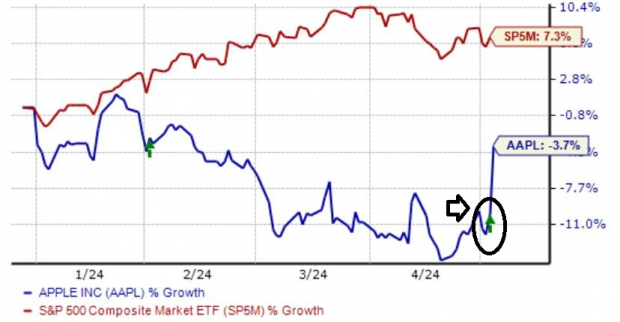

Image Source: PexelsEarnings season continues to roll along, with a solid chunk of companies already delivering their quarterly results. The period has remained positive, underpinned by strong results from the technology sector.And interestingly enough, several companies – Apple (AAPL – Free Report), Eaton (ETN – Free Report), and Spotify (SPOT – Free Report) – posted quarterly records, with shares of each seeing buying pressure post-earnings. Let’s take a closer look at each.AppleTechnology heavyweight Apple reported after the close yesterday, with the results bringing post-earnings fireworks. Concerning headline figures, the company posted a 1.3% beat relative to the Zacks Consensus EPS estimate and posted sales 1% ahead of expectations.Impressively, Services revenue of $23.9 billion reflected a quarterly record, showing 14% growth from the year-ago period. iPhone results weren’t as positive, with $45.9 billion in sales down 10% year-over-year.Nonetheless, the titan wrapped up the quarterly results by announcing the biggest buyback in corporate history totaling $110 billion. The print helped Apple shares see notable bullish activity post-earnings but overall remain underperforming relative to the S&P 500 YTD.

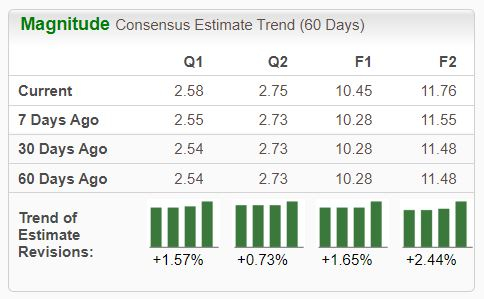

Image Source: PexelsEarnings season continues to roll along, with a solid chunk of companies already delivering their quarterly results. The period has remained positive, underpinned by strong results from the technology sector.And interestingly enough, several companies – Apple (AAPL – Free Report), Eaton (ETN – Free Report), and Spotify (SPOT – Free Report) – posted quarterly records, with shares of each seeing buying pressure post-earnings. Let’s take a closer look at each.AppleTechnology heavyweight Apple reported after the close yesterday, with the results bringing post-earnings fireworks. Concerning headline figures, the company posted a 1.3% beat relative to the Zacks Consensus EPS estimate and posted sales 1% ahead of expectations.Impressively, Services revenue of $23.9 billion reflected a quarterly record, showing 14% growth from the year-ago period. iPhone results weren’t as positive, with $45.9 billion in sales down 10% year-over-year.Nonetheless, the titan wrapped up the quarterly results by announcing the biggest buyback in corporate history totaling $110 billion. The print helped Apple shares see notable bullish activity post-earnings but overall remain underperforming relative to the S&P 500 YTD. Image Source: Zacks Investment ResearchEatonEaton posted EPS of $2.40, growing 28% year over year and reflecting a quarterly record. Sales totaled $5.9 billion, reflecting another quarterly record and improving 8% from the year-ago period. Finally, segment margins reached 23.1%, another quarterly record and a 340-basis-point climb from the same period last year.The company topped off the robust results with positive guidance, raising its outlook for organic growth, segment margins, and EPS. Shares have been considerably strong performers in 2024, gaining 34% and crushing the S&P 500.Unsurprisingly, analysts raised their earnings expectations across the board following the record-breaking quarter, with the stock holding its favorable Zacks Rank #2 (Buy).

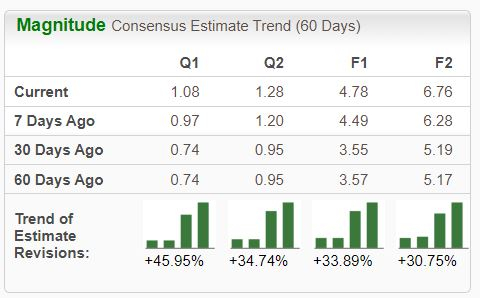

Image Source: Zacks Investment ResearchEatonEaton posted EPS of $2.40, growing 28% year over year and reflecting a quarterly record. Sales totaled $5.9 billion, reflecting another quarterly record and improving 8% from the year-ago period. Finally, segment margins reached 23.1%, another quarterly record and a 340-basis-point climb from the same period last year.The company topped off the robust results with positive guidance, raising its outlook for organic growth, segment margins, and EPS. Shares have been considerably strong performers in 2024, gaining 34% and crushing the S&P 500.Unsurprisingly, analysts raised their earnings expectations across the board following the record-breaking quarter, with the stock holding its favorable Zacks Rank #2 (Buy). Image Source: Zacks Investment ResearchSpotifySpotify’s set of quarterly results came in well above expectations, beating our Zacks Consensus EPS estimate by a sizable 67% and posting revenue 2% ahead of expectations. The company’s growth has been stellar, with EPS growing 185% and sales 21% higher from the year-ago periods.The company posted record profitability, aided by healthy subscriber gains and improved monetization. Monthly Active Users (MAUs) grew 19% year-over-year, whereas Premium Subscribers saw 14% growth from the year-ago period.Similar to ETN, analysts have revised their earnings expectations considerably higher post-earnings, with Spotify holding the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment ResearchSpotifySpotify’s set of quarterly results came in well above expectations, beating our Zacks Consensus EPS estimate by a sizable 67% and posting revenue 2% ahead of expectations. The company’s growth has been stellar, with EPS growing 185% and sales 21% higher from the year-ago periods.The company posted record profitability, aided by healthy subscriber gains and improved monetization. Monthly Active Users (MAUs) grew 19% year-over-year, whereas Premium Subscribers saw 14% growth from the year-ago period.Similar to ETN, analysts have revised their earnings expectations considerably higher post-earnings, with Spotify holding the highly-coveted Zacks Rank #1 (Strong Buy). Image Source: Zacks Investment ResearchBottom LineEarnings season continues its rapid pace, with a plethora of companies scheduled to deliver results in the coming weeks. The Q1 cycle has turned out to be positive, underpinned by the technology sector’s strong growth.And throughout the period so far, several companies, including Apple, Eaton, and Spotify, have posted quarterly records.More By This Author:Dividend Watch: 3 Companies Boosting PayoutsThese 3 Companies Recently Lifted Guidance3 Tech Stocks Suited For Dividend-Focused Investors

Image Source: Zacks Investment ResearchBottom LineEarnings season continues its rapid pace, with a plethora of companies scheduled to deliver results in the coming weeks. The Q1 cycle has turned out to be positive, underpinned by the technology sector’s strong growth.And throughout the period so far, several companies, including Apple, Eaton, and Spotify, have posted quarterly records.More By This Author:Dividend Watch: 3 Companies Boosting PayoutsThese 3 Companies Recently Lifted Guidance3 Tech Stocks Suited For Dividend-Focused Investors