Morgan Stanley Triumphs: Posts Higher FICC Revenue Than Goldman Sachs

Jul 19, 2017

Jeremy Parkinson

Finance

After yesterday’s stunning 40% plunge in Goldman’s FICC revenue, market watchers and MS shareholders were nervously anticipating the release of today’s Morgan Stanley Q2 earnings data. In retrospect, they had no reason to be worried, because moments ago MS reported revenue and EPS which both beat expectations, with Q2 EPS of $0.87 (est $0.76) on revenue […]

What We Have Seen And Learned 20 Years After The Asian Financial Crisis

Jul 19, 2017

Jeremy Parkinson

Finance

from the International Monetary Fund — this post authored by Mitsuhiro Furusawa Asia today is the fastest-growing region in the world, and the largest contributor to global growth. It has six members of the Group of Twenty advanced and emerging economies, and its economic and social achievements are well recognized. But 20 years ago, July 1997 […]

Is The Canadian Dollar Too Strong For The BOC?

Jul 19, 2017

Jeremy Parkinson

Finance

USD/CAD collapsed on the hawkishness of the BOC and the weakness of the US dollar. Has it gone too far? Here are two opinions: Here is their view, courtesy of eFXnews: USD/CAD: Loonie Strength To Send BoC To The Sidelines; Where To Target? – CIBC CIBC FX Strategy Research argues that while CAD strength could extend towards a temporarily […]

The Stock Market Season Is Changing

Jul 19, 2017

Jeremy Parkinson

Finance

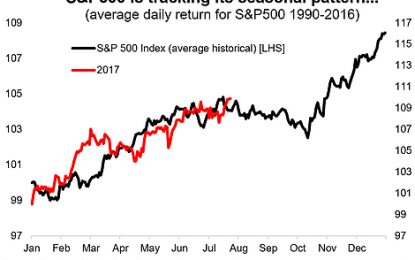

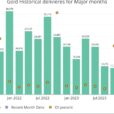

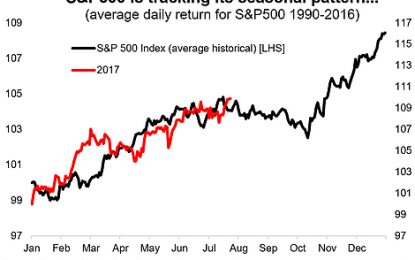

Following on from the popular post on the seasonal turning point for the VIX last week, here’s an insight into seasonality for the S&P 500 and how 2017 is tracking YTD vs the historical seasonal pattern. The first chart shows 2017 superimposed on the historical average and it looks like a fairly decent fit with the implication […]

US Business Cycle Risk Report – Wednesday, July 19

Jul 19, 2017

Jeremy Parkinson

Finance

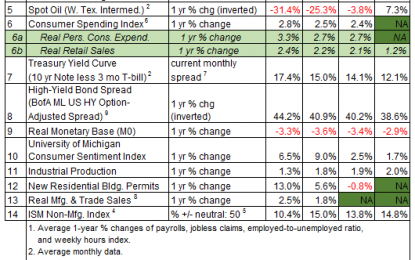

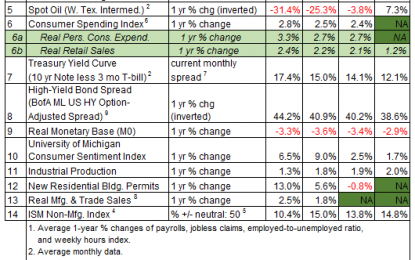

The recent run of soft economic data inspires some pundits to claim that a new recession is brewing. They could be right, but they could just as easily be wrong. Although some numbers published to date have been weaker than expected, a broad profile of economic activity still reflects low recession risk. Near-term projections tell […]

Global Stocks Hit Record High, Set For Longest Winning Streak Since 2015

Jul 19, 2017

Jeremy Parkinson

Finance

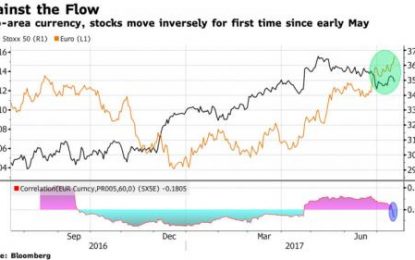

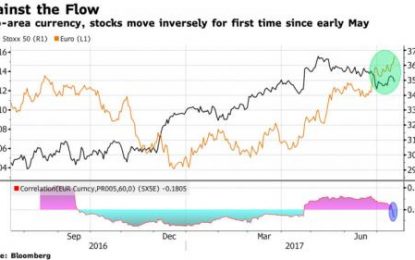

In what has been a less exciting session than the previous two, the euro retraced some recent gains as traders grew concerned they may have overestimated the ECB’s hawkish bias ahead of Thursday’s rate decision; in turn the dollar edged higher after the collapse of the GOP healthcare bill sent it to the lowest since […]

E

Low U.K. Unemployment Rate Not A Signal For Rate Hike

Jul 19, 2017

Jeremy Parkinson

Finance

The Bank of England announced U.K.’s lowest unemployment rate of 4.5% in 45 years thereby triggering comments across the media channels that a rate hike could be next on the cards. However, when you look at the entire basket of numbers released on the most recent jobs report, it could be unwise to jump into […]

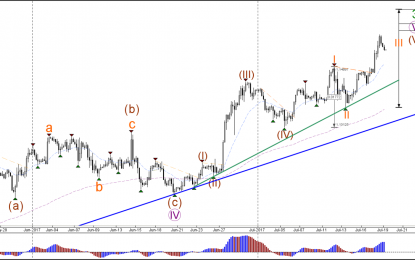

SPX Elliott Wave View: Showing Impulse

Jul 19, 2017

Jeremy Parkinson

Finance

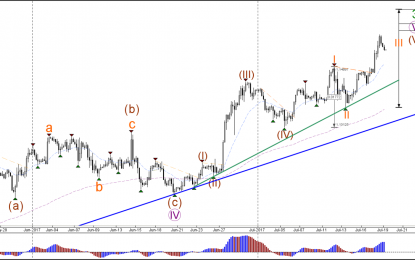

Short term SPX Elliott Wave view suggests the rally from 5/18 low (2352.7) to 6/19 peak (2453.8) ended Minor wave 3. The pullback from 2453.8 to 2405.70 on 6/29 low ended Minor wave 4. Up from there, the rally is unfolding as an impulse Elliott Wave structure with extension. This 5 waves move could be Minute wave ((a)) […]

EUR/USD, GBP/USD Bearish Pullback To 1.15 And 1.30 Within Bullish Trend

Jul 19, 2017

Jeremy Parkinson

Finance

EUR/USD 4 hour After the break above the 1.15 round level resistance, the EUR/USD continues the established bullish trend with yet another higher high. The uptrend shows no signs of weakening as yet and price is on its way towards the Fibonacci targets of wave 3 vs 1. Currently a retracement is taking place, which […]

Above The 40 – A Food-Borne Breakdown And Classic Post-Earnings Gaps

Jul 19, 2017

Jeremy Parkinson

Finance

AT40 = 61.9% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 59.8% of stocks are trading above their respective 200DMAsVIX = 9.9 (volatility index)Short-term Trading Call: cautiously bullish Commentary The S&P 500 (SPY) closed effectively flatline with a point and a half gain. The Nasdaq returned to the new-high business with a 0.5% […]