Three Earnings Reports You Need To Watch Before Tomorrow’s Opening Bell

Jul 20, 2017

Jeremy Parkinson

Finance

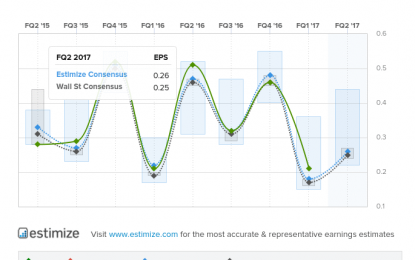

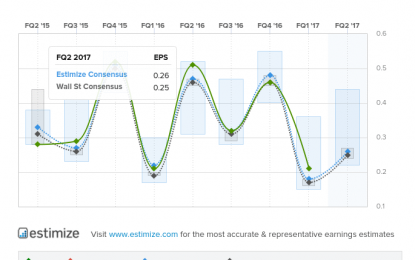

General Electric (GE): Industrials – Industrial Conglomerates | Reports July 21st, BMO. The Estimize consensus calls for EPS of $0.26, one cent higher than the Wall Street consensus and a decrease of 49% YoY. Currently, the Estimize community is looking for sales of $29.23B, which is roughly inline with the Street. The industrial conglomerate and […]

Vol Sellers Branch Out

Jul 20, 2017

Jeremy Parkinson

Finance

By now most of us are fed up with hearing apocalyptic warnings of the coming VIX disaster when all the naïve short sellers will be squeezed in an epic 2008 style equity crash. Either you buy this argument, or you don’t. No sense wasting too much more time on it. I am of the opinion […]

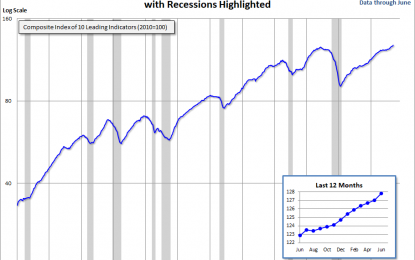

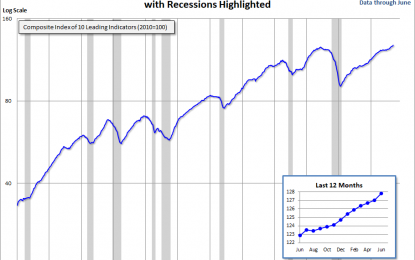

Conference Board Leading Economic Index: Continued Growth In June, All-Time High

Jul 20, 2017

Jeremy Parkinson

Finance

The Latest Conference Board Leading Economic Index (LEI) for June increased to 127.8 from 127.0 in May and is currently at an all-time high. The 0.6 percent month-over-month gain was better than the 0.4% increase forecast by Briefing.com. The Conference Board LEI for the U.S. increased again in June, driven by positive contributions from the majority of its […]

Credit Suisse Cuts Pfizer To Hold, Prefers Merck, J&J

Jul 20, 2017

Jeremy Parkinson

Finance

Credit Suisse downgraded Pfizer (PFE) to Neutral from Outperform, saying that the company’s positive catalysts will become “more limited” over the next six to twelve months. DRIVERS TO SLOW: In recent years, Pfizer has benefited from strong use of its Ibrance drug for breast cancer and its Prevnar drug for bacterial infections, wrote Credit Suisse […]

Trucking Data Again Continues Mixed In June 2017 But Growth Suggested

Jul 20, 2017

Jeremy Parkinson

Finance

Headline data for truck shipments were again mixed in June – but our analysis believes trucking growth rate is modestly improving. Analyst Opinion of Truck Transport I tend to put heavier weight on the CASS index which again showed a moderate improvement year-over-year. The ATA data continues to wander all over the map – and […]

GBPUSD Below 1.30 As Talks End With Little Progress

Jul 20, 2017

Jeremy Parkinson

Finance

GBPUSD tumbled back below the 1.30 level in late European trading Thursday as it became clear that the second round of divorce talks between the UK and the EU has ended with the two sides little or no closer on any of the key issues. Moreover, the next round of discussions will not now begin […]

Largest Short Value Per Sector

Jul 20, 2017

Jeremy Parkinson

Finance

Written by IB Securities Lending Desk The following table shows the securities with the largest short value per sector on 7/18/2017.

Aflac: A Cheap Dividend Aristocrat Or Value Trap?

Jul 20, 2017

Jeremy Parkinson

Finance

Over the past decades boring old insurance specialist Aflac (AFL) has done a remarkable job of enriching long-term income growth investors thanks to its impressive 34-year dividend growth streak. That’s courtesy of its strong, cash-rich business model, which has allowed it to grow its dividend by 14.6% annually over the past quarter century, resulting in annual total […]

Genuine Parts Company Announces Record Q2 Sales & Earnings And Maintains Positive Guidance

Jul 20, 2017

Jeremy Parkinson

Finance

Genuine Parts Company (NYSE: GPC), a distributor of automotive replacement parts in the U.S., Canada, Mexico and Australasia, as well as industrial replacement parts in the U.S., Canada and Mexico through its Motion Industries subsidiary, business products in the U.S. and Canada through its S. P. Richards Company subsidiary and electrical and electronic components throughout the […]

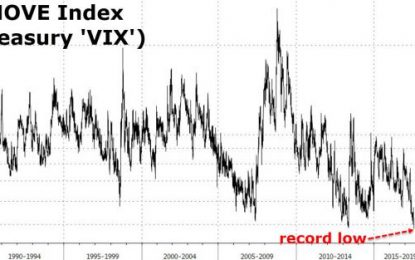

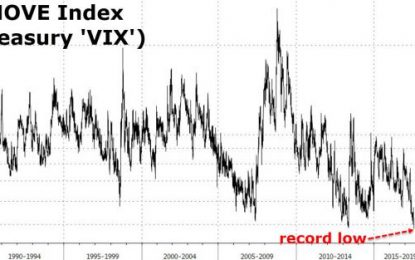

Treasury Volatility Crashes To Record Lows

Jul 20, 2017

Jeremy Parkinson

Finance

Another day, another record low for volatility gauges, with Bank of America’s MOVE Index (considered Treasury Market ‘VIX’) falling to an unprecedented 48.26. As Bloomberg notes, the slide back down in volatility comes as the Treasury term premium looks to be failing in its latest attempt to climb back above zero. So investors in the world’s biggest bond market don’t want […]