Light, Low, Nonexistent Volume

Jul 18, 2017

Jeremy Parkinson

Finance

What was that yesterday? Where was the volume? That had to be one of the least interesting trading days in my entire trading career. I mean, it was horrible, miserable – and outright boring. Even so, there is a market to analyze, and what you had yesterday was a situation where there was nobody willing […]

Billion Dollar Unicorns: Clover Health Reaches Milestone Valuation

Jul 18, 2017

Jeremy Parkinson

Finance

Over the past few years, there has been an added focus within the global healthcare industry to reduce costs and manage resources more efficiently while improving patient care. To meet these pressures, healthcare organizations including physicians and insurance service providers have become data driven. San Francisco-based Clover Health is a Billion Dollar Unicorn club member making big strides […]

E

The Employment, Wages And Inflation Nexus

Jul 18, 2017

Jeremy Parkinson

Finance

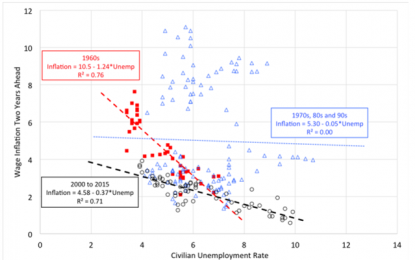

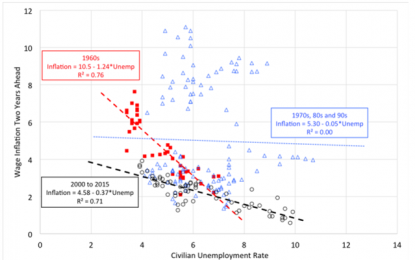

Central bankers are confronted by a nexus in which unemployment falls, wages stagnant and inflation slows down. It is not supposed to be this way. According to the Phillips curve ( developed in 1958) [1], as unemployment falls, the labor market tightens, wages rise and ultimately inflation picks up. This is a neat way to […]

Mega Cap Growth ETF (MGK) Hits New 52-Week High

Jul 18, 2017

Jeremy Parkinson

Finance

For investors seeking momentum, Vanguard Mega Cap Growth ETF (MGK – Free Report) is probably on the radar now. The fund just hit a 52-week high and is up about 22% from its 52-week low price of $83.68/share. But are more gains in store for this ETF? Let’s take a quick look at the fund and the […]

What Is Capital And Why Is It Essential?

Jul 18, 2017

Jeremy Parkinson

Finance

As an economist, Israel Kirzner is best known for his contributions to the theory of entrepreneurship. His renown in this area extends into the literature on management studies where recently his insights have become the focus of spirited discussions about the discovery of entrepreneurial opportunities. Ranging from his view of the entrepreneur as essentially a […]

‘ETFs Will Be Disproportionally Influential In Selloffs’: BofAML On EM Bond Funds

Jul 18, 2017

Jeremy Parkinson

Finance

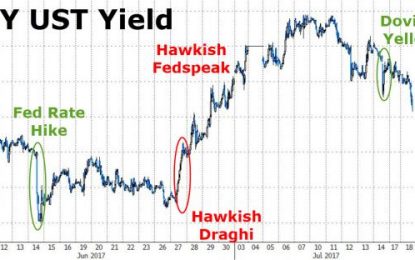

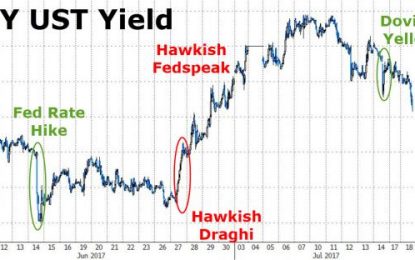

Another day another warning about emerging market debt ETFs. This has become something of a crusade for us in the weeks that followed Mario Draghi’s efforts to marshal global support for a hawkish shift from DM central banks. That effort kicked off on June 27 in Sintra, Portugal, and it was followed by a rates […]

Markets: Too Much Winning

Jul 18, 2017

Jeremy Parkinson

Finance

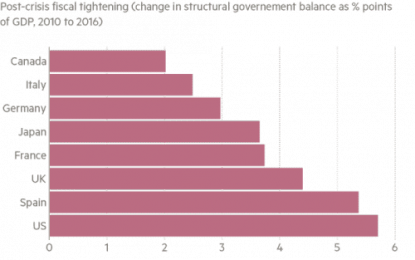

With the 72nd failed attempt to “repeal and replace” – as well as a wall that’s never going to get built, a Hillary that’s never going to be “locked up”, a Goldman Sachs that’s never going to be kept out of D.C., and tax reform that’s never going to happen – yeah, I think we’ve […]

Some Thoughts On Full Employment And This Asset-Based Economic Recovery

Jul 18, 2017

Jeremy Parkinson

Finance

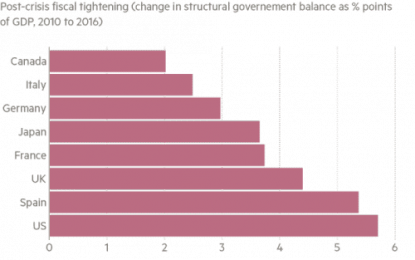

I see that Dartmouth economics professor Danny Blanchflower is talking about slack in the US labor market because he believes the Fed is premature in assessing its full employment mandate as fulfilled. I have a few thoughts on this issue I want to flesh out below and the crux of my narrative revolves around the over-dependence on […]

Amicus Therapeutics Announces Closing Of Underwritten Offering Of Common Stock

Jul 18, 2017

Jeremy Parkinson

Finance

CRANBURY, N.J., July 18, 2017 (GLOBE NEWSWIRE) — Amicus Therapeutics (Nasdaq:FOLD), a global biotechnology company at the forefront of therapies for rare and orphan diseases, today announced the closing of its previously announced offering of common stock. Prior to the closing, the underwriters exercised in full their option to purchase an additional 2,755,102 shares of […]

Treasury Yields Tumble To Lowest Since June As Stocks Sink

Jul 18, 2017

Jeremy Parkinson

Finance

Treasury yields are tumbling once again (10Y at 2.25%, the lowest since June 29th) – as more weak US macro data is compounding Yellen’s dovish tilt from last week. As bond yields began to tumble, so stocks rolled over and VIX jerked above 10… 10Y Yields have retraced exactly 50% of the post-hawkish-Draghi swing higher… Notably UST […]