Image Source: PexelsHere’s an interview I did with Oliver Renick on the Schwab Network from Wednesday discussing the macro outlook and the risks in the coming 12 months.

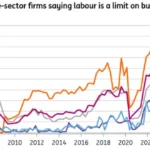

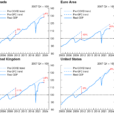

Image Source: PexelsHere’s an interview I did with Oliver Renick on the Schwab Network from Wednesday discussing the macro outlook and the risks in the coming 12 months. My baseline assumption is that growth will continue to moderate in the 2-3% RGDP range and the disinflationary trend will persist thru year-end, albeit at a lower rate than we saw last year. I expected Core PCE to end the year around 2.3%. But the tricky part in all of this is the election. Here’s my general timing on things. The calendar for the Fed is in the attached image.I expect Core PCE to be about 2.55% in June. The Fed likely wants inflation below 2.5% and perhaps well below it before they start cutting. So this means we won’t get cuts at the June and July meetings. The next meeting is in September that’s just a few week before the Presidential election so I think that cut is off the table because the Fed can’t risk looking politically motivated. That leaves us with a November baseline for the first cut. And that might also end up being too close to the election if the election is remotely close.The reason this is especially interesting is because that means the Fed Funds Rate will still be at 5% if they cut in November. The Taylor Rule (which you can always find at our Macro Dashboard) says the FFR should be 5% right now. So now we’re getting into the really interesting phase of the interest rate cycle where the risk of staying too high for too long becomes elevated. We could potentially get well into 2025 with a Fed Funds Rate of over 4.5%. And that makes this whole environment very interesting for risky assets.Of course, I like to think of the stock market as a 15-20 year instrument that yields about 6.25% right now so it’s not a great idea to think of the stock market across 12 months, but I would certainly argue that the next 12 months pose some elevated risks. At the same time, bonds look increasingly attractive and savers clipping T-Bill rates over 5% will continue to be in hog heaven. Interesting times. Good luck out there.More By This Author:Some Midweek Reading – Economic Tightness And Easing Demand Chart Of The Week: The Softening Labor Market Three Views On The Yen “Collapse”

My baseline assumption is that growth will continue to moderate in the 2-3% RGDP range and the disinflationary trend will persist thru year-end, albeit at a lower rate than we saw last year. I expected Core PCE to end the year around 2.3%. But the tricky part in all of this is the election. Here’s my general timing on things. The calendar for the Fed is in the attached image.I expect Core PCE to be about 2.55% in June. The Fed likely wants inflation below 2.5% and perhaps well below it before they start cutting. So this means we won’t get cuts at the June and July meetings. The next meeting is in September that’s just a few week before the Presidential election so I think that cut is off the table because the Fed can’t risk looking politically motivated. That leaves us with a November baseline for the first cut. And that might also end up being too close to the election if the election is remotely close.The reason this is especially interesting is because that means the Fed Funds Rate will still be at 5% if they cut in November. The Taylor Rule (which you can always find at our Macro Dashboard) says the FFR should be 5% right now. So now we’re getting into the really interesting phase of the interest rate cycle where the risk of staying too high for too long becomes elevated. We could potentially get well into 2025 with a Fed Funds Rate of over 4.5%. And that makes this whole environment very interesting for risky assets.Of course, I like to think of the stock market as a 15-20 year instrument that yields about 6.25% right now so it’s not a great idea to think of the stock market across 12 months, but I would certainly argue that the next 12 months pose some elevated risks. At the same time, bonds look increasingly attractive and savers clipping T-Bill rates over 5% will continue to be in hog heaven. Interesting times. Good luck out there.More By This Author:Some Midweek Reading – Economic Tightness And Easing Demand Chart Of The Week: The Softening Labor Market Three Views On The Yen “Collapse”