Bitcoin (BTC) came into existence in January 2009. It was not the first ‘cryptocurrecny’ and there are now an estimated 950 competitors, with new ICO’s ‘Initial Coin Offerings’ appearing almost daily.

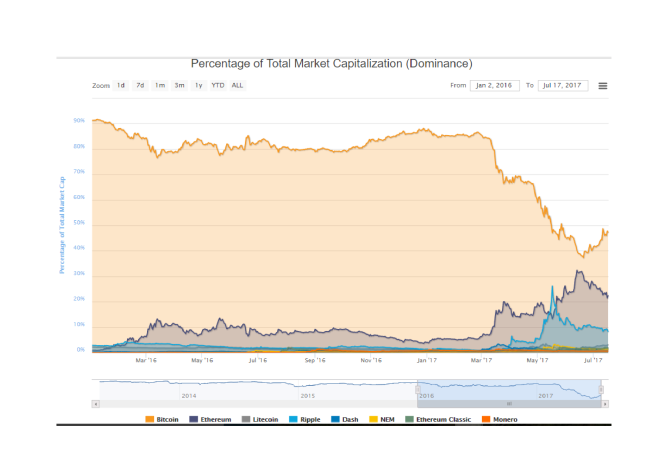

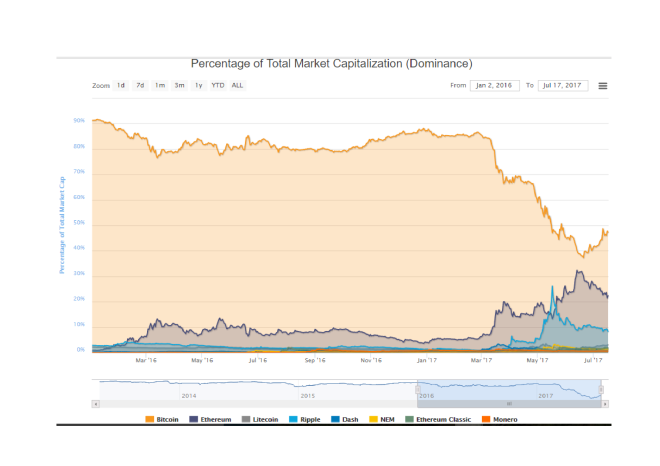

BTC’s closest rival in terms of coins in circulation is Ethereum (ETH). The chart below shows how these currencies % of total market capitalisations has waxed and waned:-

Source: coinmarketcap.com

I want to concentrate on BTC since it remains the market leader with a total circulation of $33bln (reference BTCUSD 2000) whilst the outstanding issuance of its nearest rival ETH is $16bln.

Below is a four month chart of BTCUSD, its price has fallen by almost one third in just over a month:-

Source: Bitcoincharts.com

The recent price action needs to be seen in a broader context. The price has increased from less than BTCUSD 1000 in late March. On April 1st the Japanese authorities officially recognised BTC for the first time: perhaps, this was the catalyst for its spectacular rise.

The subsequent precipitous decline in price may be related to a proposed software change to be introduced on 21st July, known as SegWit, which is discussed in Cryptocurrency Value: Growing Pains or Something More? By Ryan Shea – here’s the rub:-

SegWit2x software, which introduces SegWit while doubling the block size to 2MB, will be released on July 21. More than 80% of the network hash rate has agreed to run the SegWit2x code, which suggests that the solution to increasing bitcoin’s scalability will be enacted smoothly.

However, it is also possible that the hard fork required to increase the block size leads to a bifurcation of bitcoin into two separate currencies –something that would unquestionably trigger a sharp price correction by undermining the bitcoin brand. (The key date by which a split can be avoided is August 1 when BIP148 activates – this represents the last opportunity for miners to accept Segwit2x and thereby avoid a chain split resulting in the creation of two parallel bitcoins.)

There have been victories and defeats during the evolution of BTC, as it has evolved from an obscure novelty to a serious contender for investors seeking a store of value. The price volatility reflects these uncertainties but it is not demonstrably different from the volatility seen in several commodity markets.

Financial deepening

For a security, commodity or a currency to gain credence, among financial market operators, it needs to offer a store of value, liquidity and convertibility. If can achieve these attributes it should have collateral value, by which I mean, BTC should be capable of being borrowed or lent. This is already happening. Some cryptocurrency exchanges are offering a rate of interest on term deposits and others offer the opportunity for holders of BTC to lend their currency to traders who wish to borrow it, primarily to sell the currency short. Whilst there is not really a ‘risk-free rate’ for BTC an interest rate term structure is beginning to emerge as the table below, derived from a number of exchanges, shows:-