Six Flags Drops As CEO ‘Retires’ After Under Two Years In Role

Jul 18, 2017

Jeremy Parkinson

Finance

Shares of Six Flags Entertainment (SIX) dropped in afternoon trading after the company announced the retirement of its chief executive officer after just 17 months in the role. Following the news, an analyst said the news that the company’s current chairman and former CEO is returning to the CEO role is “a positive.” CEO DEPARTURE: […]

It’s Complicated

Jul 18, 2017

Jeremy Parkinson

Finance

Things changed a lot in the past two weeks. The US Fed’s promises to keep tightening financial conditions look a lot shakier than they did at the start of the month, thanks to a series of weak economic readings in the US. I still think we need to be wary of central bankers but with […]

June 2017 Import Sea Containers Suggest Improving Economy

Jul 18, 2017

Jeremy Parkinson

Finance

The June month-over-month import and export container counts are suggesting a growing USA economy, but a slowing global economy – and a worsening trade balance. Analyst Opinion of Container Movements January was great. February was bad. March was good. April is ok. May and June were a mixed bag. Simply looking at this month versus […]

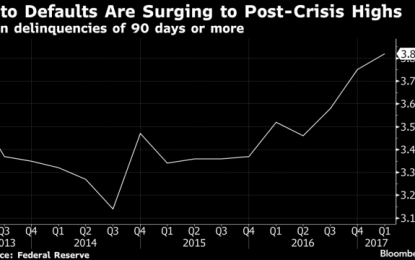

Subprime Redux: Problems Brewing In Auto Loans

Jul 18, 2017

Jeremy Parkinson

Finance

It’s classic subprime: hasty loans, rapid defaults, and, at times, outright fraud. Only this isn’t the U.S. housing market circa 2007. It’s the U.S. auto industry circa 2017. A decade after the mortgage debacle, the financial industry has embraced another type of subprime debt: auto loans. And, like last time, the risks are spreading as […]

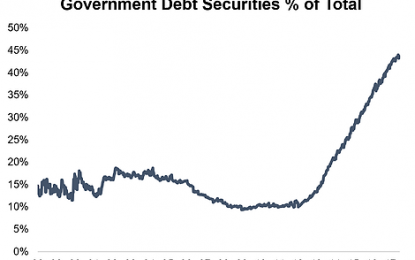

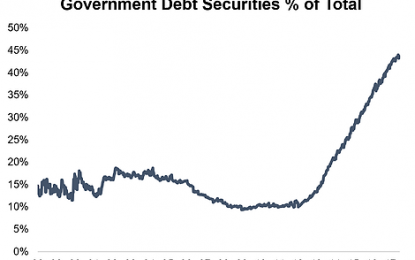

The BOJ Bond Buying Binge

Jul 18, 2017

Jeremy Parkinson

Finance

As the Bank of Japan is set to meet this week to review monetary policy settings it’s worth checking in on a couple of particularly relevant charts. The first one shows the Bank of Japan has now accumulated an impressive 45% of all outstanding Japanese government debt. Strictly speaking this is not debt monetization but it’s not […]

AUD/JPY Rallies To Fresh Yearly Highs – Initial 2017 Targets In View

Jul 18, 2017

Jeremy Parkinson

Finance

Technical Outlook: AUD/JPY closed above technical resistance at 87.55/64 last week, keeping the broader long-bias intact. Price is pushing through the yearly opening-range highs on this stretch with the rally now eyeing our initial yearly target at 90.64-91.23. This range is defined by the 1.618% extension of the 2016 advance and the 50% retracement of the […]

Homebuilder Seniment Falls To Eight Month Low As Lumber Prices Spike

Jul 18, 2017

Jeremy Parkinson

Finance

Shares of U.S. homebuilders are all trading lower after a key metric for the group missed expectations. HOME BUILDER SENTIMENT: Builder confidence for newly-built single-family homes dropped to its lowest level since before the Trump election. The confidence metric slipped two points in July to 64. The HMI measure of current sales conditions has been […]

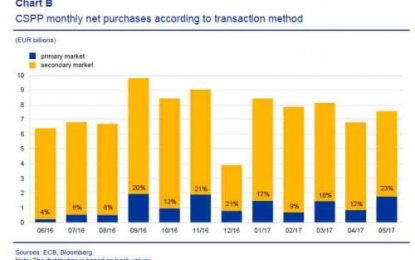

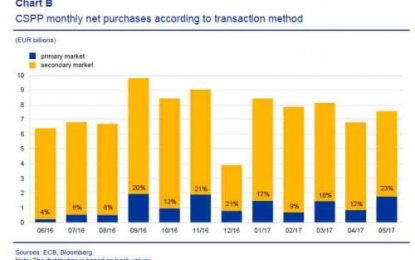

The ECB’s Balance Sheet Is Now The Size Of Japan’s GDP

Jul 18, 2017

Jeremy Parkinson

Finance

Yesterday was a landmark day for the ECB. First, the central bank disclosed that its CSPP, or corporate bond, holdings rose above €100Bn for the first time. As DB’s Jim Reids notes this morning, to put things in perspective, a similar market cap company would be the 18th largest in the Stoxx 600 and 42nd […]

Get Rich Slowly

Jul 18, 2017

Jeremy Parkinson

Finance

“The people who have gotten rich quickly are also the ones who got poor quickly.” – John Templeton A Forbes article of July 1974 profiled John Templeton and highlighted some of the wisdom he implemented in his investment process. The article touched on his discipline of consistently praying to God “for wisdom and clear thinking” at the start […]

The Road To Financialization With Charles Hugh Smith

Jul 18, 2017

Jeremy Parkinson

Finance

How we got to where we are today? A discussion of the chronology of US & Global Monetary Events regarding the Evolution of Financialization in America. Video Length: 00:50:26