With the 72nd failed attempt to “repeal and replace” – as well as a wall that’s never going to get built, a Hillary that’s never going to be “locked up”, a Goldman Sachs that’s never going to be kept out of D.C., and tax reform that’s never going to happen – yeah, I think we’ve had about all the winning we can stand.

(In fairness I should note that the Mexicans are, in fact, going to fully fund the wall that isn’t getting built.)

With the latest Republican failure, the US dollar is experiencing another leg down:

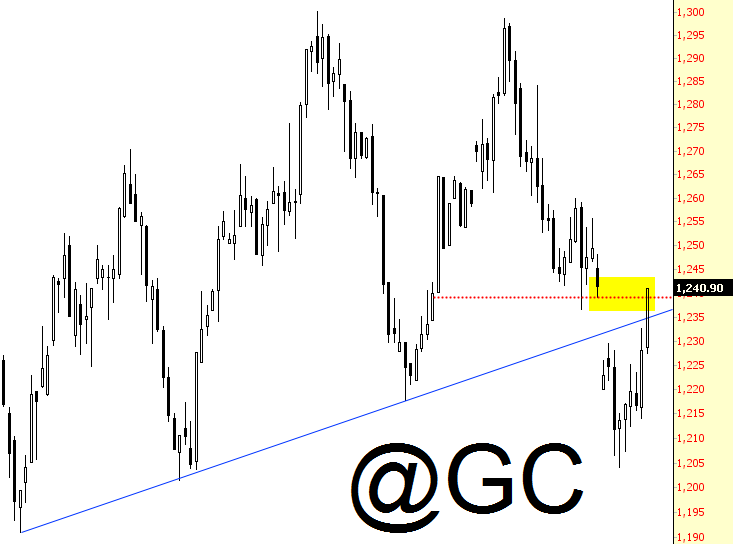

In turn, gold is rallying again. Indeed, I think my entire premise of a commodity downturn is pretty much getting torn to ribbons, although there’s still quite a lot of overhead supply that I think will hold things back.

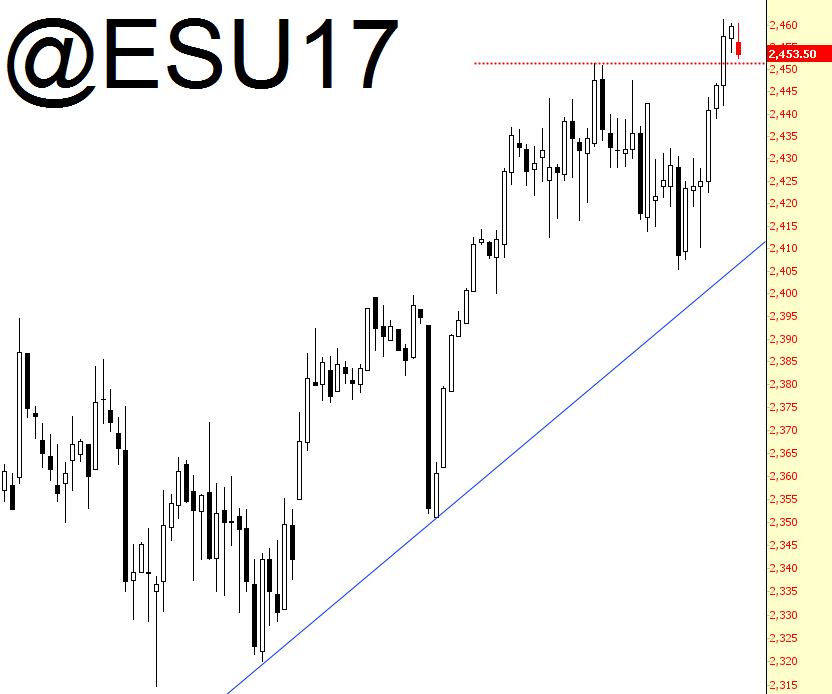

As for equities in general, even though darling Netflix is up about 10% or so (since its ability to bleed money has become even more phenomenal), stocks, in general, are a little squishy. As I type this, the NQ is down about 20, and the ES is down about 6. None of it will mean much until and unless we break the red line I’ve drawn below, which is the latest bullish breakout. That will at least allow us to retrace some of the recent surge.

Well… time to get back to more winning. If we can stand it, of course.