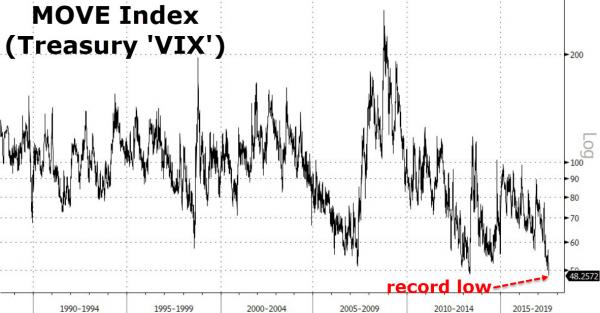

Another day, another record low for volatility gauges, with Bank of America’s MOVE Index (considered Treasury Market ‘VIX’) falling to an unprecedented 48.26.

As Bloomberg notes, the slide back down in volatility comes as the Treasury term premium looks to be failing in its latest attempt to climb back above zero.

So investors in the world’s biggest bond market don’t want to pay for protection against price swings and they don’t care about getting paid for time risk — that can only add to concerns expressed by commentators including the Federal Reserve that markets are dangerously complacent.