Markets: Too Much Winning

Jul 18, 2017

Jeremy Parkinson

Finance

With the 72nd failed attempt to “repeal and replace” – as well as a wall that’s never going to get built, a Hillary that’s never going to be “locked up”, a Goldman Sachs that’s never going to be kept out of D.C., and tax reform that’s never going to happen – yeah, I think we’ve […]

Some Thoughts On Full Employment And This Asset-Based Economic Recovery

Jul 18, 2017

Jeremy Parkinson

Finance

I see that Dartmouth economics professor Danny Blanchflower is talking about slack in the US labor market because he believes the Fed is premature in assessing its full employment mandate as fulfilled. I have a few thoughts on this issue I want to flesh out below and the crux of my narrative revolves around the over-dependence on […]

Amicus Therapeutics Announces Closing Of Underwritten Offering Of Common Stock

Jul 18, 2017

Jeremy Parkinson

Finance

CRANBURY, N.J., July 18, 2017 (GLOBE NEWSWIRE) — Amicus Therapeutics (Nasdaq:FOLD), a global biotechnology company at the forefront of therapies for rare and orphan diseases, today announced the closing of its previously announced offering of common stock. Prior to the closing, the underwriters exercised in full their option to purchase an additional 2,755,102 shares of […]

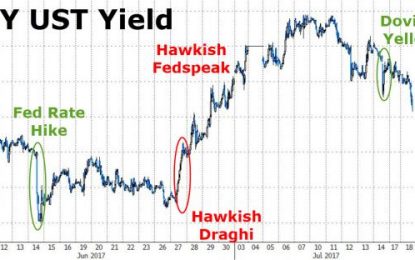

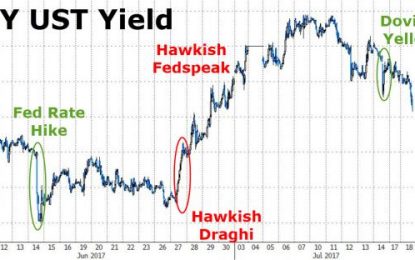

Treasury Yields Tumble To Lowest Since June As Stocks Sink

Jul 18, 2017

Jeremy Parkinson

Finance

Treasury yields are tumbling once again (10Y at 2.25%, the lowest since June 29th) – as more weak US macro data is compounding Yellen’s dovish tilt from last week. As bond yields began to tumble, so stocks rolled over and VIX jerked above 10… 10Y Yields have retraced exactly 50% of the post-hawkish-Draghi swing higher… Notably UST […]

Will Emerging Markets Continue To Shine?

Jul 18, 2017

Jeremy Parkinson

Finance

This year, emerging markets have run ahead of the S&P 500 after years of underperformance. Thanks to a declining dollar and continued monthly inflows, emerging markets have been a shining star in the 1st half of the year. Now the question is: will the trend continue? Let’s take a quick look at a couple of […]

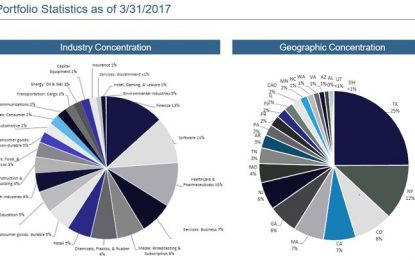

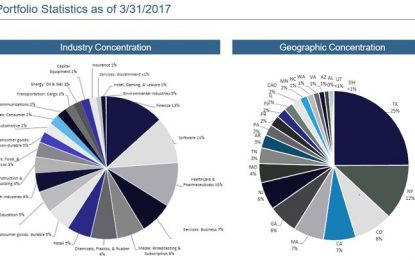

3 Best Mid-Cap Value Funds To Add To Your Portfolio

Jul 18, 2017

Jeremy Parkinson

Finance

Value funds are those that tend to trade at prices lower than their fundamentals (i.e. earnings, book value and debt to equity). It is a common practice to invest in value funds for income or yield. However, not all value funds solely comprise companies that primarily use their earnings to pay dividends. Investors interested in […]

Stellus Capital: 10% Monthly Dividend Is Sustainable… For Now

Jul 18, 2017

Jeremy Parkinson

Finance

As the saying goes, if something looks too good to be true, it usually is just that. This can often be applied to unusually high-yielding dividend stocks. For example, Stellus Capital Investment Corp. (SCM) has a 10% dividend yield, which is very attractive on the surface. The S&P 500 Index, on average, has a dividend […]

Lockheed Martin Corporation Q2 Earnings: Shares Rise, Outlook Boosted

Jul 18, 2017

Jeremy Parkinson

Finance

The Lockheed Martin (LMT) Q2:F17 earnings report was released before opening bell this morning. The defense contractor posted earnings of $3.23 per share on $12.7 billion in revenue, compared to the consensus estimates of $3.11 per share and $12.4 billion in sales. In last year’s second quarter, the defense contractor reported $11.58 billion in sales […]

Trader: ‘Algos And Dark Pools’ Are Making It Impossible To Know ‘What’s Going On’

Jul 18, 2017

Jeremy Parkinson

Finance

Former FX trader Richard Breslow has a good piece out on Tuesday. It’s particularly apt given what we saw in FX markets overnight between the RBA minutes, the Riksbank minutes, soft UK inflation data, and of course, the death of the GOP healthcare bill in the US. All of this would be impossible to trade […]

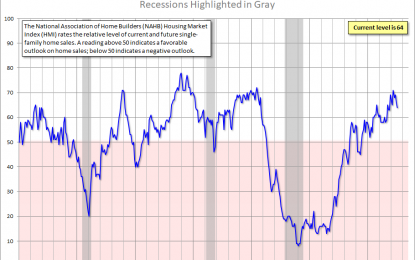

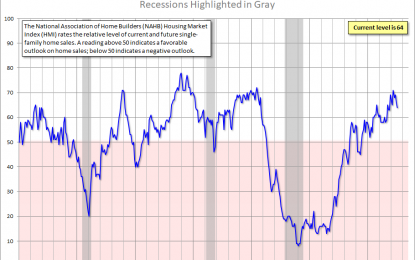

NAHB Housing Market Index: “Builder Confidence Slips Two Points In July, Remains Solid”

Jul 18, 2017

Jeremy Parkinson

Finance

The National Association of Home Builders (NAHB) Housing Market Index (HMI) is a gauge of builder opinion on the relative level of current and future single-family home sales. It is a diffusion index, which means that a reading above 50 indicates a favorable outlook on home sales; below 50 indicates a negative outlook. The latest […]