Market Talk – Wednesday, July 19

Jul 19, 2017

Jeremy Parkinson

Finance

A healthy close for Asia in today’s trading after the uncertainty seen from a mixed US session. The large cap DOW recovery helped but it was the broader S&P and Nasdaq that contributed most for Asia’s impetus. The Nikkei only marginally closed in positive territory but it was the fact that it closed above the […]

Crude Oil Prices Rise On Inventory Drop, Gold Eyes BOJ And ECB

Jul 19, 2017

Jeremy Parkinson

Finance

Crude oil prices raced higher after official EIA inventory data revealed a far larger outflow than expected. US stockpiles shed 4.73 million barrels compared with the 3.46 million draw expected by the markets and a shock gain foreshadowed in API figures for the same period. A pause to consolidate may now be in the cards. The stock of […]

American Express Reports Q2 EPS Of $1.47

Jul 19, 2017

Jeremy Parkinson

Finance

American Express Company (NYSE: AXP), the New York City-based global services company that offers charge and credit cards, business credit cards, travel services, gift cards, prepaid cards and merchant services, reported financial results today for its second-quarter 2017, as follows: In reference to the Q2 results Chairman and CEO, Kenneth I. Chenault, said: “We…continue to execute a strategy that […]

Introducing Granddad Russell 2000!

Jul 19, 2017

Jeremy Parkinson

Finance

Today, at 5 PM EST on my Facebook page called: Mish’s Market Minute Daily, I went live with the first of six cartoons that represent the Modern Family. Coincidence or not? The Russell 2000 must like the publicity and his character depiction as IWM made a new all-time high! Now, Gramps was not alone. The […]

American Express Down On Massive Q2 Profit Decline

Jul 19, 2017

Jeremy Parkinson

Finance

American Express Company (AXP – Free Report) released its second-quarter 2017 financial results, posting earnings of $1.47 per share and revenues of $8.31 billion. Currently, AXP is a Zacks Rank #3 (Hold) and is down 1.20% to $85 per share in after-hours trading shortly after its earnings report was released. AXP: Beat earnings estimates. The company posted earnings […]

Why Is This Financial Powerhouse’s Dividend Safety Rating So Low?

Jul 19, 2017

Jeremy Parkinson

Finance

When it comes to investments, T. Rowe Price Group (Nasdaq: TROW) is thought of as a model of stability. The 80-year-old company has $861.6 billion under management. It manages dozens of stock and bond funds for individual and institutional investors. T. Rowe Price currently pays a $0.57 per share quarterly dividend, or $2.28 on an annual basis. […]

The Real Reason You’re Always Broke

Jul 19, 2017

Jeremy Parkinson

Finance

One hundred thousand dollars in an annuity today will buy you about $5,700 per year in income. If you have $1 million to give away to some insurance guy, you can earn about 10 times that, or $57,000. Easy math! That’s not a lot of income for a $1 million investment. Consider this… 25 years […]

Y2K Was Really The Great Uncertainty

Jul 19, 2017

Jeremy Parkinson

Finance

In late 1999, the Federal Reserve established what was ostensibly an emergency credit facility. On October 1 that year, this offshoot of the Discount Window went live. Its main feature was that it was to be a primary program, meaning that banks didn’t have to prove they could access funds elsewhere first. They could go […]

‘Things Are Starting To Reverse’: Goldman Warns On ‘Shock’ Risk

Jul 19, 2017

Jeremy Parkinson

Finance

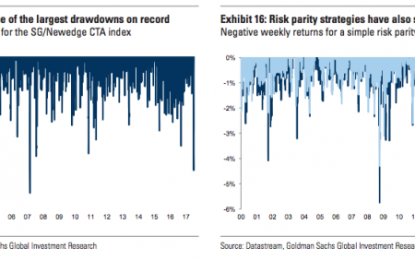

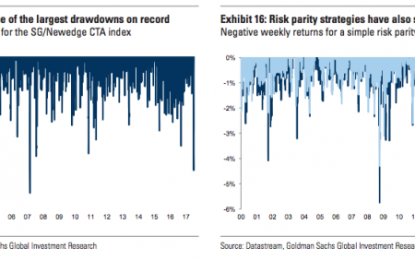

Ok, so it was just two days ago when I tweeted this: here’s your DM rates mini-tantrum in action in stock-bond return correlations… pic.twitter.com/UPDf7DWPLD — Walter White (@heisenbergrpt) July 18, 2017 The point was that the mini-tantrum in DM rates that Mario Draghi kicked off in Sintra, Portugal on June 27 was accompanied by sharply […]

Small Caps Breakout – Wednesday, July 19

Jul 19, 2017

Jeremy Parkinson

Finance

It has taken a few days for Small Caps to make their move but today was the day the Russell 2000 joined other indices in mounting a breakout. It was a clean breakout supported by positive technical strength – putting to bed the June ‘bull trap’. Watch for the second round of stop-whips with an intraday […]