Understanding What A Neutral Macro-Economic Policy Looks Like

Jul 18, 2017

Jeremy Parkinson

Finance

This is going to be a quick follow-on to the last post on monetary policy as the only game in town. I feel like the obvious question that post doesn’t answer is this one: what other policy tools should we use? And I want to tee up that question with this post. First, remember that the […]

Health Care Circus, Earnings In Focus

Jul 18, 2017

Jeremy Parkinson

Finance

I am technology-challenged today (why my laptop had to crap out 21 days before I get my big desktop rig back is beyond me), so I am going to keep this brief. Health Care and earnings are the focal points in the early going today and if the early action is any guide, we can […]

Dollar Gloom: Key Technical Level Breached, Yields Dive

Jul 18, 2017

Jeremy Parkinson

Finance

Well, the dollar just can’t catch a break. Already in the doldrums, the greenback started taking on more water on Monday evening when two more Republican defections killed the GOP healthcare bill. The malaise continued into the US session and now, DXY has breached a technical level that Bloomberg notes has “helped guard the 2016 lows at […]

5 Undervalued Companies For Value Investors With A Low Beta – July 2017

Jul 18, 2017

Jeremy Parkinson

Finance

There are a number of great companies in the market today. By using the ModernGraham Valuation Model, I’ve selected five undervalued companies with a low beta reviewed by ModernGraham. A company’s beta indicates the correlation at which its price moves in relation to the market. A beta less than 1 indicates a company is less volatile than the […]

Spot The Horse

Jul 18, 2017

Jeremy Parkinson

Finance

Yesterday after writing my piece about Tesla and Bitcoin, I received an email from one of the smartest guys I know. “Funny that you wrote about shorting Elon’s science project and GBTC. I just bought both this morning. Thanks for the extra liquidity. Always appreciative of those willing to sell me more on the cheap.” I […]

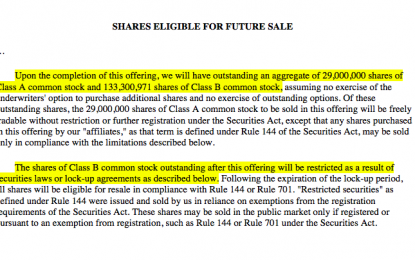

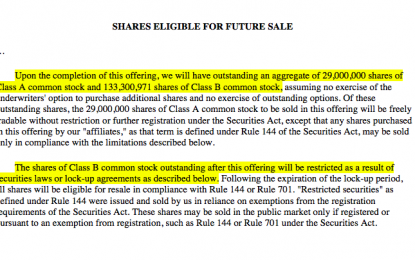

IPO Lockup Expiration For Laureate Education Could School Investors

Jul 18, 2017

Jeremy Parkinson

Finance

Laureate Education (Nasdaq: LAUR) – Sell or Short Recommendation Price Target- $16.50. Event Overview July 31, 2017 concludes the 180-day lockup period on Laureate Education Inc. (LAUR). When the lockup period ends for LAUR on 7.31, its pre-IPO shareholders, directors and executives will have the chance to sell 133M shares, previously restricted from trading since the […]

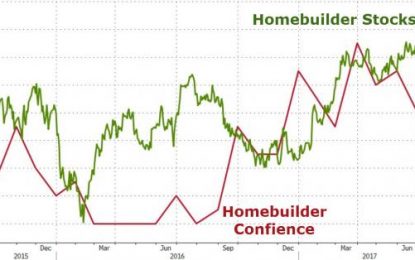

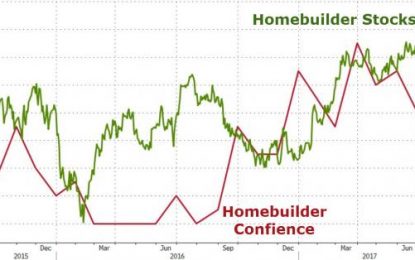

Homebuilder Stocks Hit Record High As Homebuilder Confidence Plunges To 8-Month Lows

Jul 18, 2017

Jeremy Parkinson

Finance

While homebuilder stocks are hovering near record highs, confidence among homebuilders has tumbled to its lowest since before Trump’s election. As opposed to blaming stagnating wages, or higher rates, the NAHB chooses to blame President Trump’s Canadian Lumber tariffs for making costs unaffordable… Builder confidence fell two points in July to its lowest reading since November 2016 […]

Cryptocurrency: Sharp Rebounds Continue But Risks Remain

Jul 18, 2017

Jeremy Parkinson

Finance

Last Sunday’s (July 16) recent lows seem a distant memory for most of the cryptocurrencies as buyers take back control and force the digital markets sharply higher. Bitcoin (BTC) has jumped nearly 28% from the $1790 low to a current quote of $2293, while Ether (ETH) has risen from $131 to $192, a massive low-to-current […]

WGC’s June Gold Investor: Gold In Digital World

Jul 18, 2017

Jeremy Parkinson

Finance

This month, the World Gold Council (WGC) released a new edition of Gold Investor. What can we learn from the report? The summer issue of the WGC’s Gold Investor contains a few interesting articles. The first one which we would like to cover is an interview with John Reade, the new WGC’s Chief Market Strategist and Head […]

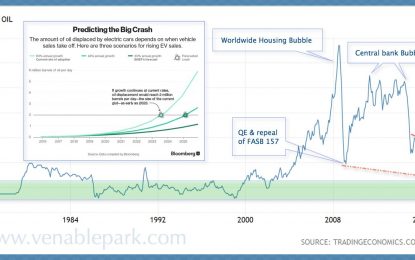

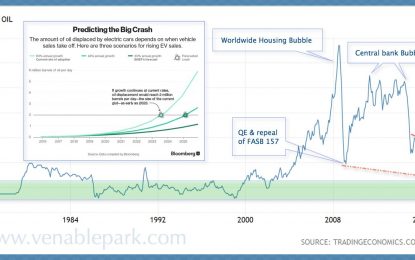

Oil Racing Against End Of The Ice-Age

Jul 18, 2017

Jeremy Parkinson

Finance

The U$ has slumped on increasing Trump lumps the past month–no health care rewrite, no imminent tax code overhaul, and that debt ceiling is back. This has spurred some strength in the price of crude and its handmaiden the Canadian dollar. It seems likely that both of these short-term rebounds are overdone. As shown here, crude […]