Auto Stocks To Watch For Q2 Earnings On Jul 21: ALV, GNTX

Jul 20, 2017

Jeremy Parkinson

Finance

Second-quarter 2017 earnings season for the auto sector has already started. One important company which has already reported its second-quarter results is Harley-Davidson Inc. (HOG – Free Report). The company recorded earnings of $1.48 per share, beating the Zacks Consensus Estimate of $1.37. However, it reported revenues of $1.58 billion, narrowly missing the Zacks Consensus Estimate of $1.6 billion. […]

The Future Of Outsourcing: The Largest Economic Transformation Ever

Jul 20, 2017

Jeremy Parkinson

Finance

Since World War II, trade and technology have been expanding rapidly. Increased technology has led to increased trade, which spurs increases in technology and contributes to a constant fear of outsourcing. As technology progressed in the 1960s, Americans began to fear the loss of our manufacturing jobs. Then again, in the late 90s, we feared […]

EUR/USD Could Face Limited Upside; More Weakness Ahead

Jul 20, 2017

Jeremy Parkinson

Finance

EUR/USD is trading sharply higher following the ECB rate decision and press conference. We see the pair approaching the 1.1585 highs from where we may see a test of the 1.1600/20 area. This might be the next stop for euro bulls as the pair could be in its final stages of an ending diagonal. However, […]

Union Pacific Beats On Q2 Earnings

Jul 20, 2017

Jeremy Parkinson

Finance

Union Pacific Corporation (UNP – Free Report), based in Omaha, NE, is the largest railroad in North America providing rail transportation services across more than 20 states in the U.S. Union Pacific also connects with Canada’s rail systems and is the only railroad, serving all the six major gateways to Mexico. Zacks Rank: Currently, Union Pacific has a […]

Philly Fed Manufacturing Index: Positive But Weaker Growth In July

Jul 20, 2017

Jeremy Parkinson

Finance

The Philly Fed’s Manufacturing Business Outlook Survey is a monthly report for the Third Federal Reserve District, covers eastern Pennsylvania, southern New Jersey, and Delaware. While it focuses exclusively on business in this district, this regional survey gives a generally reliable clue as to the direction of the broader Chicago Fed’s National Activity Index. The latest Manufacturing Index […]

Bank Assets Are Ephemeral – Here Today Gone Tomorrow

Jul 20, 2017

Jeremy Parkinson

Finance

It is not only paper gold which is Fake. Few investors realize that most of their investments are Fake. Fake news and Fake assets are everywhere. Let’s start with social media which dominates major parts of the world. Facebook, for example, has 2 billion active users. WhatsApp has 1.2 billion users and Instagram 700 million. […]

Euro Rips On Dovish Draghi; Yen Slips After BoJ

Jul 20, 2017

Jeremy Parkinson

Finance

Yesterday we looked at the high probability of the European Central Bank taking a dovish outlook to markets at today’s rate decision and press conference. This very much fit the pattern of how the bank has communicated with markets throughout this year, as the ECB rate decisions in April and again in June saw a […]

Pfizer Downgraded To Neutral From Outperform At Credit Suisse

Jul 20, 2017

Jeremy Parkinson

Finance

Credit Suisse analyst Vamil Divan downgraded Pfizer (PFE) to Neutral and lowered his price target for the shares to $36 from $38. The shares closed yesterday up 26c to $33.62. The analyst, who notes he’s long been a supporter of Pfizer and continues to see opportunities for upside over the long-term, believes the stock’s […]

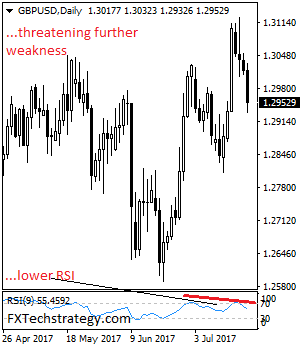

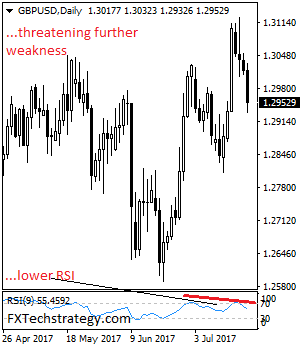

GBP/USD: Extends Weakness, Remains Vulnerable

Jul 20, 2017

Jeremy Parkinson

Finance

GBP/USD: The pair continues to retain its nearer downtrend weakening further on Thursday. Support lies at the 1.2900 level where a break will turn attention to the 1.2850 level. Further down, support lies at the 1.2800 level. Below here will set the stage for more weakness towards the 1.2750 level. Its daily RSI is bearish […]

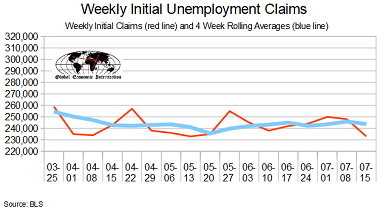

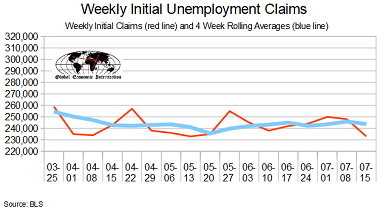

July 2017 Initial Unemployment Claims Rolling Average Marginally Improves

Jul 20, 2017

Jeremy Parkinson

Finance

The market expectations for weekly initial unemployment claims (from Bloomberg/Econoday) were 240 K to 250 K (consensus 245,000), and the Department of Labor reported 233,000 new claims. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 246,000 (reported last […]