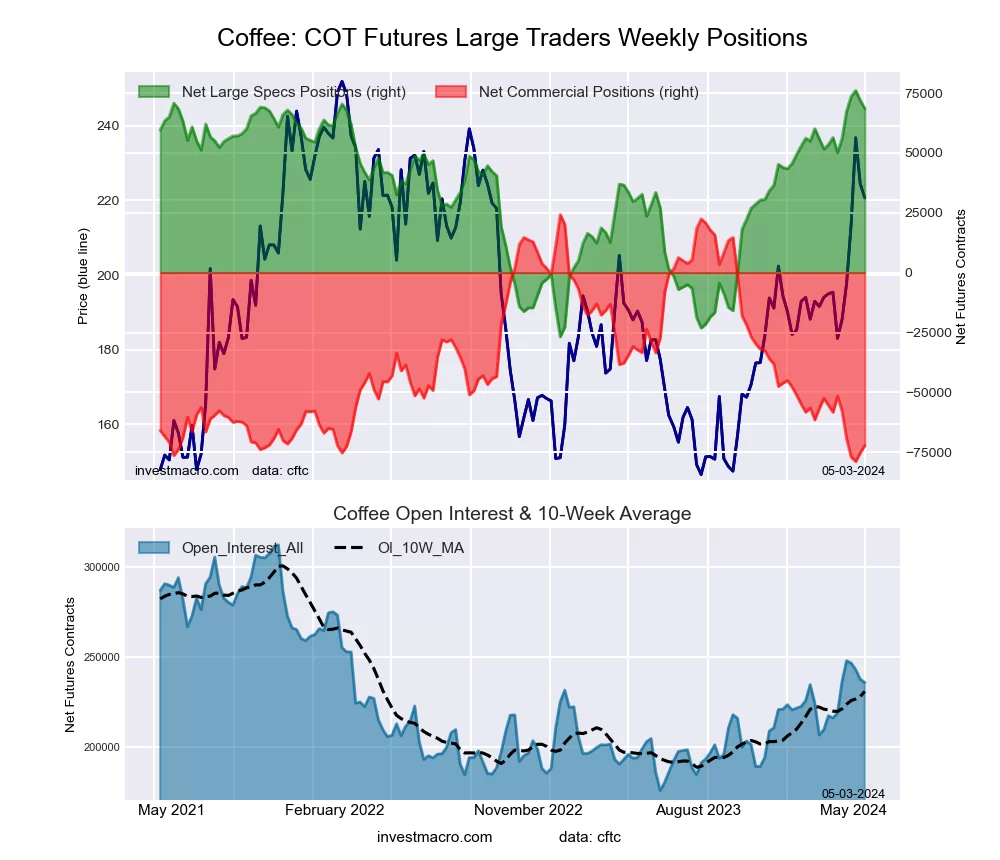

Coffee

The Coffee speculator position comes up number four in the extreme standings this week. The Coffee speculator level is at a 92.7 percent score of its 3-year range.

The six-week trend for the speculator strength score totaled a change of 17.9 this week. The overall speculator position was 68,590 net contracts this week with a shortfall of -3,324 contracts in the speculator bets.

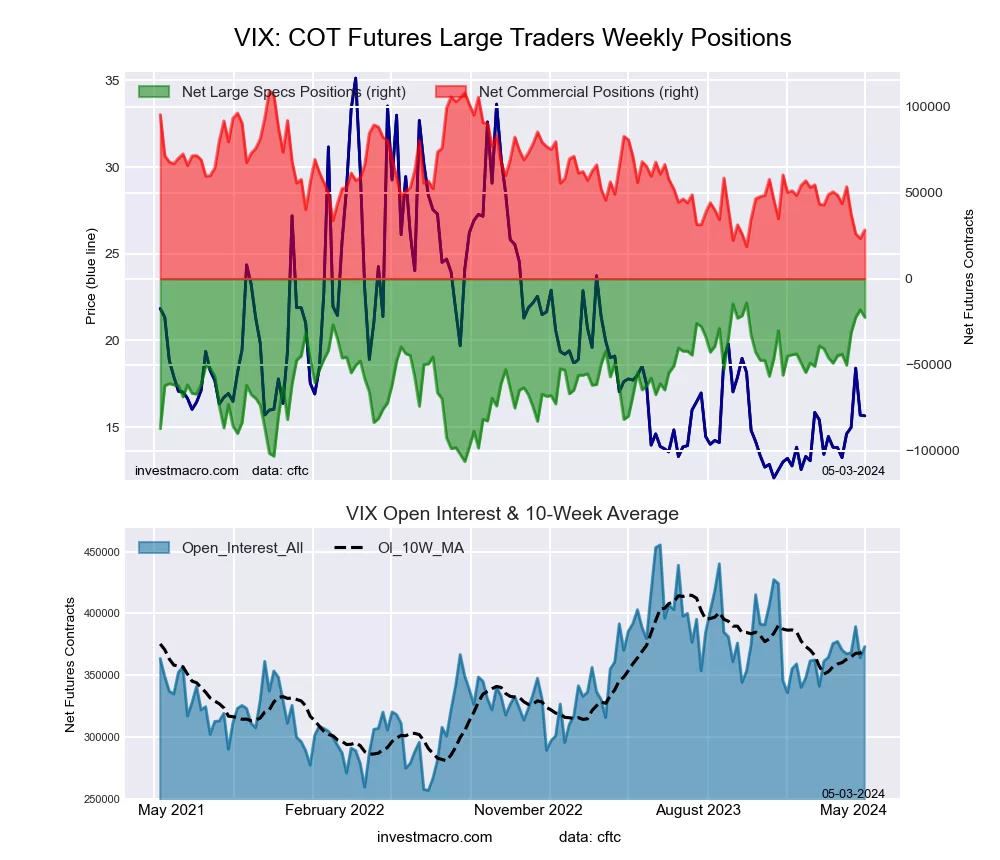

VIX

The VIX speculator position rounds out the top five in this week’s bullish extreme standings. The VIX speculator level sits at a 90.8 percent score of its 3-year range. The six-week trend for the speculator strength score was 24.2 this week.

The speculator position was -22,433 net contracts this week with a decrease by -4,433 contracts in the weekly speculator bets.

This Week’s Most Bearish Speculator Positions:

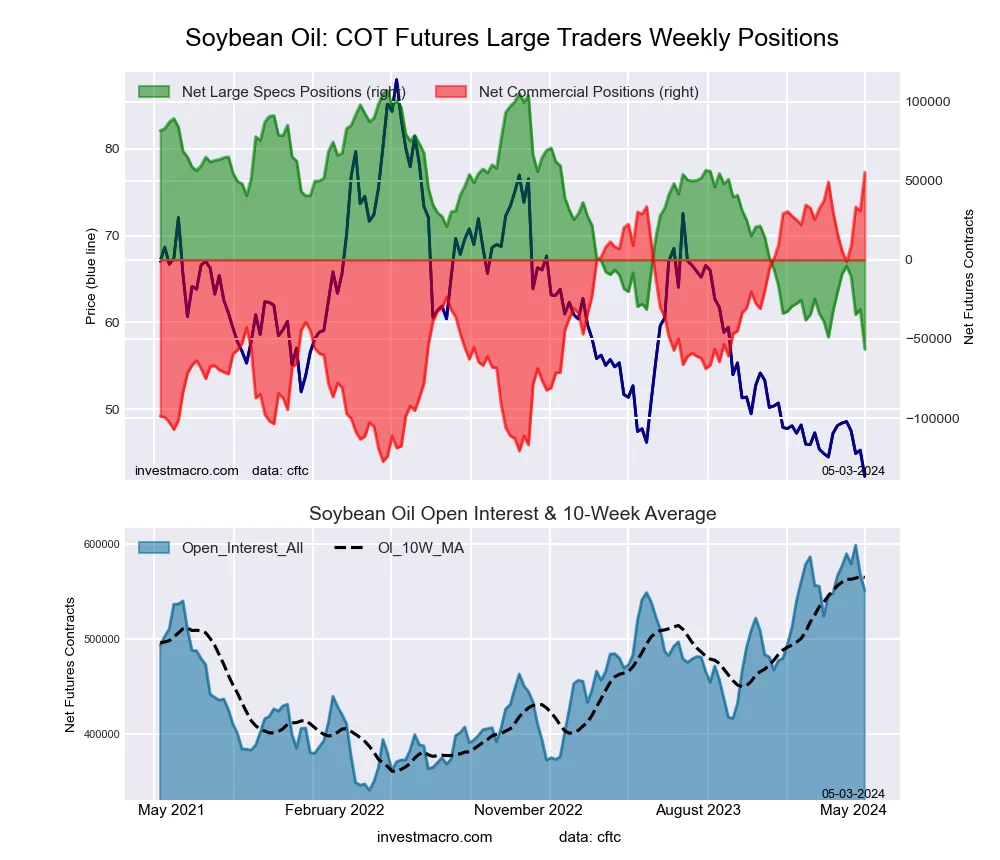

Soybean Oil

The Soybean Oil speculator position comes in as the most bearish extreme standing this week. The Soybean Oil speculator level is at a 0.0 percent score of its 3-year range.

The six-week trend for the speculator strength score was -22.2 this week. The overall speculator position was -56,442 net contracts this week with a sharp fall by -25,101 contracts in the speculator bets.

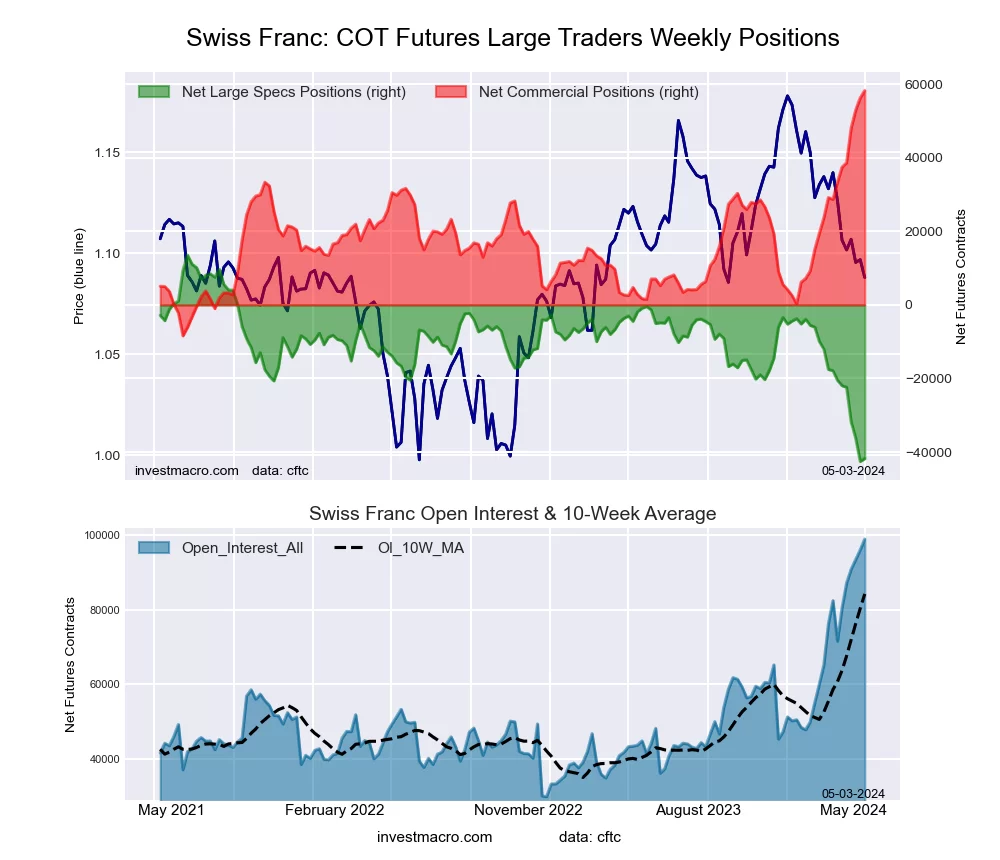

Swiss Franc

The Swiss Franc speculator position comes in next for the most bearish extreme standing on the week. The Swiss Franc speculator level is at a 1.4 percent score of its 3-year range.

The six-week trend for the speculator strength score was -37.9 this week. The speculator position was -41,786 net contracts this week with an edge higher by 776 contracts in the weekly speculator bets.

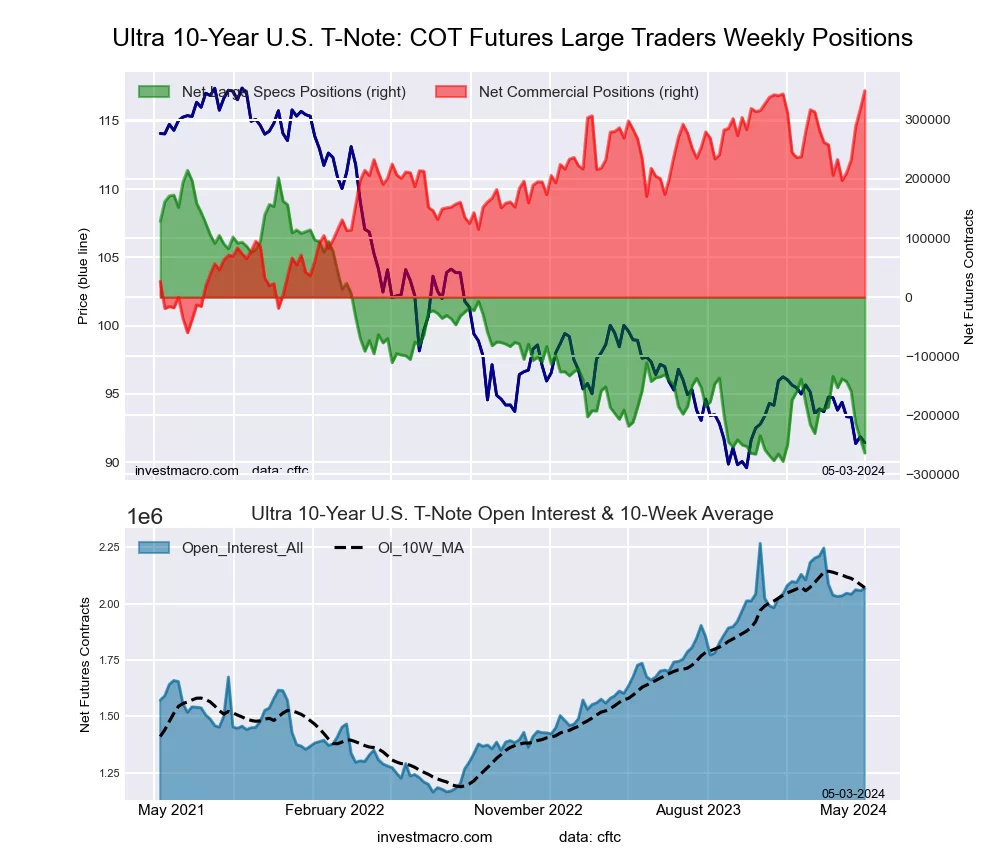

Ultra 10-Year U.S. T-Note

The Ultra 10-Year U.S. T-Note speculator position comes in as third most bearish extreme standing of the week. The Ultra 10-Year U.S. T-Note speculator level resides at a 2.9 percent score of its 3-year range.

The six-week trend for the speculator strength score was -22.4 this week. The overall speculator position was -263,683 net contracts this week with a decrease of -24,156 contracts in the speculator bets.

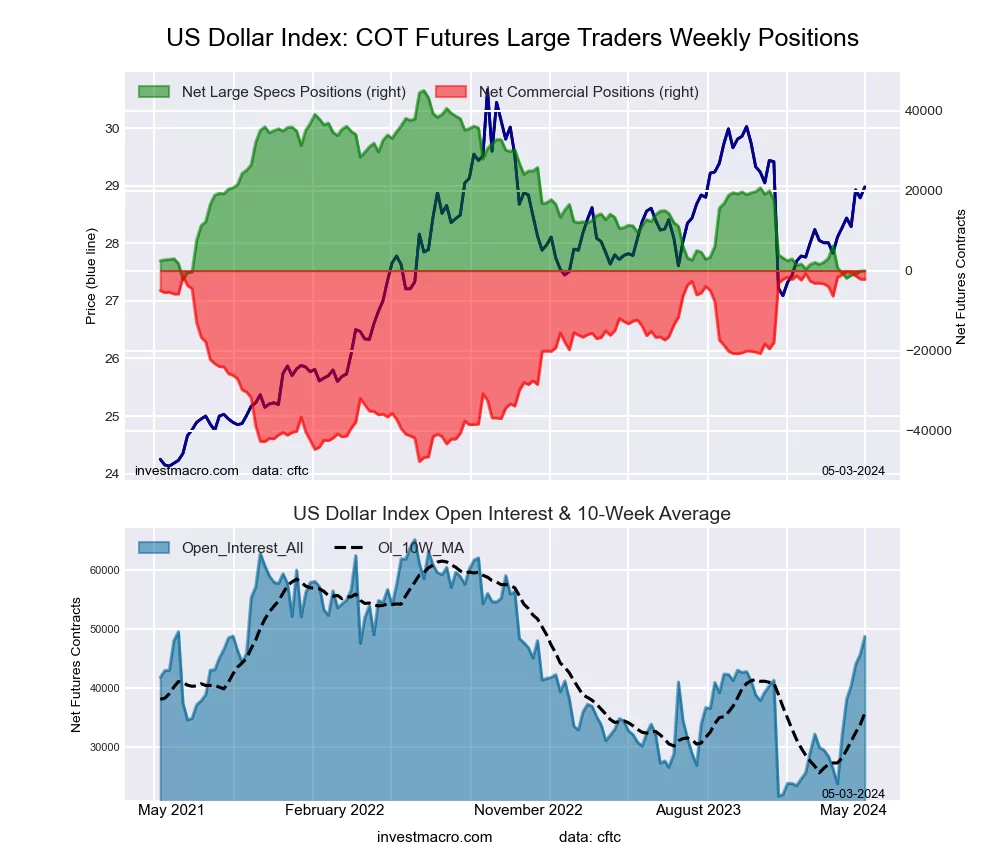

US Dollar Index

The US Dollar Index speculator position comes in as this week’s fourth most bearish extreme standing. The US Dollar Index speculator level is at a 4.8 percent score of its 3-year range.

The six-week trend for the speculator strength score was -1.5 this week. The speculator position was -35 net contracts this week with a gain of 178 contracts in the weekly speculator bets.

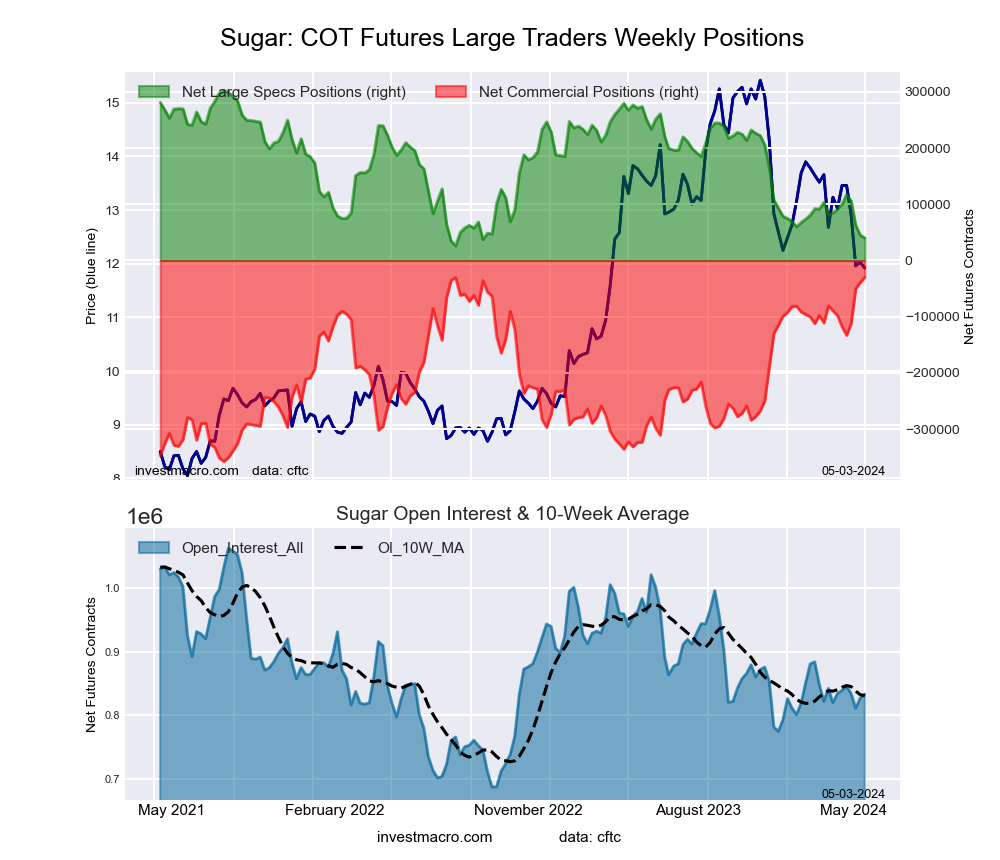

Sugar

Finally, the Sugar speculator position comes in as the fifth most bearish extreme standing for this week. The Sugar speculator level is at a 5.2 percent score of its 3-year range.

The six-week trend for the speculator strength score was -18.5 this week. The speculator position was 40,305 net contracts this week with a decline of -4,796 contracts in the weekly speculator bets.

*COT Report: The data table, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

More By This Author:Speculator Extremes: Silver, Peso & Coffee Lead Bullish Positions

Speculators Push Japanese Yen Bearish Bets To Highest Since 2007

Speculator Extremes: Silver, Gasoline & Peso Lead Bullish & Bearish Positions